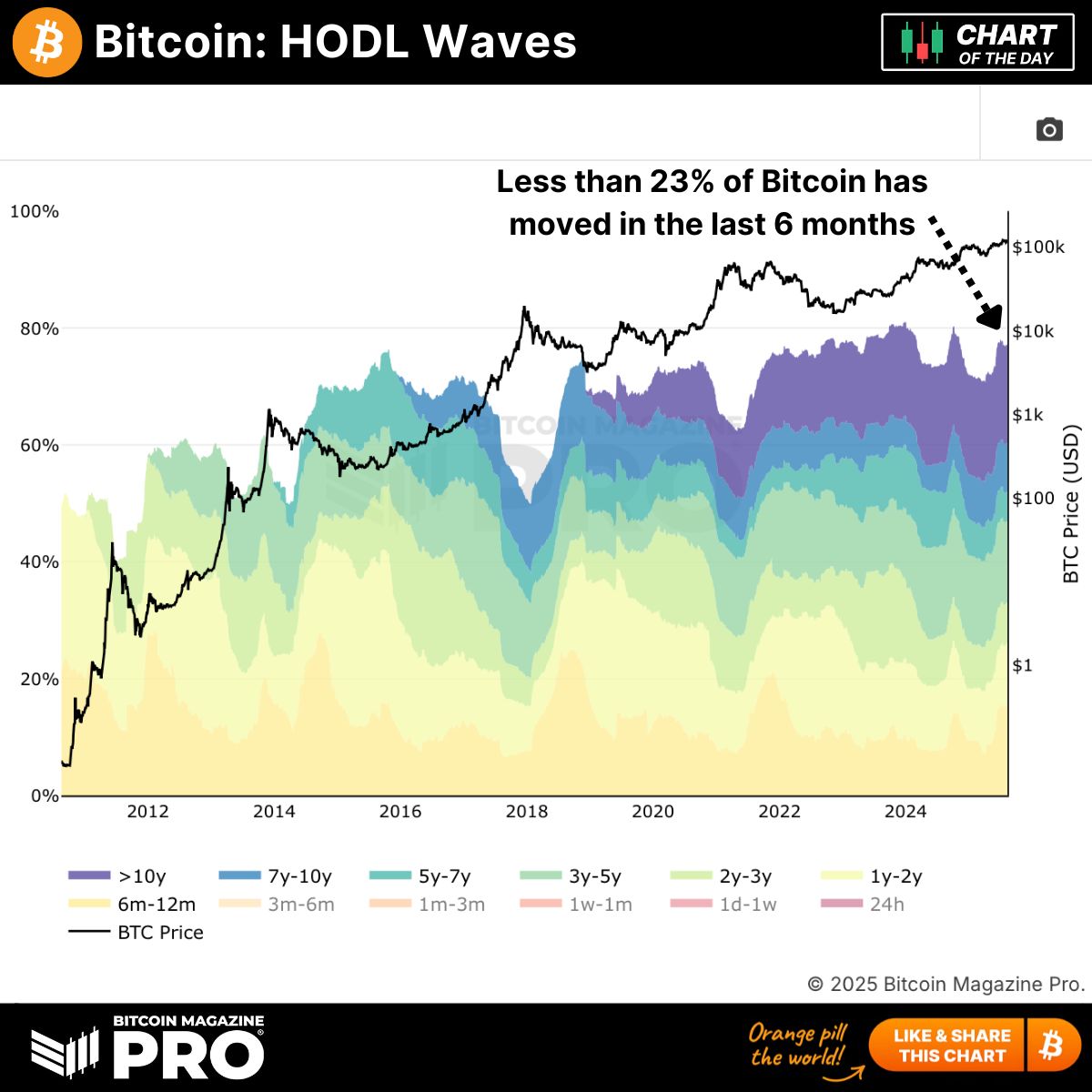

Contemporary information from Bitcoin Journal Professional’s HODL Waves chart reveals that long-term holders are holding an iron grip on their cash.

Fewer than 23% of all Bitcoin in circulation has modified addresses up to now six months – an indication of tightening provide that has traditionally preceded main value strikes.

The HODL Waves metric segments Bitcoin by the point since every coin final moved. At current, the overwhelming majority of BTC is sitting dormant, with a considerable portion held for over a yr and a rising share untouched for a number of years. This lack of motion suggests holders are resisting the urge to promote, at the same time as costs stay close to historic highs.

Provide squeezes within the Bitcoin market usually emerge when a big proportion of cash are held tightly, leaving fewer out there for buying and selling on exchanges. In earlier cycles – reminiscent of late 2020 and early 2021 – comparable circumstances coincided with fast upward value acceleration as new demand met skinny provide.

What’s driving the present standoff? Analysts level to a mixture of macroeconomic uncertainty, optimism round institutional adoption, and a deepening perception amongst holders that Bitcoin’s long-term trajectory outweighs short-term volatility. With the subsequent halving already factored into many merchants’ plans, the immobility of such a big share of provide may amplify future value reactions.

Whereas short-term merchants should dictate every day strikes, the info reveals that the true energy in Bitcoin’s market lies with those that hardly ever – if ever – promote. If new demand rises sharply, these “HODLers” may discover themselves sitting on belongings in a fast-climbing market, additional reinforcing their resolution to carry.