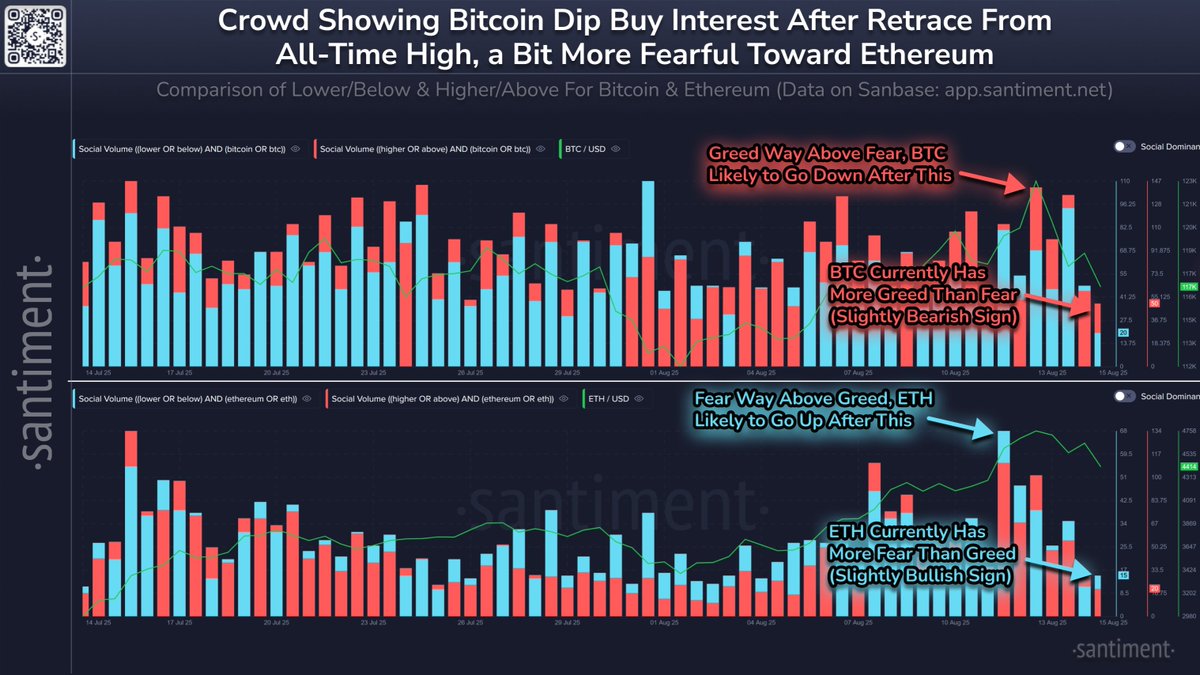

Recent information from market intelligence platform Santiment reveals a hanging divergence in sentiment between Bitcoin (BTC) and Ethereum (ETH) that would set the stage for Ethereum to outperform within the close to time period.

Santiment’s evaluation in contrast social media mentions of “decrease” or “under” versus “greater” or “above” in relation to every asset’s worth ranges. For Bitcoin, the greed spike coincided nearly completely with its all-time excessive and subsequent native high – a traditionally bearish signal. The report notes that extreme optimism typically precedes a worth pullback, suggesting BTC’s rally could also be cooling.

In distinction, Ethereum has quietly outperformed Bitcoin over the previous three months but has generated far much less bullish chatter. In reality, the ETH crowd is displaying extra worry than greed – an uncommon dynamic that Santiment views as a barely bullish sign.

Traditionally, costs have a tendency to maneuver reverse to retail sentiment. When merchants present robust greed, property typically dip, whereas fear-dominated markets can gasoline upside as sellers get exhausted.

This means Ethereum’s relative lack of hype, regardless of its robust efficiency, might depart extra room for good points in comparison with Bitcoin, the place sentiment seems overheated.

If this divergence continues, Ethereum might see renewed shopping for curiosity from contrarian merchants betting on a sentiment-driven rotation away from Bitcoin.