The countdown to a possible altcoin surge is choosing up tempo as market indicators align forward of September.

Analysts at Coinbase Institutional say the following few months may see a decisive shift of capital into different cryptocurrencies, supported by macro traits, regulatory readability, and institutional positioning.

ETH emerges because the frontrunner for institutional allocations

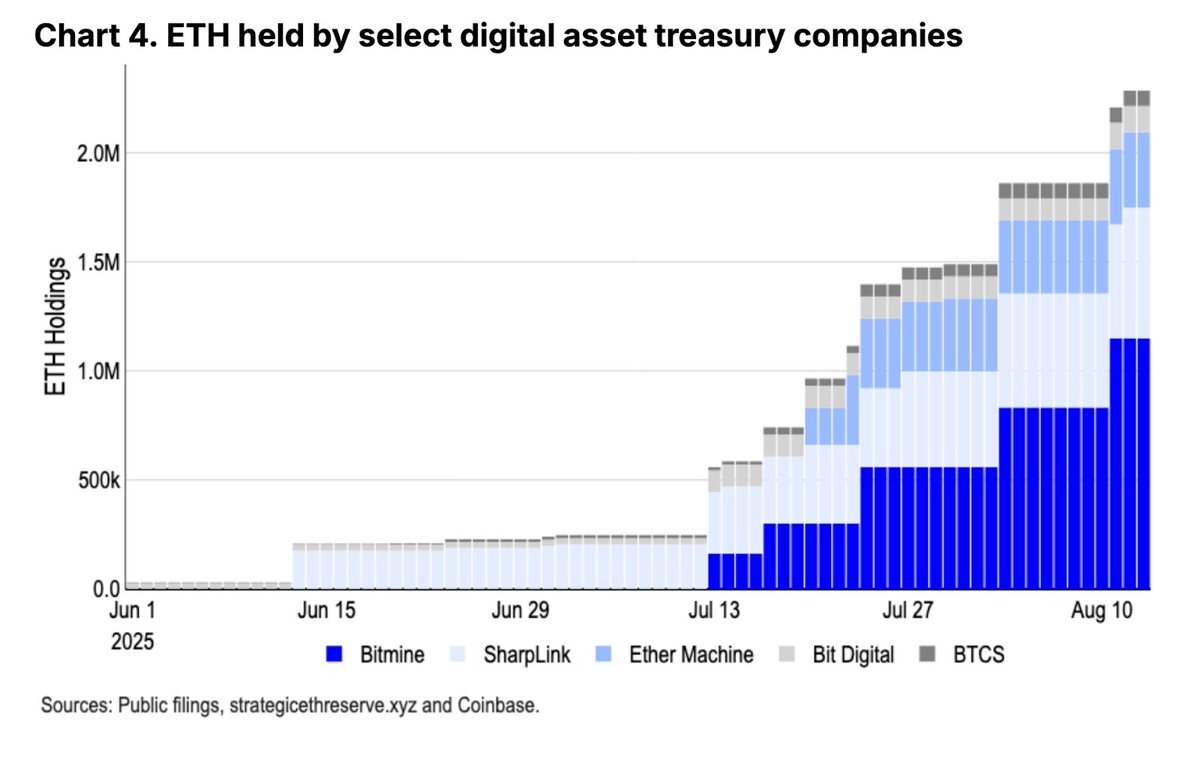

One of many clearest indicators of this shift is the fast accumulation of Ethereum by company digital asset treasuries. Since early June, holdings by companies akin to Bitmine, SharpLink, Ether Machine, Bit Digital, and BTCS have surged previous two million ETH, based on public filings tracked by Coinbase. A lot of this shopping for has been tied to narratives round stablecoins and digital asset treasuries, each of which have been gaining traction with institutional allocators.

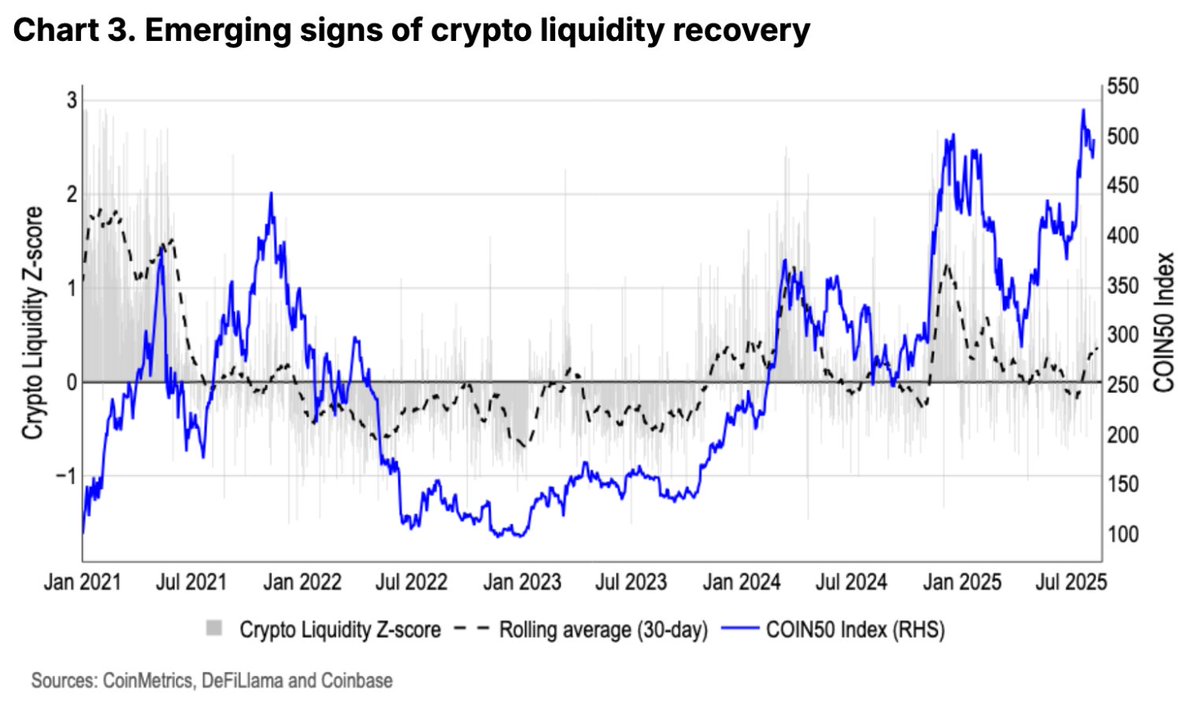

Liquidity restoration modifications the market temper

After half a 12 months of regular decline, crypto liquidity metrics are turning constructive. Coinbase knowledge exhibits enhancements in buying and selling volumes, order e-book depth, and internet issuance of stablecoins. Analysts attribute the rebound partly to a friendlier regulatory surroundings, which has inspired market makers and long-term members to re-enter with higher conviction. This shift may present the mandatory gas for sharper altcoin rallies if momentum holds.

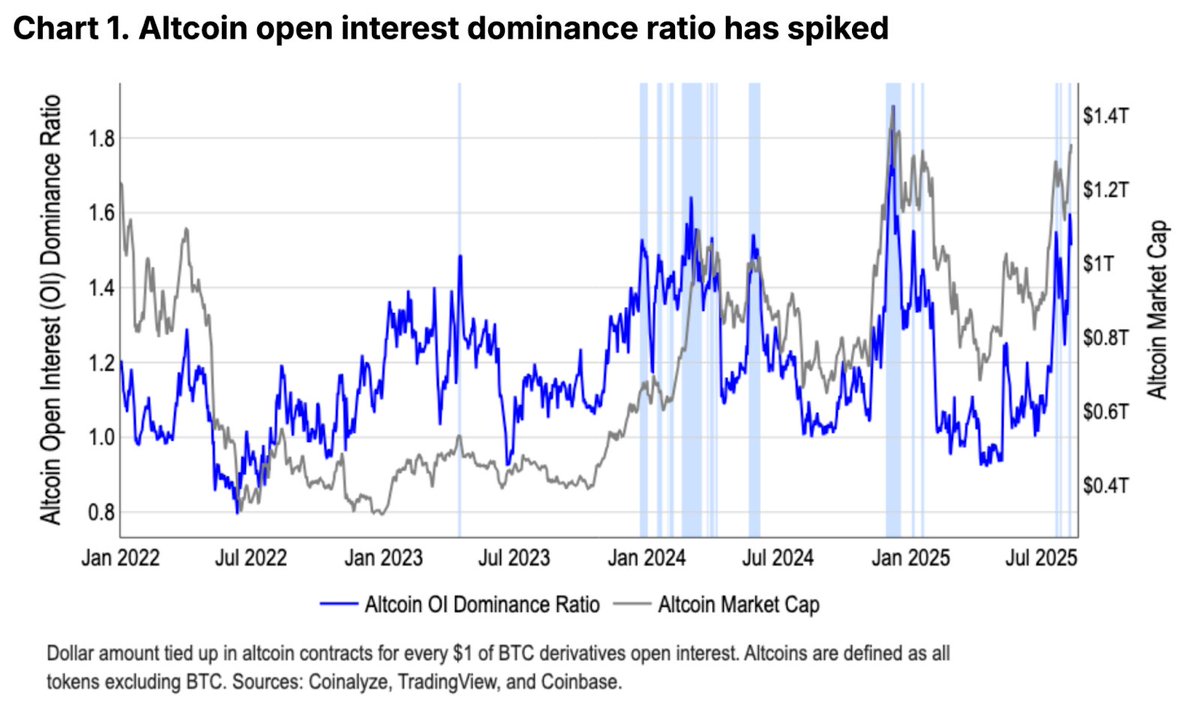

Leverage and positioning level to an altcoin rotation

Open curiosity dominance in altcoin derivatives has additionally spiked, signaling that merchants are more and more keen to place for outsized strikes exterior Bitcoin.

Whereas the Altcoin Season Index nonetheless sits at 40% – properly beneath the 75% threshold marking a confirmed season -a projected liquidity wave in late Q3 to early This fall may speed up rotation into smaller-cap belongings.

Macro tailwinds set the stage for Q3 and past

Coinbase’s newest outlook factors to potential Federal Reserve charge cuts and regulatory developments as catalysts for the following progress section. With institutional demand for ETH rising, liquidity recovering, and derivatives markets heating up, circumstances are forming for a extra sustained altcoin cycle.

If these traits proceed into September, the market may very well be on the verge of its most vital altcoin season since 2021—solely this time, establishments could also be main the cost.

Supply