Keep within the loop with our weekly crypto digest as we get you in control on the most popular traits and occasions within the crypto house.

Right here’s what occurred in crypto this week:

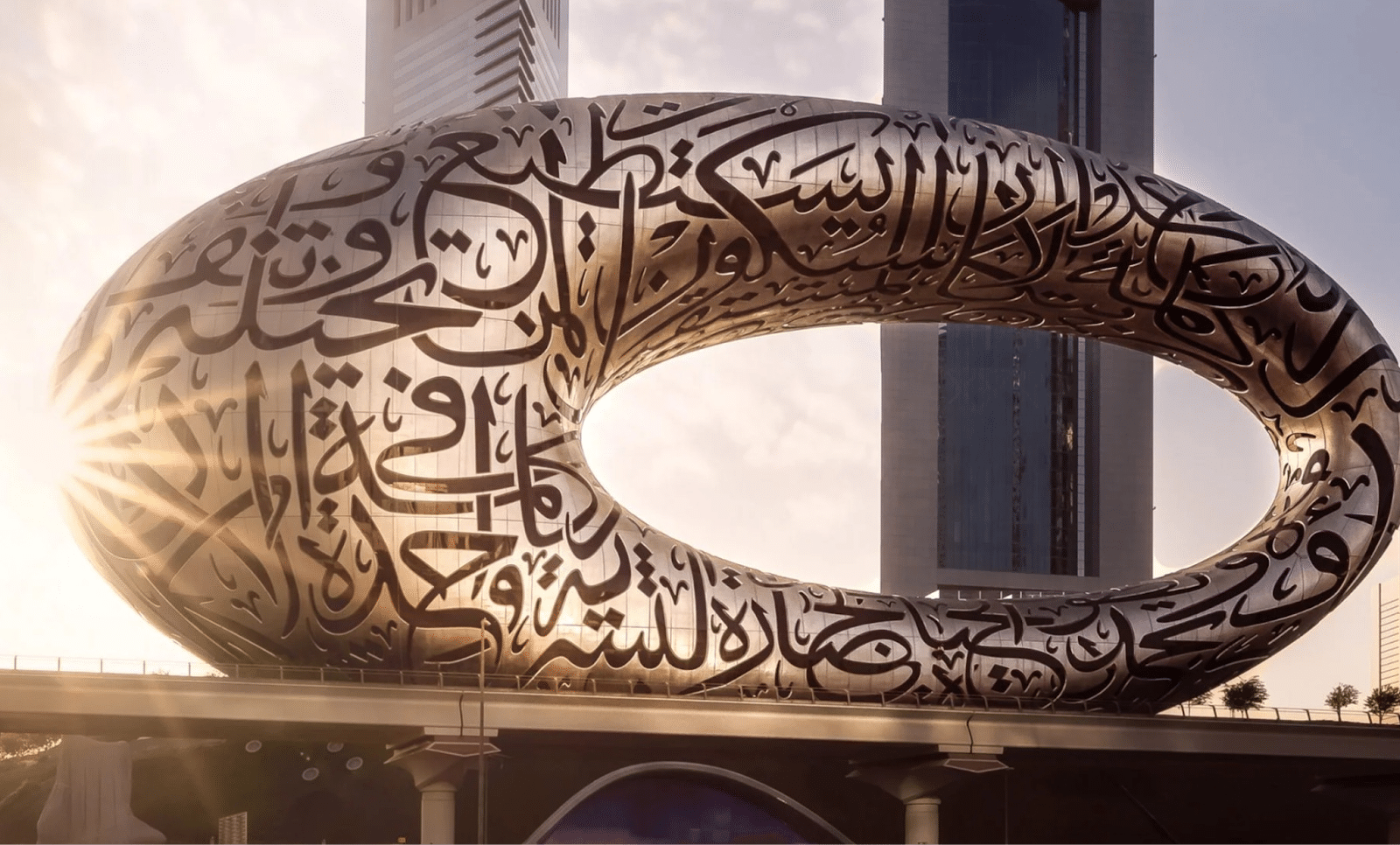

Dubai Formally Approves First Crypto Choices License

Dubai’s Digital Asset Regulatory Authority (VARA) has formally authorized Bitcoin and crypto choices for retail buyers by way of Laser Digital.

With its tax-free standing, clear regulation, and rising ecosystem of over 600 crypto companies, Dubai is positioning itself as a key hub for digital belongings.

Laser Digital will supply primary Bitcoin choices beneath strict oversight to reinforce safety and liquidity.

China To Permit Launch Of Its First Crypto Stablecoin

As a part of an initiative to internationalize the renminbi (Chinese language Yuan) and improve its competitiveness towards the US greenback, China is poised to launch its first stablecoin. In the meantime, the US is making vital progress towards its mission of changing into the crypto capital of the world.

In keeping with a report from the Monetary Occasions, Hong Kong has emerged as a testing floor for cryptocurrency, significantly given the strict bans on the mainland.

Just lately, the territory handed laws permitting licensed companies to situation tokens backed by any fiat forex. Nonetheless, the Hong Kong Financial Authority (HKMA) has taken a cautious stance, indicating that solely a restricted variety of licenses shall be issued beginning subsequent 12 months.

Policymakers in China have more and more turned their consideration to stablecoins, recognizing the rising dominance of dollar-backed tokens within the international economic system.

Twister Money Creator Roman Storm Discovered Responsible On Cash Transmitting Fees

Roman Storm, co-founder of Twister Money, was discovered responsible of conspiracy to function an unlicensed cash transmitting enterprise however acquitted on sanctions violation expenses.

The jury in Manhattan convicted Storm on the cash transmitting cost, highlighting considerations over unregulated crypto companies facilitating illicit funds. This might set a precedent for a way builders are held liable for his or her platforms’ misuse.

Being cleared on sanctions evasion suggests the courtroom didn’t discover adequate proof linking Storm on to violations involving entities like North Korea’s Lazarus Group.

This case underscores the stress between innovation and regulation in crypto. Builders may face tighter scrutiny, particularly for privacy-focused instruments, as authorities push compliance boundaries.

Trump Indicators Govt Order Permitting 401(ok) Traders To Entry Different Property For Higher Returns And Diversification

President Donald Trump simply signed an government order opening 401(ok) retirement plans to various belongings like crypto, personal fairness, and actual property, aiming for higher returns and diversification for American buyers.

This implies tens of millions of Individuals saving for retirement by way of 401(ok) accounts may have the choice of placing their cash in higher-risk personal fairness and cryptocurrency investments.

This order targets the huge $12.5 trillion 401(ok) market, directing the Labor Secretary to revisit fiduciary guidelines on personal market investments beneath ERISA (Worker Retirement Revenue Safety Act of 1974).

There isn’t a quick change in how folks make investments a part of their work earnings. Federal businesses would want to rewrite guidelines and rules to permit the expanded selections, and that might take months or extra to finish. However as soon as executed, employers may supply a broader array of mutual funds and investments to employees, in keeping with the White Home.

SEC And Ripple Formally Finish Authorized Battle Following Joint Dismissal Of Appeals

The US Securities and Alternate Fee (SEC) and Ripple Labs’ legal professionals have collectively agreed to withdraw the attraction to the Second Circuit Courtroom of Appeals. A joint movement to dismiss submitted exhibits that each events will bear their very own prices.

Beforehand, Ripple Labs CEO Brad Garlinghouse introduced in June that the corporate supposed to withdraw its cross-appeal, stating the necessity to ‘flip the web page and deal with constructing the worth web.’

Now, each events have deserted the attraction, and Decide Analisa Torres’ combined ruling in 2023 will turn out to be the ultimate judgment.

This landmark resolution units a precedent for institutional therapy and paves the way in which for potential trade relistings and wider adoption.

Chainlink has partnered with Intercontinental Alternate (ICE), the guardian of NYSE, to ship high-quality foreign exchange and treasured metals knowledge on-chain, bridging conventional finance with blockchain for DeFi and tokenized asset progress.

This collaboration integrates ICE’s Consolidated Feed into Chainlink Information Streams, offering dependable FX and metals charges to over 2,000 apps in Chainlink’s ecosystem, together with main banks and asset managers.

With tokenized real-world belongings projected to hit $30.1 trillion, this transfer positions Chainlink and ICE to drive innovation in digital markets by enhancing knowledge reliability for on-chain finance.

Paxos Says It Is Making use of For Belief Financial institution License With US OCC

Paxos, a key participant in blockchain and stablecoin issuance, has introduced its utility for a belief financial institution license with the US Workplace of the Comptroller of the Foreign money (OCC), aiming for federal regulation standing.

Paxos is pushing to solidify its standing within the US monetary system by searching for a nationwide belief financial institution constitution. If authorized, it will place it amongst a choose few crypto-native companies beneath federal oversight.

This utility aligns with Paxos’ historical past of regulatory engagement, having already secured a provisional belief constitution in 2021.

Canary Recordsdata For Staked INJ ETF With CBOE

Canary Capital has filed with the CBOE BZX Alternate to listing a staked Injective ($INJ) exchange-traded fund (ETF), a possible first for US markets, providing regulated publicity to staked Injective tokens.

The submitting, documented as SR-CboeBZX-2025-115, marks a major transfer by Canary Capital to deliver a staked $INJ ETF to the US by way of CBOE, one of many largest equities exchanges.

This follows Canary’s preliminary SEC Kind S-1 submitting, displaying a two-step course of towards institutional adoption of Injective’s decentralized finance (DeFi) choices in conventional finance areas.

Grayscale Cardano And Hedera Belief ETFs Registered In Delaware

Grayscale has registered trusts for Cardano (ADA) and Hedera (HBAR) in Delaware, hinting at potential exchange-traded funds (ETFs). This alerts rising institutional curiosity in these altcoins, although registration doesn’t assure product launches.

These registrations spark hypothesis about future ETF choices, particularly with the Securities and Alternate Fee (SEC) acknowledging a Hedera ETF submitting earlier.

Cardano’s research-driven scalability and Hedera’s hashgraph effectivity spotlight their enterprise potential, signaling Grayscale’s confidence in diversified crypto portfolios.

Coinbase Ventures Buys TON Tokens ‘Straight From Telegram,’ Says TON Basis Govt

Coinbase Ventures has reportedly bought $TON tokens straight from Telegram, in keeping with a TON Basis government. This transfer alerts rising institutional curiosity in The Open Community blockchain, tied to Telegram’s huge person base.

The undisclosed funding expands Coinbase’s involvement in TON, a Telegram-backed blockchain beforehand going through regulatory challenges however now centered on DeFi and Web3 progress.

Analysts be aware institutional curiosity in altcoins like TON could increase credibility, however market success is determined by broader crypto circumstances and TON’s technical execution.

Circle To Launch Arc, A Layer-1 Blockchain Devoted To Stablecoins

Circle, the issuer of USDC, is reportedly launching Arc, a brand new Layer-1 blockchain particularly designed for stablecoins, aiming to reinforce effectivity and cross-chain liquidity for digital currencies.

Circle’s Arc blockchain may redefine stablecoin infrastructure, specializing in optimized transactions and native help for USDC. This aligns with their latest pushes for cross-chain options like Circle Gateway.

Arc may additionally problem present Layer-1s by prioritizing stablecoin use instances, doubtlessly lowering friction in funds and DeFi, and bolstering Circle’s place amid rising regulatory readability post-GENIUS Act.

Do Kwon To Plead Responsible To US conspiracy, Fraud Fees In $40 Billion Terra Collapse

Do Kwon, co-founder of Terraform Labs, will plead responsible to 2 legal expenses of conspiracy to defraud and wire fraud associated to the 2022 collapse of his terrausd (UST) and luna (LUNA) cryptocurrencies that erased an estimated $40 billion in worth.

The South Korean entrepreneur had pleaded not responsible in January to a nine-count indictment alleging securities fraud, wire fraud, commodities fraud, and cash laundering conspiracy.

Prosecutors accused Kwon of deceptive buyers by falsely claiming an algorithm maintained UST’s $1 peg after its Could 2022 depegging, whereas secretly arranging tens of millions in token purchases to artificially inflate its worth. These alleged misrepresentations helped drive LUNA’s worth to $50 billion by spring 2022. Kwon agreed to an $80 million civil effective and crypto transaction ban in a 2024 SEC settlement.

US Inflation Stays At 2.7%

The US annual Client Value Index (CPI) got here in at 2.7%, in contrast with economists’ estimates of two.8%. The Core CPI, which excludes extremely unstable sectors resembling vitality and meals, registered 3.1%, beating forecasts by 0.1 proportion level.

Analysts see the info as a constructive sign for crypto market bulls, as it could immediate the US Federal Reserve to chop rates of interest at its upcoming September Federal Open Market Committee assembly.

The Fed targets a wholesome inflation price of round 2%, and the newest figures have been edging nearer to that degree in latest months.

It’s price noting that CPI figures aren’t the one issue the Fed considers when deciding on a potential price lower; the newest US jobs report confirmed the economic system weaker than anticipated, rising the probability of reducing the benchmark price.

Closing Ideas

In order that’s it for this week!

To remain forward of the sport with the freshest crypto information and insights delivered straight to your inbox, contemplate subscribing to UseTheBitcoin’s publication in the present day.

Have a unbelievable week forward!