A number of main institutional buyers are seizing the latest dip in Ethereum’s worth to broaden their holdings, signaling a give attention to long-term publicity fairly than short-term positive aspects.

This exercise means that the establishments are positioning for long-term publicity fairly than short-term positive aspects.

Ethereum’s Market Sentiment Edges Previous Bitcoin as Accumulation Grows

Blockchain analytics from Lookonchain reveal that one unnamed establishment created three new wallets final week. The agency additionally withdrew 92,899 ETH, price roughly $412 million, from Kraken.

Usually, market analysts interpret such withdrawals as a bullish sign, indicating that buyers are shifting cash into self-custody with a long-term holding technique.

In the meantime, Donald Trump’s DeFi enterprise World Liberty additionally joined the shopping for spree.

On-chain information exhibits that the agency spent $8.6 million USDC to buy 1,911 ETH at round $4,500 every. On the similar time, the agency allotted one other $10 million to amass 84.5 Wrapped Bitcoin (WBTC) at $118,343 per coin.

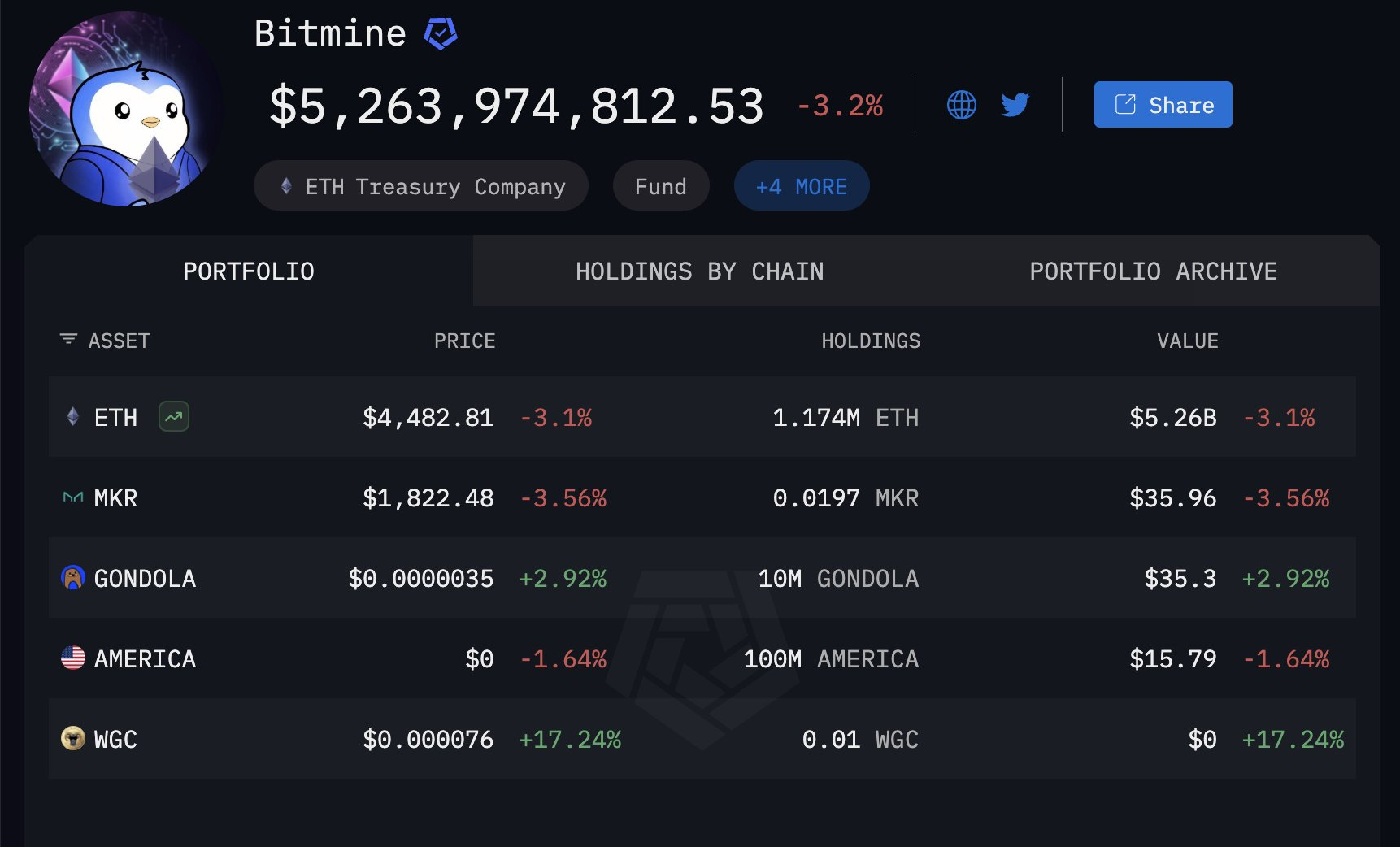

Moreover, the Ethereum-focused agency BitMine made probably the most vital single transfer in the course of the interval. Lookonchain reported that the corporate added 106,485 ETH to its steadiness sheet at a value of $470 million.

This brings BitMine’s Ethereum treasury to 1.17 million ETH, which is now valued at roughly $5.3 billion. The Tom Lee-led agency is the biggest company holder of an Ethereum reserve.

These institutional strikes observe Ethereum’s latest correction after weeks of upward momentum that almost introduced ETH to its all-time excessive.

Market analysts be aware that the timing and scale of those institutional purchases level to a calculated accumulation technique fairly than speculative buying and selling.

Notably, the institutional urge for food is pushed by rising ETF publicity and the rise of treasury corporations. Collectively, these entities have collected over 10 million ETH, or round $40 billion, of the digital asset.

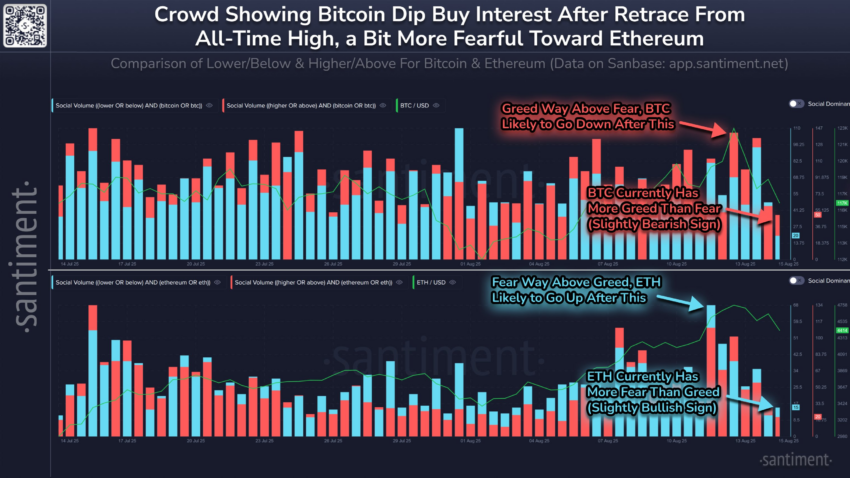

Contemplating this, the blockchain analytics platform Santiment means that Ethereum at present maintains a modest short-term benefit over Bitcoin in market sentiment.

Santiment’s evaluation exhibits that Bitcoin’s rallies typically generate social media hype. In distinction, Ethereum’s constant efficiency over the previous three months has attracted measured, affected person accumulation by whales fairly than public frenzy.

In line with the agency, this disciplined method means that establishments are positioning for sustained progress. It additionally reinforces Ethereum’s position as a number one macro play within the digital asset market over the following decade

The publish Institutional Buyers Seize Ethereum Dip with Almost $900 Million in New Buys appeared first on BeInCrypto.