Be part of Our Telegram channel to remain updated on breaking information protection

JPMorgan says Ethereum is about to soar on the ‘’meteoric development’’ of stablecoins, which principally run on its community.

The outlook follows US President Donald Trump’s signing of the GENIUS Act in July, a landmark regulation giving stablecoin issuers clear guidelines.

The transfer has prompted titans like Amazon, Citigroup and Mastercard to ramp up stablecoin plans, following the blockbuster IPO of USD Coin issuer Circle.

“We expect ether is rising as a direct strategy to acquire publicity to the anticipated meteoric development in stablecoins because the Ethereum community hosts most of those stablecoin property, straight because the L1 or not directly by means of some L2s,” analysts on the financial institution wrote in a be aware on Thursday.

Stablecoin Market Cap Soars

The market cap of stablecoins rose for an eighth consecutive month in July to $272.6 billion and surged virtually $3.8 billion previously week. The sector’s year-to-date development is outpacing that of the broad crypto market.

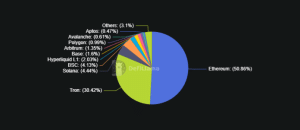

Information from the decentralized finance (DeFi) aggregator DefiLlama reveals that Ethereum at the moment holds round a 50% market share price $138.595 billion. That’s nicely forward of the 30% held by Justin Solar’s Tron blockchain, placing it in prime place to profit.

Stablecoin market share breakdown (Supply: DefiLlama)

Ethereum’s native ETH token has not set a brand new all-time excessive (ATH) worth since Nov. 16, 2021. Again then, the altcoin reached $4,891.70.

It got here inside 4% of that peak yesterday, however a broader market selloff after a hotter-than-expected US PPI launch dashed merchants’ hopes {that a} new document worth will lastly be achieved.

Whereas ETH has been in a position to get well from yesterday’s each day low of $4,461.28 to commerce at $4,634.63 as of 5:50 a.m. EST, it’s nonetheless down greater than 2% on the 24-hour time-frame.

GENIUS Act And Professional-Crypto Insurance policies In The US Ignite Stablecoin Frenzy

The catalyst for an anticipated stablecoin increase is the regulatory framework established by the GENIUS Act. It lays out clear guidelines round reserve backing, disclosures, AML insurance policies, licensing and compliance.

Already Circle’s IPO has set the market alight. It went public on the New York Inventory Change (NYSE) on June 5 after elevating about $1.1 billion by promoting 24 million shares at $31 every.

Circle shares, with the ticker “CRCL,” opened at $69, greater than double the IPO worth. They reached an intraday excessive of $100 earlier than closing the primary day’s session at $83, marking a debut acquire of 168%.

Even the Trump household is entering into the stablecoin enterprise, with its World Liberty Monetary venture launching USD1 in March this 12 months. It’s already listed on Binance.

Information from CoinMarketCap reveals that USD1 is at the moment the fifth greatest stablecoin with a market cap of $2.18 billion.

Largest stablecoins by market cap (Supply: CoinMarketCap)

The present chief by a considerable margin is Tether’s USDT, with a capitalization of $165.95 billion. Circle’s USDC is the following greatest, with a market cap of round $67.75 billion.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection