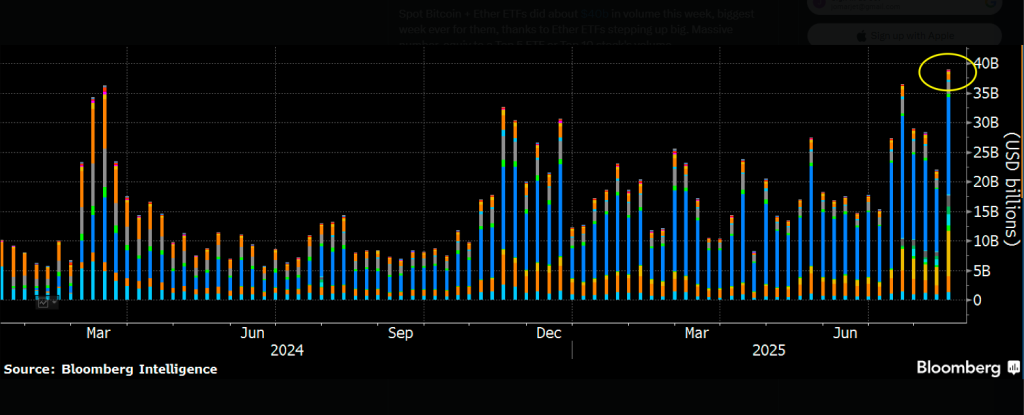

This week noticed document buying and selling in US spot Bitcoin and Ether ETFs, pushed largely by a sudden rush into Ether funds.

Associated Studying

In keeping with ETF analyst Eric Balchunas, Ether ETFs alone posted roughly $17 billion in weekly quantity, a determine that stunned many after months of quiet. The spike has pushed buying and selling desks to rethink how briskly cash can circulation into these funds.

Ether ETFs File Large Quantity

Reviews have disclosed that spot Ether ETFs not solely logged about $17 billion in weekly buying and selling quantity, but additionally noticed a document single-day web influx of $1 billion.

Throughout the primary two weeks of August, the funds pulled in additional than $3 billion. In keeping with Balchunas, it was nearly as if the Ether ETFs have been in hibernation mode for 11 months after which crammed one 12 months’s value of exercise into six weeks. That phrase captured how abruptly demand arrived.

Spot Bitcoin + Ether ETFs did about $40b in quantity this week, largest week ever for them, due to Ether ETFs stepping up huge. Large quantity, equiv to a Prime 5 ETF or Prime 10 inventory’s quantity. pic.twitter.com/Z89uV63A3w

— Eric Balchunas (@EricBalchunas) August 15, 2025

Worth Peaks And Fast Pullbacks

Primarily based on market knowledge, Bitcoin hit a headline-making excessive of $124,000 on Thursday, whereas Ether got here inside practically 2.1% of its November 2021 excessive by reaching $4,787, CoinMarketCap knowledge reveals.

The highs didn’t stick. Since Thursday, Bitcoin has fallen over 5% from that peak and was buying and selling round $117,648, whereas Ether dropped 6.15% and sat close to $4,475. Brief swings like these are widespread when pleasure and recent flows meet skinny liquidity.

Comparisons To The Bitcoin ETF Run

Analysts are drawing parallels to final 12 months’s Bitcoin ETF rush. Reviews level out that Bitcoin ETFs reached new highs of $73,680 simply two months after launching in January 2024.

MN Buying and selling Capital founder Michael van de Poppe stated, “There’s far more to return for this cycle.” That view displays optimism amongst some merchants that ETFs can preserve driving costs greater throughout crypto markets.

Associated Studying

Warning From Market Watchers

On the similar time, some market watchers warn {that a} recent all-time excessive for Ether may nonetheless be weeks or months away. Flows will be risky. Large one-day inflows can transfer markets shortly, however they’ll additionally reverse simply as quick when merchants take income or shift methods.

If Ether funds preserve bringing in giant sums past the primary two weeks of August, the transfer appears to be like extra sturdy. If not, the massive numbers may become a short-lived spike.

Primarily based on stories and market conduct to date, ETFs are clearly a significant near-term driver for each Bitcoin and Ether.

The story remains to be unfolding. Some anticipate extra positive aspects; others urge endurance. Both approach, the sudden rush into Ether ETFs has made this chapter one of many busiest in latest crypto buying and selling historical past.

Featured picture from Pexels, chart from TradingView