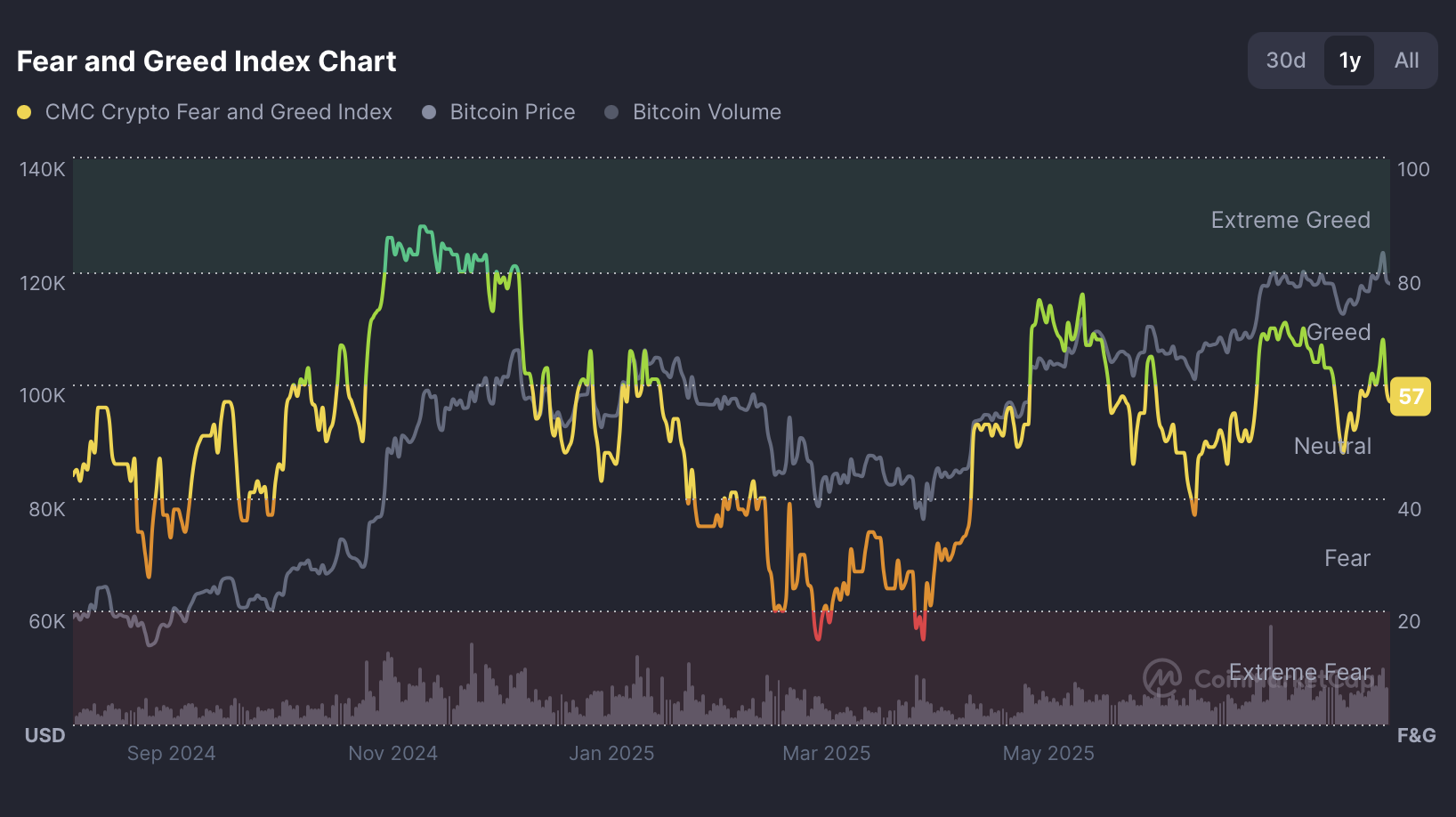

The cryptocurrency market is getting into a consolidation section as speculative momentum cools. CoinMarketCap’s Worry & Greed Index dropped to 57/100, slipping from yesterday’s 59 and effectively beneath July’s “Greed” zone at 68.

The shift displays a tempering of bullish exuberance regardless of Bitcoin holding close to $117,000 and complete crypto market capitalization remaining above $3.85 trillion.

Whereas institutional alerts proceed to flash bullish — highlighted by the Federal Reserve ending its crypto banking scrutiny program and Ethereum ETFs attracting $2.31 billion in weekly inflows — merchants are more and more cautious. Technical charts present the market cap is now testing resistance on the $4.04 trillion Fibonacci stage, a barrier that might outline near-term route.

1. CMC Worry & Greed stability

The Worry & Greed Index sits at 57 (Impartial), down 16% from July’s peak. This cooling displays fading hypothesis regardless of Bitcoin’s resilience. Over the past week, the index held regular between 57–58, suggesting merchants are ready for a stronger catalyst after August’s 6.6% rise in complete market cap. Impartial readings traditionally align with sideways worth motion earlier than decisive strikes.

2. Institutional entry bullish impression

Institutional flows stay a shiny spot. The Fed’s choice to scrap its crypto banking scrutiny program removes a longstanding barrier to conventional finance participation. In the meantime, Ethereum ETFs recorded $2.31 billion in weekly inflows, underlining rising demand. Nevertheless, Bitcoin dominance climbed to 59.03%, signaling capital rotation into BTC as threat urge for food towards smaller-cap altcoins cools. Collectively, these strikes recommend institutional confidence in crypto’s long-term trajectory whilst retail hypothesis eases.

3. Technical consolidation alerts

The overall crypto market cap continues to commerce above its 30-day EMA at $3.85T, preserving the bullish construction. Nonetheless, resistance looms on the $4.04T Fibonacci stage (23.6%), with the RSI(14) at 68.17, close to overbought situations. Day by day spot volumes dropped sharply by 59% to $446B, underscoring hesitation. Analysts at the moment are anticipating a MACD histogram reversal (presently +$5.6B) to verify whether or not the subsequent pattern factors larger or alerts a retracement.

What this implies for crypto

For now, the market sits in a impartial zone of steadiness – institutional assist and ETF inflows present a flooring, however fading retail exercise and technical resistance cap upside. If bulls can break via the $4T barrier with quantity, the subsequent leg larger may carry Bitcoin and Ethereum towards recent highs. If not, impartial sentiment may harden into consolidation or perhaps a correction. Both method, the approaching weeks are more likely to set the tone for the rest of 2025’s crypto cycle.