The Pi Coin worth is up 5.5% over the previous week, outperforming XRP, BCH, Ton, and even Uniswap. Nevertheless, the broader bearish shift has pressured traders to ask questions.

A brand new line of thought has surfaced, placing its worth habits in the identical lane as cash from a well-liked crypto sector; a shift that would redefine its short-term outlook.

Pi Coin Correlation Now Mirrors Meme Coin Majors

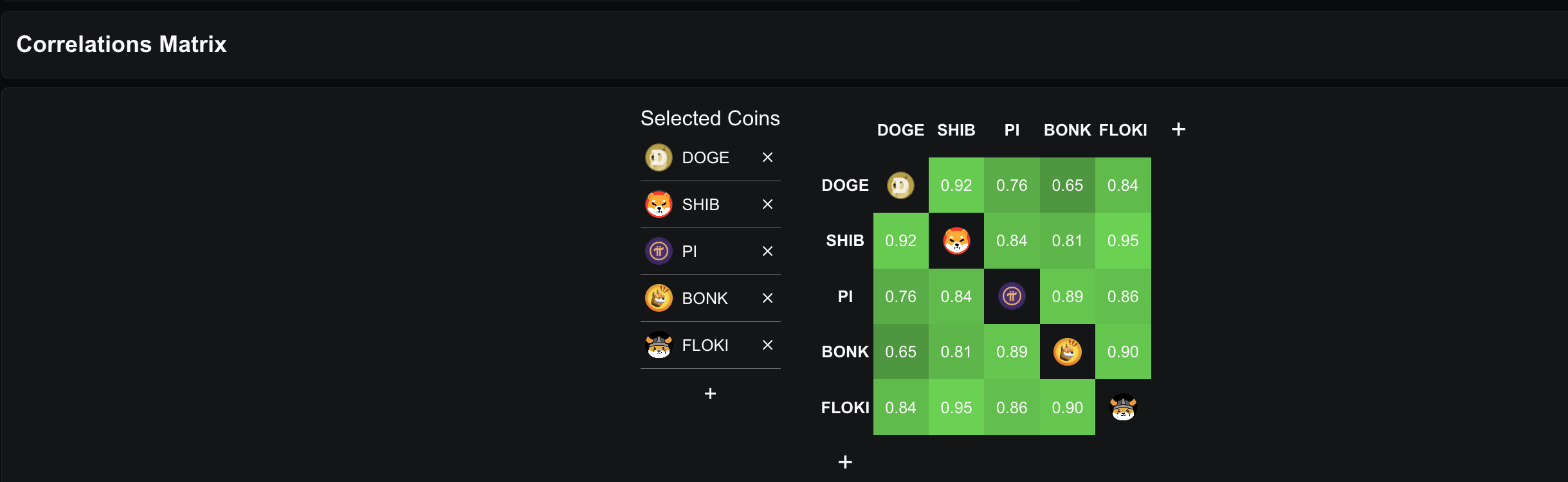

The most recent month-to-month correlation information exhibits PI’s market habits has shifted considerably. It now holds a 0.76 correlation with Dogecoin, 0.84 with Shiba Inu, 0.89 with Bonk, and 0.86 with Floki. These numbers place PI firmly contained in the meme coin volatility bracket, that means the sector’s rallies and corrections usually tend to spill over into the Pi Coin worth motion.

If meme cash begin one other upside run, PI might experience that momentum. Conversely, if the sector cools off, PI’s latest alignment means it might shortly comply with them decrease, making meme coin sentiment a very powerful short-term driver for Pi Coin’s path.

A Pearson Correlation Matrix is a desk that exhibits how strongly totally different variables transfer in relation to one another, utilizing Pearson’s correlation coefficient values between -1 and +1. A price near +1 means two variables transfer in the identical path more often than not, a price near -1 means they transfer in reverse instructions, and a price close to zero means there’s little to no linear relationship. In crypto evaluation, it’s typically used to measure how intently a coin’s worth adjustments observe with or diverges from different cash over a set interval.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Technical Threat Builds on the 4-Hour Chart

Pi Coin’s rising correlation with main meme cash means it’d now be extra uncovered to sector-wide strikes. Over the previous few days, the meme coin market has been beneath stress, and if this weak point persists, Pi Coin might be dragged decrease in tandem.

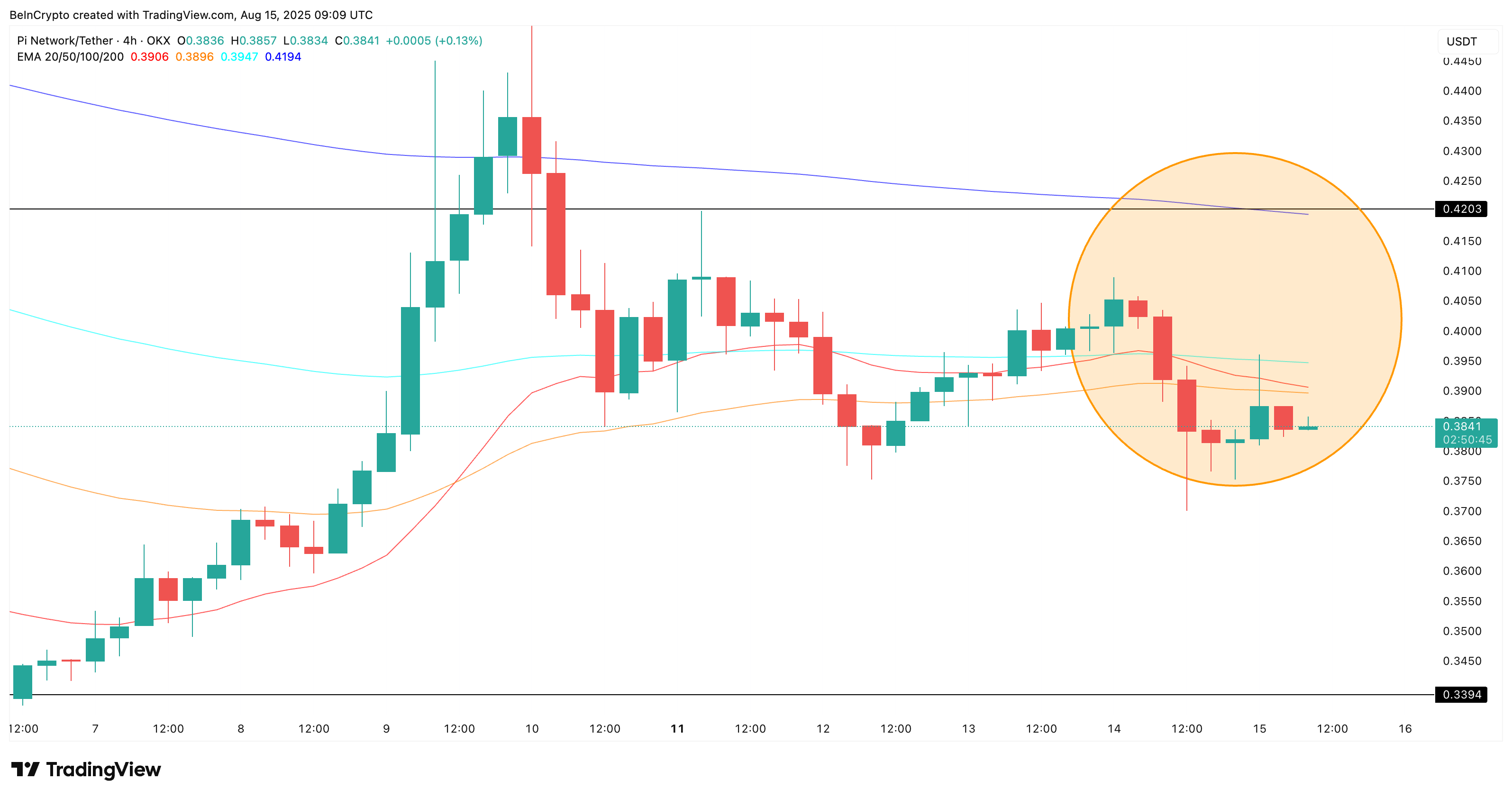

On the 4-hour chart, the 20-period EMA or Exponential Shifting Common (orange line) is edging nearer to crossing under the 50-period EMA (purple line); a sample often called a demise crossover. If this crossover confirms whereas meme coin sentiment stays destructive, it might speed up promoting stress and deepen the present correction.

An Exponential Shifting Common (EMA) is a sort of shifting common that offers extra weight to latest worth information, making it extra attentive to short-term worth actions in comparison with a Easy Shifting Common (SMA).

Pi Coin Worth Motion Holds a Bullish Divergence Setup

The Pi Coin- Meme Coin hyperlink means any restoration in that area might spill over into PI’s worth motion.

On the every day chart, the token exhibits a transparent bullish RSI divergence; worth has made a decrease excessive, however RSI has printed a better excessive. RSI is holding close to 43.71, and a push above 47 would verify a contemporary increased excessive, strengthening the bullish case.

If meme cash stage a rebound, that momentum might be the lacking set off for the Pi Coin. That would assist PI reclaim $0.39 and retest $0.41–$0.43. Till then, the setup stays unconfirmed, and the 4-hour demise cross threat nonetheless shadows the chart.

A breakdown beneath $0.37 wouldn’t simply invalidate the divergence but additionally make Pi coin extra susceptible. Extra so if the correlated sector continues to bleed. The value chart nonetheless has a semblance of bullishness. However the sector pattern will determine whether or not that edge turns right into a breakout or fades with the remainder of the market.

The submit Pi Coin Now Trades Like Any Prime Meme Coin — Will Worth Features Comply with? appeared first on BeInCrypto.