South Koreans rally round Ethereum primarily based shares

South Korean retail traders are promoting off their large tech shares comparable to Tesla and Alphabet in favor of Ethereum-related shares, The Korea Financial Every day reported, citing knowledge from the Korea Securities Depository.

Tesla has lengthy been a fixture within the prime net-buy rankings for Korean retail traders, however it was offered off previously month with round 1 trillion gained ($721.6 million) in web gross sales. Alphabet and Apple had been additionally closely offered, with web gross sales of about 230 billion gained ($166 million) and 300 billion gained ($216 million), respectively.

These retail traders are domestically known as “seohak ants.” Seohak interprets to “Western studying,” however in home finance lingo, it refers to international inventory traders. “Ants” is an area nickname for retail traders, alluding to their small dimension however giant numbers in comparison with institutional whales.

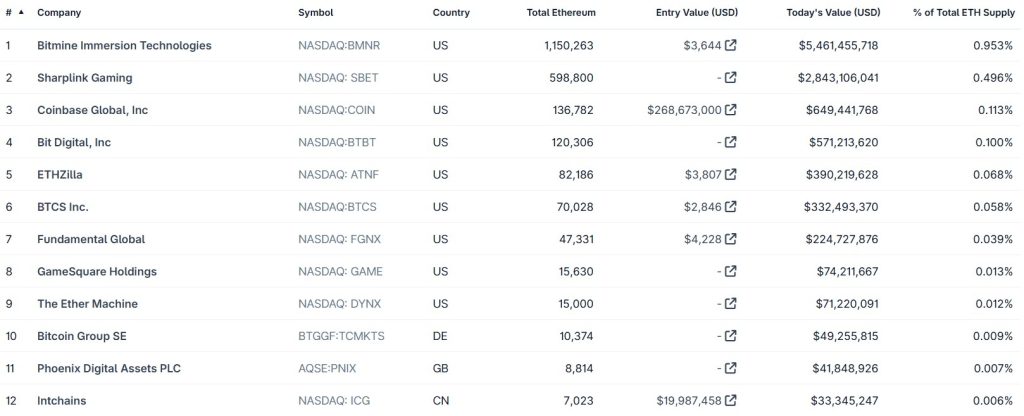

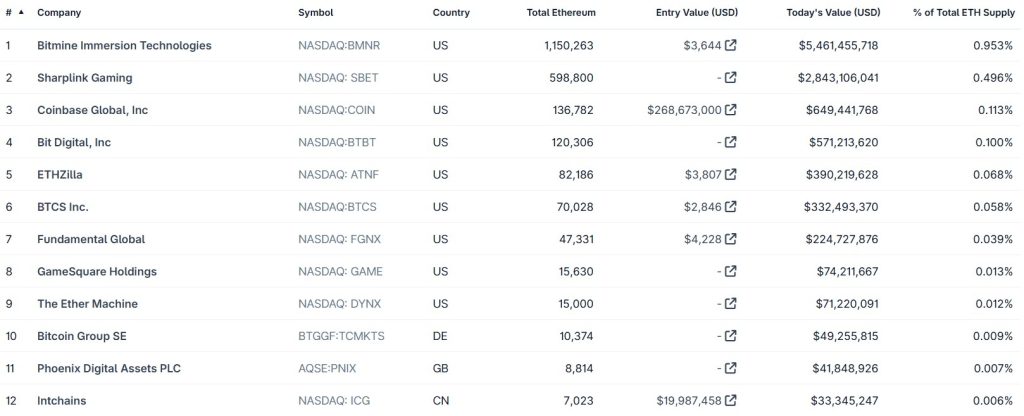

In accordance with the Korea Securities Depository, these ants have invested $269 million over the previous month in BitMine, a Bitcoin mining and Ethereum treasury firm that’s now the most important publicly listed holder of ETH.

Excluding exchange-traded funds, half of the highest seven net-buy shares by ants throughout that interval had been cryptocurrency-related corporations: Coinbase, Robinhood and Sharplink Gaming, the second-largest public ETH holder.

The worth of Ethereum holdings by public corporations have not too long ago surged, impressed by the success of Bitcoin treasury corporations — a playbook popularized by Michael Saylor and MicroStrategy. Holding BTC or ETH has not solely been useful to corporations because of the appreciation of the cryptocurrencies, however has additionally lifted their share costs. On the time of writing, 18 public corporations collectively maintain 1.88% of Ethereum’s provide, in line with CoinGecko knowledge.

Vietnam state-backed financial institution to launch on crypto alternate

A financial institution based by Vietnam’s protection ministry intends to launch its personal cryptocurrency alternate.

Navy Financial institution (MB Financial institution) signed a memorandum of understanding with Dunamu, the operator of cryptocurrency alternate Upbit, to entry the corporate’s South Korean alternate’s infrastructure, know-how and regulatory compliance expertise to ascertain its personal alternate.

MB Financial institution, which was based below Vietnam’s Ministry of Nationwide Protection in 1994, claims to be the fifth-largest financial institution within the nation with whole belongings of round $50 billion.

If profitable, it might develop into the primary regulated crypto alternate in Vietnam, and comes as Vietnam preps the nation for a crypto push of its personal throughout a worldwide crypto rules growth. In June, Vietnam’s Nationwide Meeting handed a regulation that brings cryptocurrencies below regulatory oversight.

The Legislation on Digital Know-how Business primarily legalized cryptocurrencies by legally recognizing two classifications: digital belongings and crypto belongings.

Learn additionally

Options

Do you have to ‘orange tablet’ kids? The case for Bitcoin youngsters books

Options

Extinct or Extant: Can Blockchain Protect the Heritage of Endangered Populations?

Thai crypto corporations catch strays in “mule account” crack down

Thailand cryptocurrency corporations will share legal responsibility if their failure to observe official requirements causes buyer hurt.

The Thai Securities and Trade Fee (SEC) rolled out binding guidelines that put cryptocurrency exchanges and different digital asset companies within the scorching seat in a nationwide crackdown on “mule accounts” — previously reputable monetary accounts which have been rented out or offered to be used in scams and cash laundering.

Beneath the brand new framework, which took impact on Wednesday, crypto companies should perform Know Your Buyer checks and share buyer knowledge with regulation enforcement. If a mule account is recognized, crypto platforms should freeze them or refuse providers.

The brand new guidelines create a “shared duty” regime wherein monetary establishments, cost suppliers, telecom corporations, social media platforms and crypto corporations may be held collectively chargeable for buyer losses in the event that they neglect to observe SEC-prescribed requirements to forestall tech crime.

The SEC stated crypto mule accounts have develop into a most popular device for scammers as they’re tougher to hint than financial institution accounts. Between March and the top of June, authorities 29,000 crypto mule accounts have been frozen in Thailand, value 186 million baht (round $5.7 million).

People who hire out or promote mule accounts can resist three years in jail or as much as a 300,000 baht high-quality.

The watchdog added that anybody who rents out or permits their account for use for tech crime can resist three years in jail, a high-quality of as much as 300,000 baht, or each.

Learn additionally

Options

Polkadot’s Indy 500 driver Conor Daly: ‘My dad holds DOT, how mad is that?’

Options

Might a monetary disaster finish crypto’s bull run?

Ant Group denies forming stablecoin partnership with central financial institution

China’s tech giants are persevering with to fend off hypothesis that they plan to situation a yuan-pegged stablecoin.

Rumors circulating on social media and in some media reviews have urged that China could also be making ready to approve a yuan-pegged stablecoin. The authorities haven’t confirmed such plans.

Curiosity in stablecoins has intensified following the rollout of Hong Kong’s new stablecoin rules, which permit corporations to use for a license. Chinese language e-commerce big JD.com is reportedly among the many candidates, and was additionally pushed to disclaim claims that it had already launched one.

Ant Group is the newest main tech agency to push again towards related rumors. The corporate dismissed reviews that it had partnered with the Folks’s Financial institution of China and China Uncommon Earth Group to create a rare-earth-backed RMB stablecoin.

“Ant Group has by no means had any such plan with the talked about establishments,” it stated in a social media submit on Monday.

Stablecoin enthusiasm in China has been operating excessive, with researchers and teachers — together with these from prime state-backed establishments — publishing suggestions and research on the potential advantages of stablecoins. Regulators have reportedly intervened in latest weeks, urging the home market to halt analysis publications and seminars on the topic.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist protecting blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has coated Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.