Bitcoin is present process a structural transformation, and institutional traders are steadily tightening their grip on the cryptocurrency. As of mid-2025, institutional traders are changing into a dominant power in Bitcoin possession and are steadily capturing a big portion of its circulating provide.

Institutional Bitcoin Holdings Barrel Towards 20% Of Provide

Current information reveals that establishments, starting from ETFs to public corporations, now management an unprecedented share of Bitcoin, value tons of of billions of {dollars}. Estimates place institutional possession wherever between 17 and practically 31 p.c of complete provide when additionally factoring the quantity managed by governments.

Associated Studying

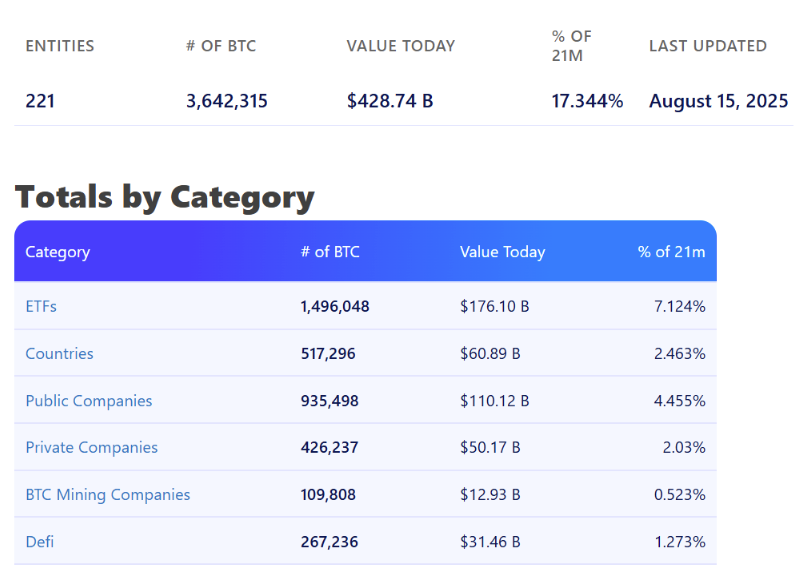

In keeping with information from Bitbo, entities similar to ETFs, private and non-private corporations, governments, and DeFi protocols collectively maintain greater than 3.642 million BTC, equal to about 17.344% of the whole provide. At at present’s costs, that represents roughly $428 billion value of Bitcoin locked away in institutional treasuries.

ETFs are the biggest contributors, with over 1.49 million BTC, whereas public corporations similar to Technique, Tesla, and others account for 935,498 BTC. Technique’s position is particularly noteworthy, because the agency’s relentless accumulation technique in recent times has seen it amass 628,946 BTC, or about three p.c of the complete circulating provide.

Bitbo information reveals non-public corporations maintain 426,237, value $50.17 billion, and about 2.03% of the whole circulating provide. BTC mining corporations personal 109,808 BTC (0.523% of the whole circulating provide), whereas DeFi protocols personal 267,236 BTC (1.273% of the whole circulating provide).

Bitcoin holdings by class. Supply: Bitbo

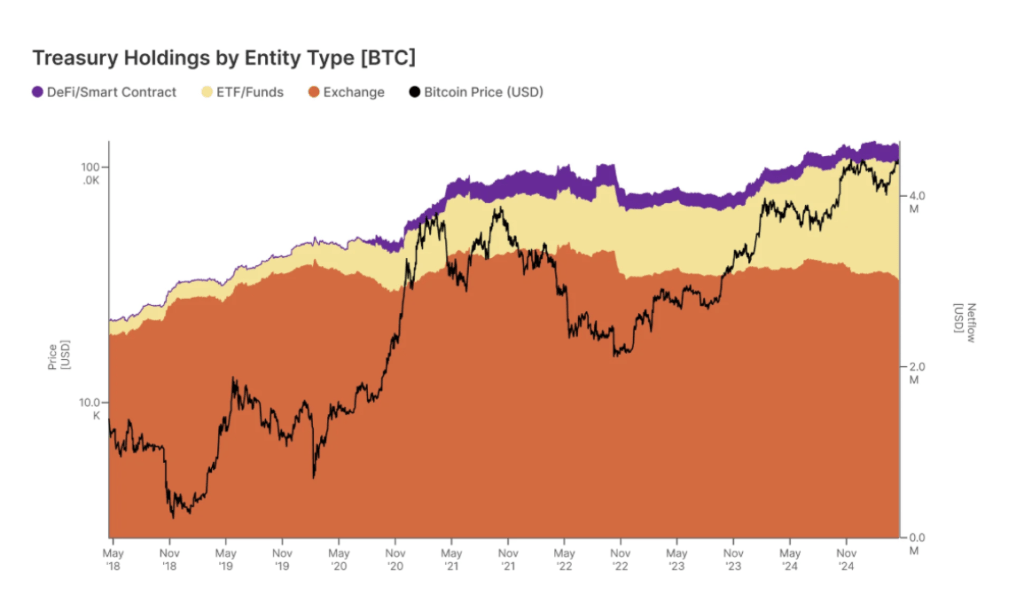

Different reviews, together with a joint examine by Gemini and Glassnode, recommend the numbers may very well be even increased. Their findings level to centralized treasuries composed of governments, ETFs, firms, and exchanges controlling as much as 30.9% of circulating Bitcoin, which equates to over 6.1 million BTC. This improve represents a 924% surge in institutional management of Bitcoin in comparison with a decade in the past.

Chart Picture From Gemini: Bitcoin treasury holdings by entity sort

Is Bitcoin The New Wall Avenue Playground?

Bitcoin’s rise in its early years was primarily based on a mixture of enthusiasm from retail traders and long-term conviction from early adopters, however the market’s steadiness of energy is shifting. In keeping with the holding information, Bitcoin is more and more changing into a lot much less reasonably priced for retail merchants and is now changing into a playground for giant Wall Avenue establishments.

Institutional demand for Bitcoin has not been confined to firms and ETFs alone. Governments are starting to make their presence felt, and the US took probably the most notable step earlier this 12 months. In March 2025, the US authorities established a Strategic Bitcoin Reserve full of seized and forfeited digital property. Different governments like El Salvador and Bhutan are additionally accumulating Bitcoin by way of intentional, ongoing purchases, additional tightening the provision in circulation

Associated Studying

Some analysts imagine this might scale back Bitcoin’s worth volatility and assist its worth development over the long run. Alternatively, the focus of Bitcoin amongst a comparatively small variety of entities might undermine its decentralization and the pure development of its worth. Both approach, the information reveals that Bitcoin is now changing into Wall Avenue’s latest playground.

On the time of writing, Bitcoin was buying and selling at $117,460.

Featured picture from Unsplash, chart from TradingView