Be part of Our Telegram channel to remain updated on breaking information protection

The crypto market tumbled 2% amid complicated feedback by Treasury Secretary Scott Bessent and hotter-than-expected US Producer Value Index knowledge for July, sending Bitcoin, Ethereum and XRP decrease.

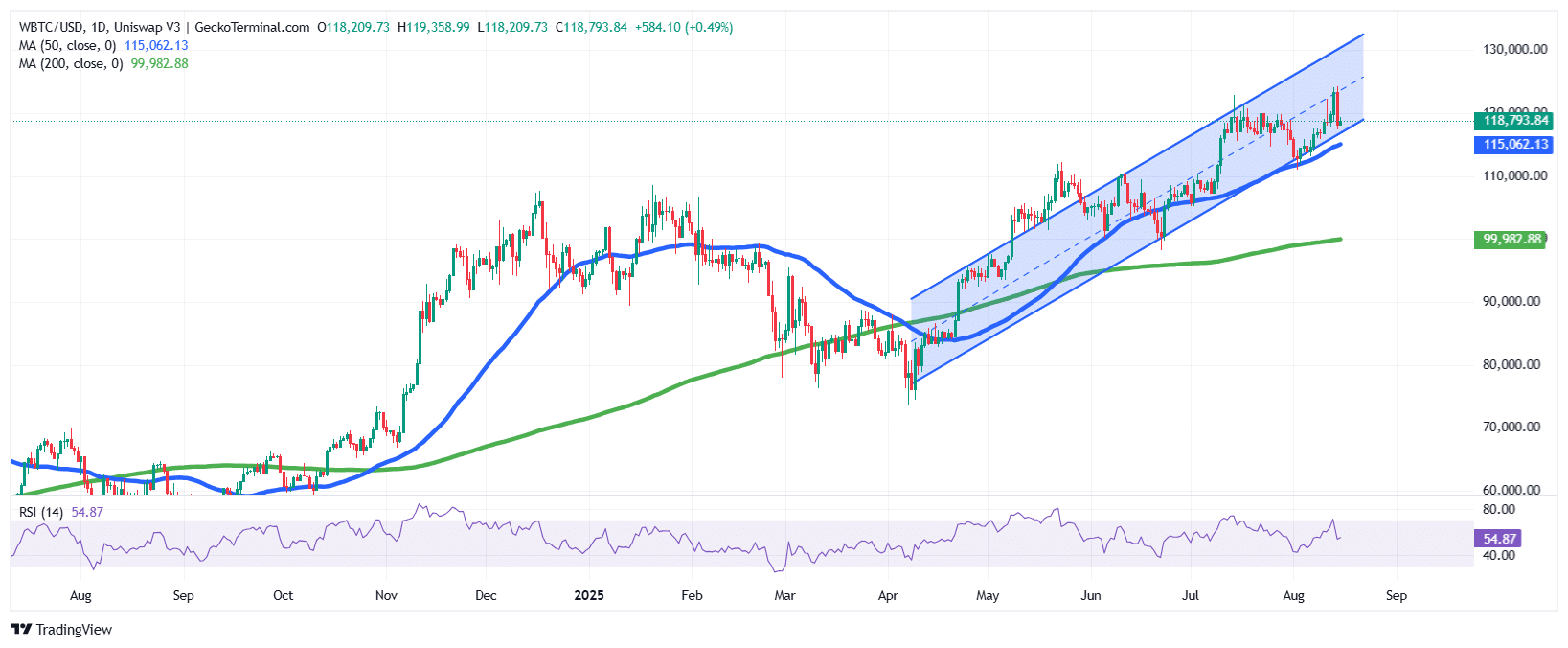

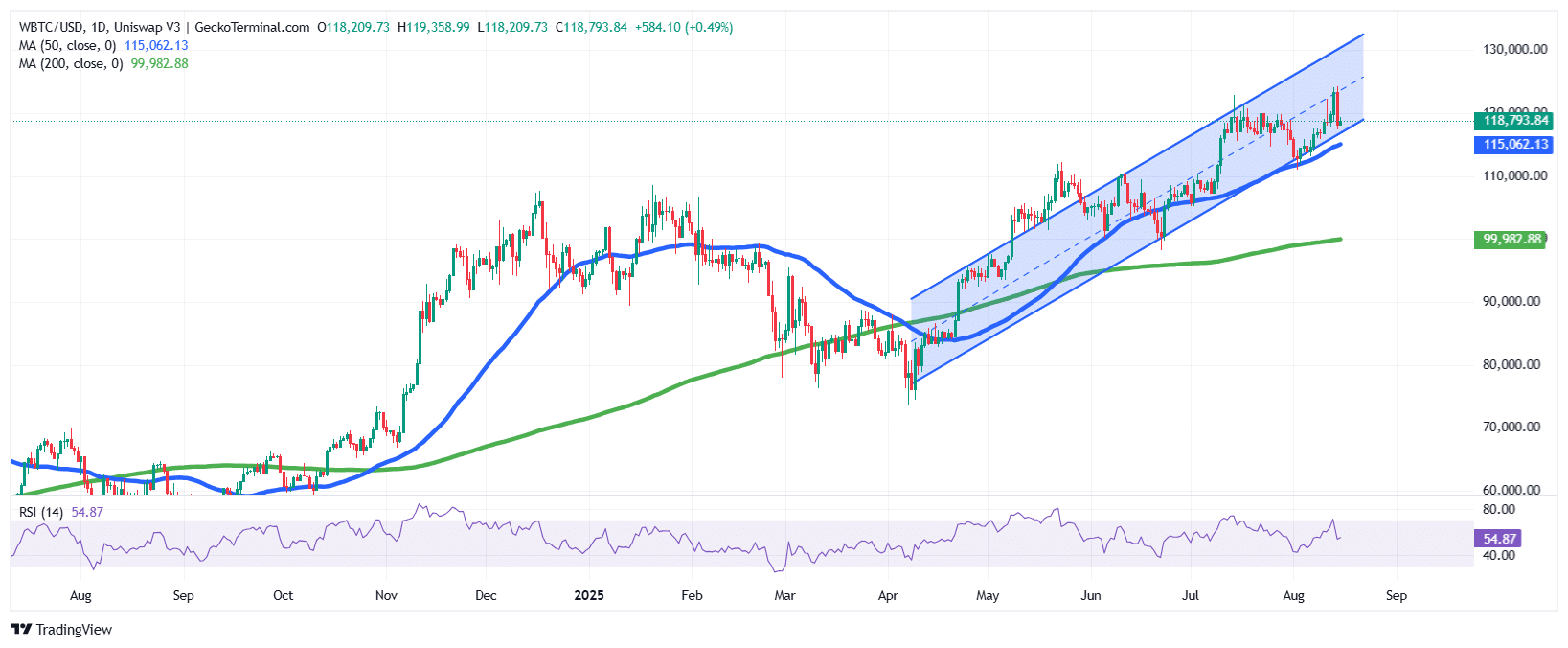

After touching a brand new all-time excessive (ATH) of $124,128 only a day in the past, the BTC worth dropped 2.4% previously 24 hours to commerce at $118,793 as of 5:55 a.m. EST.

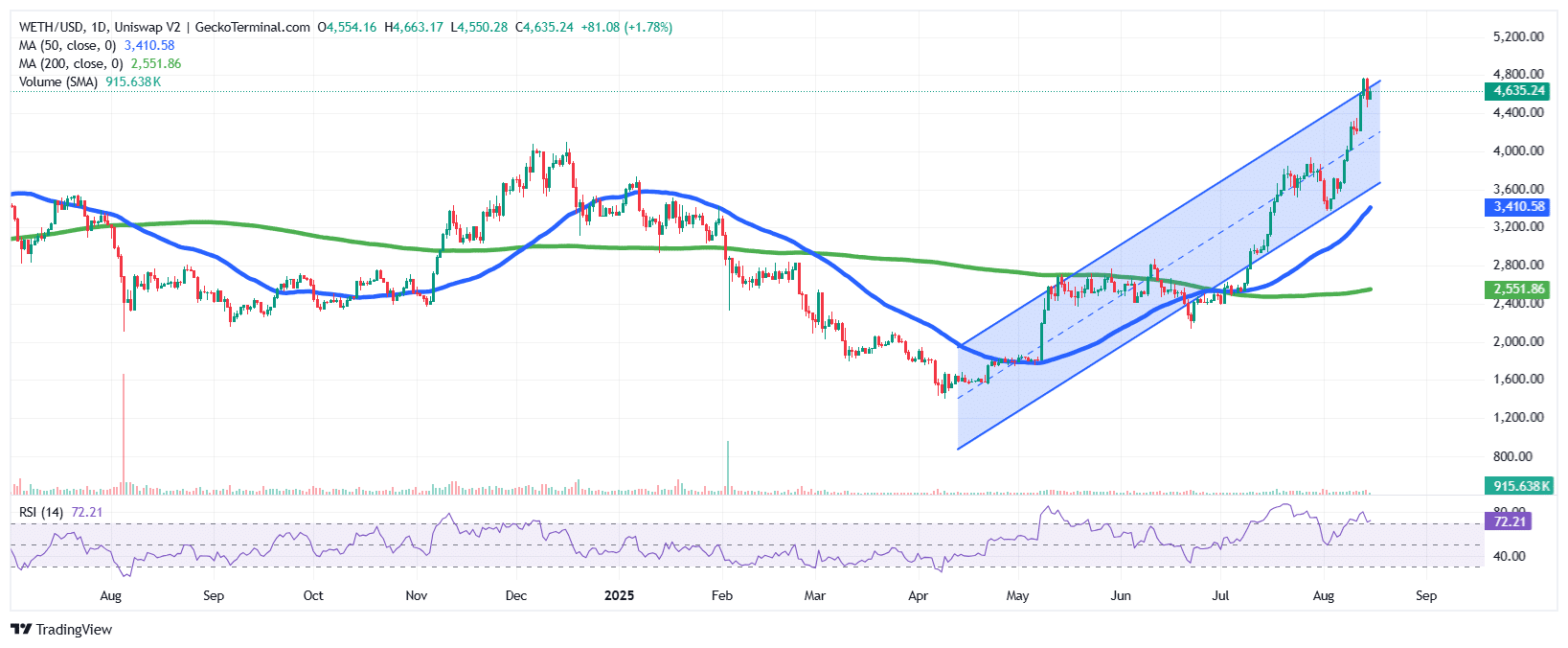

ETH fell 1.8%, taking a breather from its current hovering rally to commerce at $4,635, whereas XRP tumbled 3.7% to $3.12.

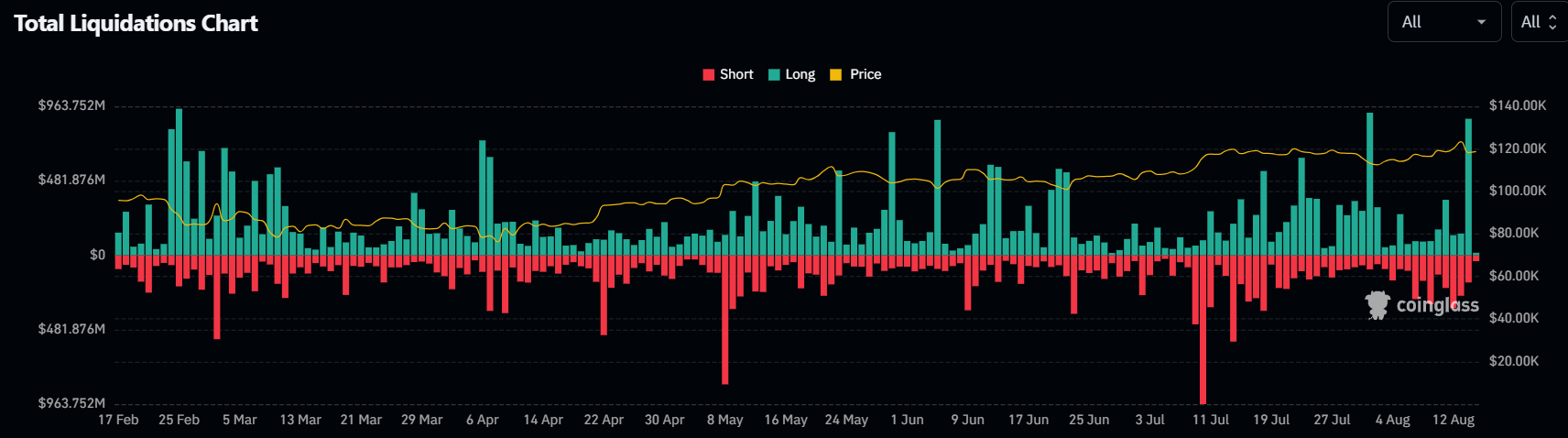

CoinGlass knowledge reveals over $932 million was liquidated within the final 24 hours.

Crypto Costs Tumble After Troubling US PPI Report

The July Producer Value Index (PPI) rose 0.9%, manner above analyst expectations. Core PPI, which doesn’t embrace meals and power, additionally surged 0.9%, hovering previous the anticipated 0.2%.

That shook buyers, who concern it reduces the percentages that the Federal Reserve will lower rates of interest in September.

CRYPTO PRICES FALL AFTER U.S. PPI DATA

Cryptos fell after stronger-than-expected U.S. wholesale inflation knowledge lowered hopes for a Fed fee lower in September, FP Markets’ Aaron Hill says. July’s producer worth index rose 0.9% vs. a 0.2% forecast, reviving inflation fears and…

— *Walter Bloomberg (@DeItaone) August 14, 2025

With inflation considerations reignited, threat property tumbled.

Meme cash led losses, dropping 6.2% within the final 24 hours to a $77.8 billion market capitalization.

Floki (FLOKI), Conflux (CFX), and Dogwifhat (WIF) are the most important losers, every recording plunges of about 7%, in keeping with knowledge from CoinMarketCap.

The highest performers among the many the biggest cryptos have been Aerodrome (AERO), Hyperliquid (HYPE), and Pendle (PENDLE), posting 10%, 5.9%, and 5.6% features, respectively.

BNB Sensible Chain’s Complete Worth Locked (TVL) rose 1% to $7.2 billion, with BNB hitting an ATH of $866.96 regardless of a 2% day by day drop, fueled by a meme coin surge led by Wiki Cat (WKC), up 258% weekly, in keeping with CoinGecko knowledge.

The broader market cap stays close to above $4 trillion, pushed by crypto-friendly insurance policies beneath Trump.

Bessent’s Bitcoin U-Flip Provides Uncertainty

A number of the crimson ink was brought on by Treasury Secretary Scott Bessent, who mentioned that the US wouldn’t buy Bitcoin for its deliberate strategic reserve. However then he had a change of coronary heart, taking to X to reverse his stance.

Whereas BTC seized by the federal authorities will function the inspiration of the reserve established beneath Trump, “Treasury is dedicated to exploring budget-neutral pathways to accumulate extra Bitcoin to develop the reserve, and to execute on the President’s promise to make the US the ‘Bitcoin superpower of the world,’” Bessent mentioned.

Bitcoin that has been lastly forfeited to the federal authorities would be the basis of the Strategic Bitcoin Reserve that President Trump established in his March Government Order.

As well as, Treasury is dedicated to exploring budget-neutral pathways to accumulate extra…

— Treasury Secretary Scott Bessent (@SecScottBessent) August 14, 2025

Bitcoin advocate Senator Cynthia Lummis backed Bessent’s revised place, and proposed that the US may revalue its gold reserves to fund additional Bitcoin accumulation.

“We can’t save our nation from $37T debt by buying extra bitcoin, however we are able to revalue gold reserves to at present’s costs & switch the rise in worth to construct SBR,” she mentioned.

.@SecScottBessent is true: a budget-neutral path to constructing SBR is the way in which. We can’t save our nation from $37T debt by buying extra bitcoin, however we are able to revalue gold reserves to at present’s costs & switch the rise in worth to construct SBR.

America wants the BITCOIN Act.

— Senator Cynthia Lummis (@SenLummis) August 14, 2025

Bullish Indicators Persist Amid Pullback

Regardless of the downturn, bullish sentiment stays. Spot Bitcoin ETFs noticed $230.8 million in internet inflows on August 14, led by BlackRock’s IBIT with $523.7 million, per Coinglass.

Ethereum ETFs recorded $639.6 million in inflows, pushed by BlackRock’s ETHA at $519.7 million, marking eight consecutive days of features.

The BTC worth on the day by day chart reveals a powerful bullish pattern, buying and selling inside a rising channel sample. Bitcoin worth is above each the 50-day ($115,062) and 200-day ($99,983) Easy Transferring Averages (SMAs), confirming bullish momentum.

The Relative Power Index (RSI) is impartial at 54.87, suggesting room for additional upside with out being overbought.

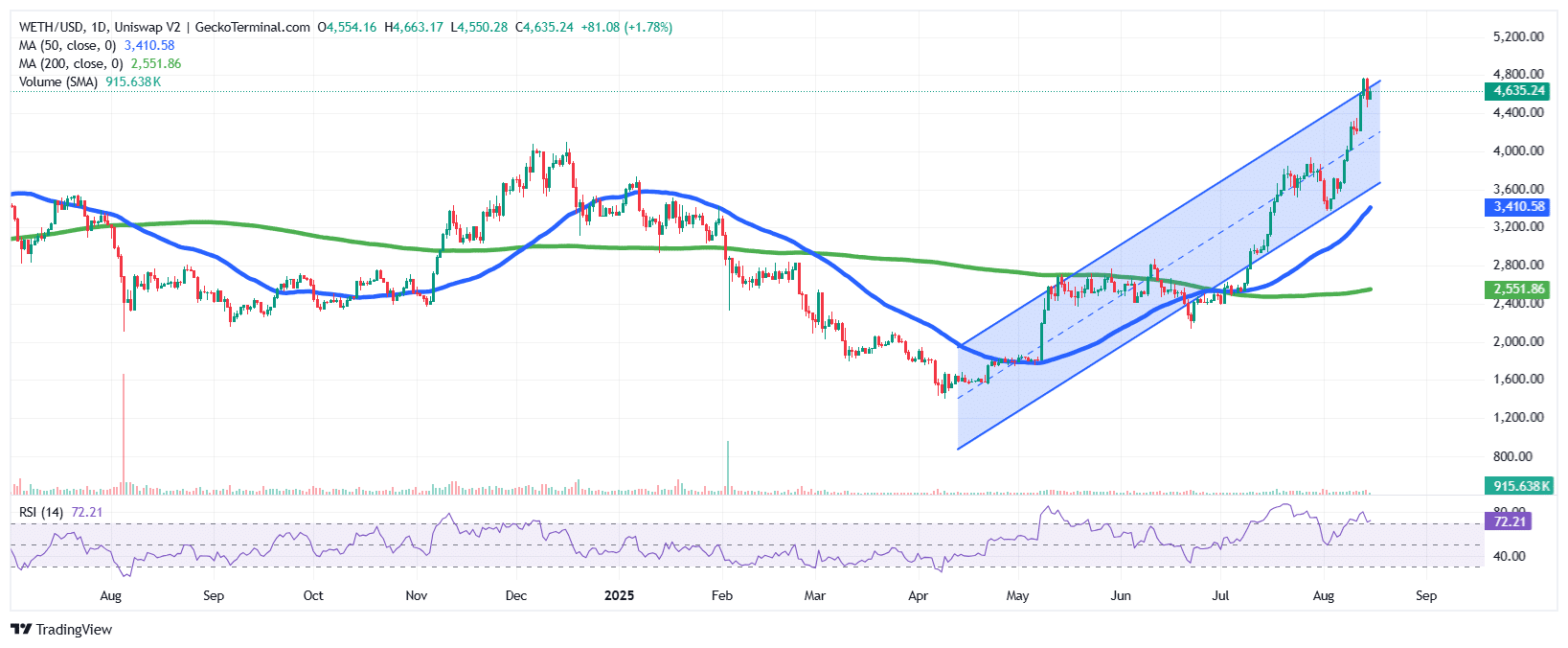

ETH can also be on a sustained bullish pattern, with the asset far above each the 50-day ($3,410) and 200-day ($2,552) SMAs. RSI is overbought at 72.21, signaling robust momentum. Ethereum is edging nearer to its November 2021 ATH of $4,878.

Opportunistic Shopping for and Market Resilience

The dip attracted patrons, with BitMEX co-founder Arthur Hayes buying over $16 million in crypto, together with HYPE, Lido (LDO), and Ethena (ENA) previously 5 days, in keeping with Lookonchain.

Arthur Hayes(@CryptoHayes) purchased extra $HYPE, $LDO, and $ENA at present.

Over the previous 5 days, Arthur Hayes has bought a complete of 1,750 $ETH($7.43M), 58,631 $HYPE($2.62M), 3.1M $ENA($2.48M), 1.29M $LDO($1.83M), 184,610 $PENDLE($1.02M), and 420,000 $ETHFI($516.6K).… pic.twitter.com/dyy6nDxTer

— Lookonchain (@lookonchain) August 15, 2025

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection