Pi Community’s efficiency has been underwhelming, even in a broader bull market. Whereas many cryptocurrencies are reaching report highs, Pi Coin (PI) fell to an all-time low earlier this month, reflecting a big lack of investor confidence.

Although it boasts an formidable community-driven mannequin and a consumer base exceeding 60 million, a number of indicators level to a rising disinterest within the community, elevating considerations about its long-term viability.

Pi Community in Hassle: 3 Indicators You Have to Watch

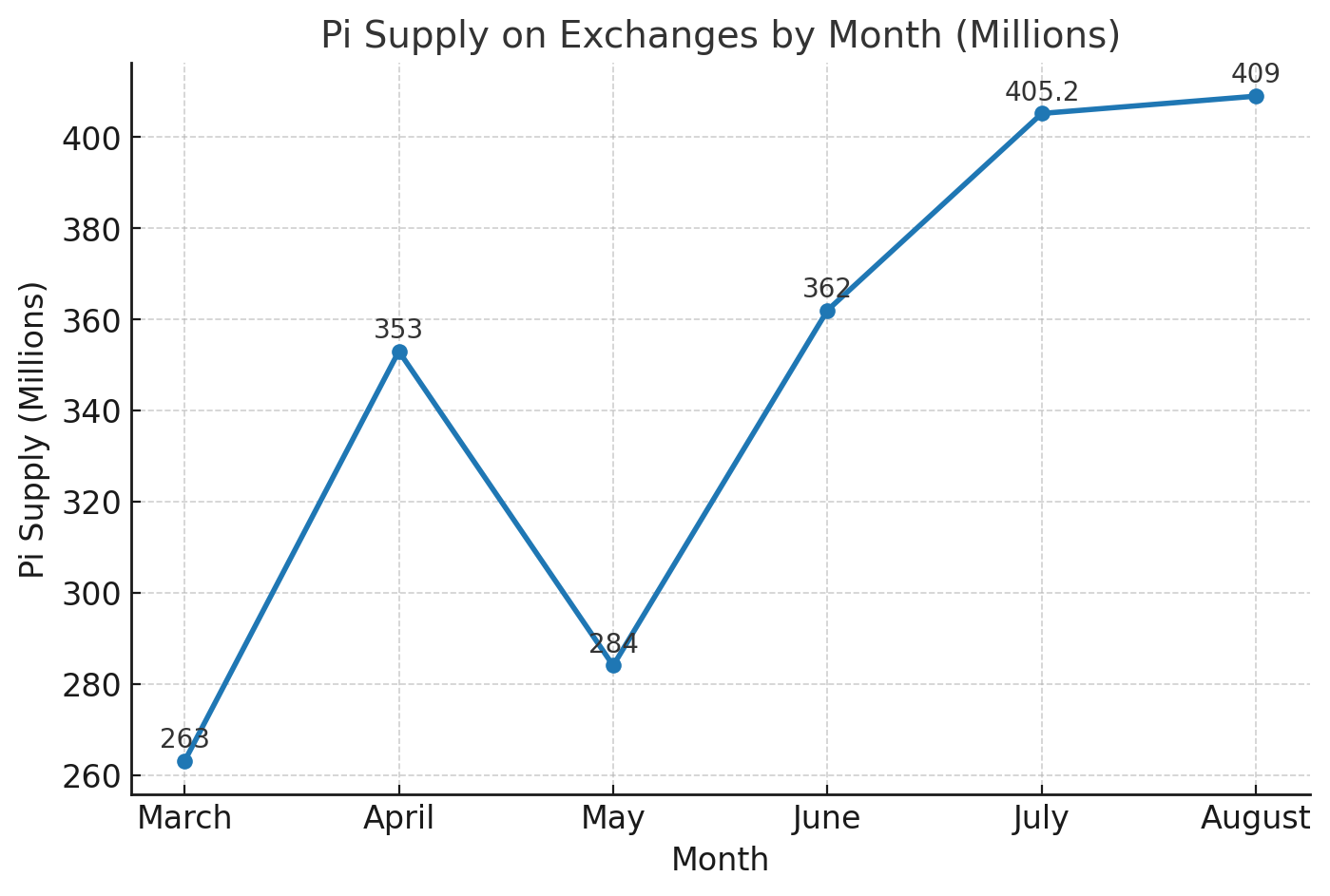

First, the availability of Pi cash on centralized exchanges has surged dramatically. Information from PiScan revealed that over 409 million Pi cash have been held on exchanges within the second week of August, marking the very best stage thus far.

This inflow means that holders are offloading their tokens to capitalize on liquidity or reduce losses. Such a spike in exchange-held tokens usually precedes elevated promoting stress.

Moreover, Pi Coin’s each day unlocks exacerbate this. Over the following 30 days, Pi Community will launch 166.5 million tokens, flooding the market with further provide.

Thus, these elements may put downward stress on the already dropping worth. CoinGecko information confirmed that Pi Coin’s worth has dipped 36.4% over the previous 60 days. This decline has made it the highest loser within the crypto market.

Second, retail curiosity in Pi Community is waning. In line with Google Tendencies, when evaluating search curiosity for ‘Pi Community’ with ‘Altcoins,’ the previous considerably lags behind. This starkly contrasts with earlier tendencies when Pi Community dominated on-line consideration.

The shift instructed that the preliminary hype surrounding PI’s mobile-mining mannequin and the open community launch has pale, as competing altcoins seize extra public curiosity amid the altcoin season build-up.

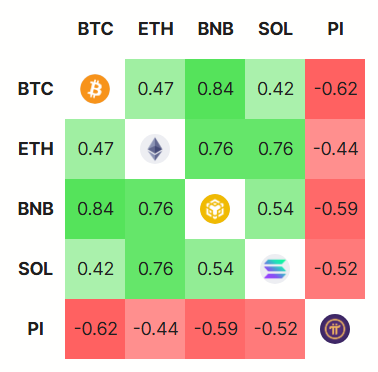

Third, Pi Community’s market habits is diverging from the broader crypto rally. Information from DeFiLlama highlighted that whereas Bitcoin, Ethereum, and Solana keep a excessive optimistic correlation—transferring in tandem as investor sentiment fuels beneficial properties—Pi Community reveals a detrimental correlation. This divergence means that PI is transferring in opposition to the prevailing optimism of the altcoin season.

Compounding these points is the continued controversy surrounding Pi Coin’s World Consensus Worth (GCV). A distinguished Pioneer, identified by the pseudonym Mr. Spock, careworn beforehand that the GCV group’s unproven valuation has led them to imagine that PI is value rather more. In consequence, they’re not contributing as the value crashes.

“We nonetheless have GCV pioneers holding solely 5 Pi who suppose they’re wealthy, but they aren’t serving to us. They don’t seem to be shopping for Pi at $0.40 as a result of they imagine they’re already wealthy, they usually say that’s not actual Pi on exchanges, even after KYB, regardless of us already being within the open community,” he wrote.

Thus, all these elements paint a bearish image for the PI. For now, evidently Pi Community faces a difficult street forward, until important adjustments are made to revive investor confidence.

The publish Buyers Flip Their Backs on Pi Community: 3 Indicators of a Rising Exodus appeared first on BeInCrypto.