Bitcoin is buying and selling at a decisive level after not too long ago setting new all-time highs, however momentum seems to be shifting. Regardless of briefly pushing previous $120,000, BTC didn’t maintain ranges above its report, and the breakout above ATH stays unconfirmed. This lack of follow-through has fueled bearish hypothesis, with some analysts warning that the market might be going through elevated draw back threat within the quick time period.

Associated Studying

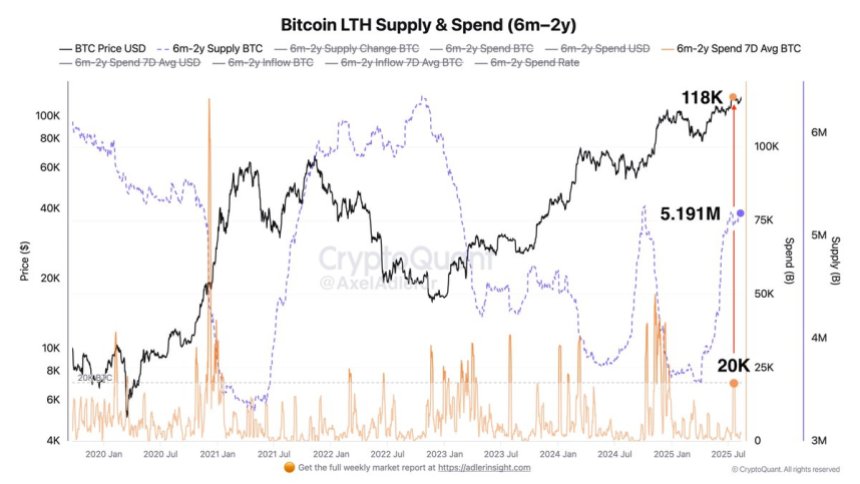

On the similar time, on-chain information paints a extra constructive image for long-term stability. In accordance with the newest insights, the Lengthy-Time period Holder (LTH) cohort—these holding Bitcoin between six months and two years—has considerably elevated its provide. Since April, when BTC was buying and selling at $83,000, their holdings have grown from 3.551 million BTC to five.191 million BTC, a outstanding enhance of 1.64 million BTC.

This accumulation suggests robust conviction amongst seasoned traders, at the same time as short-term volatility challenges the market. Whereas merchants deal with whether or not Bitcoin can reclaim $120,000 and set up a agency breakout, the continuing buildup by long-term holders reinforces the broader bullish construction. The conflict between short-term weak point and long-term power will doubtless outline Bitcoin’s subsequent main transfer.

Bitcoin Lengthy-Time period Holders Sign Power

In accordance with prime analyst Axel Adler, Bitcoin’s newest take a look at of the all-time excessive at $118,000 confirmed a really completely different habits in comparison with previous cycles. Throughout this transfer, long-term holders (LTHs) who’ve been holding cash between six months and two years engaged in some profit-taking. Information reveals their seven-day common spending climbed to twenty,000 BTC. Nonetheless, this stage is way beneath the everyday distribution spikes of earlier cycles, the place spending usually surged to between 40,000 and 70,000 BTC.

This extra average promoting exercise means that the conviction amongst long-term holders stays robust. Moderately than aggressively taking earnings, many are selecting to proceed accumulating or just holding their positions. Adler highlights that accumulation nonetheless outweighs distribution, reflecting confidence available in the market’s future course. Such habits from skilled contributors usually indicators a more healthy, extra sustainable bull section, the place promoting strain is absorbed with out disrupting the broader uptrend.

Regardless of this encouraging backdrop, Bitcoin faces a vital technical take a look at. To verify the power of the newest transfer, BTC must decisively push above the $125,000 stage. A breakout past this resistance would doubtless validate the resilience proven by long-term holders and open the trail towards additional worth discovery.

If bulls succeed, the mixture of institutional demand, long-term accumulation, and lowered promoting strain might drive the following main rally. Conversely, failure to reclaim $125,000 within the close to time period would possibly give bears room to check decrease ranges earlier than the following leg up.

Associated Studying

Testing Assist After ATH Rejection

Bitcoin’s 4-hour chart exhibits worth retreating after a pointy rejection close to $123,200, slightly below the current all-time excessive at $124,000. Following this failed breakout try, BTC has slipped again towards $117,300, the place it’s at present holding above the important thing confluence of the 100 and 200 shifting averages.

This zone between $116,900 and $117,600 is performing as quick help. A decisive breakdown right here might expose additional draw back towards $115,000. Nonetheless, the shifting averages proceed to slope upward, reflecting an underlying bullish construction regardless of the short-term weak point.

Associated Studying

The repeated rejection at $123,000–$124,000 highlights the significance of this resistance. Bulls might want to reclaim this zone with conviction to substantiate momentum and lengthen the uptrend towards greater ranges. Till then, the market stays in a consolidation section, with merchants intently watching if help on the $117K area holds.

Featured picture from Dall-E, chart from TradingView