OpenAI founder Sam Altman warned of an AI bubble that may have profound implications for crypto. Many main AI tokens could be overvalued, deriving their market presence from generalized hype.

Regardless of decentralized AI builders’ formidable targets, huge LLM builders and VC funds are steering this market. Issues on the highest ranges may trigger nasty fallout for the crypto sector.

How Crypto and AI Influence Every Different

Sam Altman, founding father of OpenAI and Worldcoin, is a vital determine for each AI and crypto. Nevertheless, regardless of the lofty guarantees he’s made about his firm’s software program capabilities, cracks are forming within the optimistic image. In a latest interview, Altman claimed that AI is in a bubble, which could have dire penalties for the market:

“When bubbles occur, good folks get overexcited a couple of kernel of reality. In case you take a look at a lot of the bubbles in historical past, just like the [Dotcom crash], there was an actual factor. The tech was actually necessary, [but] folks obtained overexcited. Are we in a part the place traders as a complete are overexcited about AI? My opinion is sure,” Altman informed The Verge.

So, what’s the proof for this? Furthermore, what are the implications for crypto’s personal AI sector? Sadly, the issues are fairly vital.

The market is giving alerts that AI infrastructure constructing is very undervalued, to make certain. However how was this bullish sign mirrored in crypto? Many of the greatest AI tokens have proven poor or erratic performances currently.

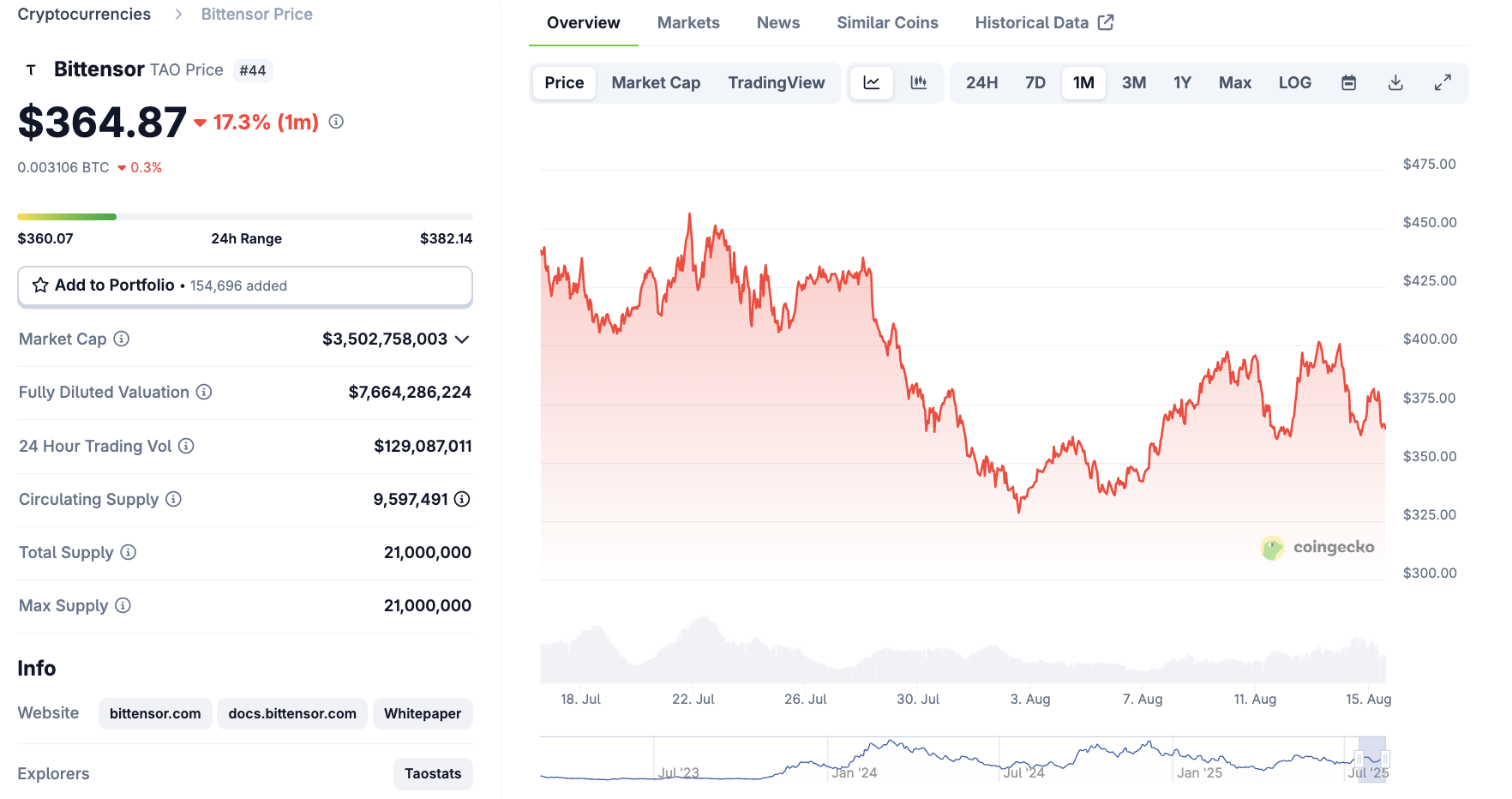

A better take a look at the most important AI tokens provides some additional context. Bittensor is constructing blockchain infrastructure and a marketplace for machine studying instruments, however not an LLM. NEAR, which confirmed encouraging indicators this month, is in an identical boat, and different massive tokens are outright gimmicks.

In the principle, this crypto sector is trailing the most important AI corporations; it’s not a market mover itself. When macroeconomic elements influence the most important LLM builders, the AI token market falls too. Does this relationship ever go the opposite method round?

Regarding Knowledge From LLM Builders

Because of this, everybody in crypto ought to be involved about Altman’s feedback and different warning indicators:

Basically, knowledgeable analysts worry that there’s a bubble as a result of VC corporations are the one factor conserving this know-how operational. Behind the scenes, this know-how is extremely costly, and it’s not clear if it’ll ever be inexpensive for shoppers. With out a really sensible use case, these platforms can’t help themselves.

One information level is especially instructive. Ed Zitron, an AI researcher, lately revealed paperwork detailing a few of the modifications between ChatGPT-5 and 4o. To make a protracted story quick, its new “router” system can doubtlessly burn twice as many tokens per question as ChatGPT-4o.

Primarily based on the group’s lukewarm response, the software program’s new performance in all probability isn’t value this excessive price. If issues like this begin reverberating for the most important AI corporations, the corresponding crypto market is particularly susceptible.

All that’s to say, traders ought to be extremely cautious for the time being. This trade is famed for its volatility; many property, companies, and software program fashions have burned up in spectacular crashes. An AI bubble may do the identical factor to this entire crypto subsector.

The publish Sam Altman Says AI Is in a Bubble—Are Crypto “AI” Tokens Subsequent to Pop? appeared first on BeInCrypto.