- Solana’s TVL hit $31B, setting a brand new file regardless of SOL buying and selling 37% beneath its all-time excessive.

- USDC on Solana leads with $8.7B, whereas Kamino, Jupiter, and Jito add $10.7B extra.

- Buying and selling quantity plunged 84% from January’s peak, however inflows to DeFi hold Solana’s development alive.

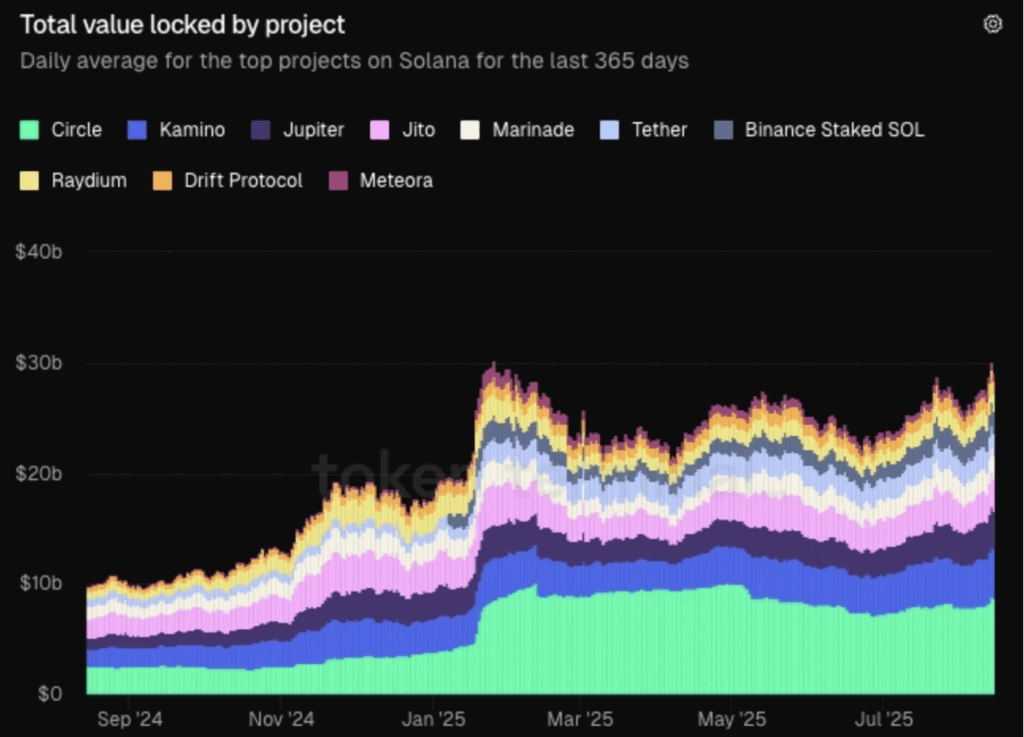

Only a week after Ethereum marked its personal all-time excessive, Solana adopted proper behind with a recent milestone. In line with Token Terminal information, Solana’s complete worth locked (TVL) has surged previous $31 billion as of August 13, edging out the earlier file of $30.8 billion set again in January. That earlier excessive was tied to SOL’s explosive run towards $293 throughout the TRUMP memecoin mania. This time although, SOL sits at $185—nonetheless 37% beneath its value peak—but the ecosystem itself retains increasing.

Who’s Driving Solana’s Progress?

On the middle of this development story is Circle, the issuer of USDC, holding $8.7 billion on Solana—about 28% of the chain’s total TVL. Lending protocol Kamino, aggregator Jupiter, and liquid staking platform Jito make up one other $10.7 billion mixed. Collectively, they’ve helped cushion the chain’s development whilst retail hype round memecoins cooled dramatically since January.

Buying and selling Quantity Crashes, However DeFi Retains Rising

The distinction is hanging. On the January peak, Solana dealt with a mind-blowing $103 billion in weekly buying and selling quantity.Quick ahead to now, and it’s down to only $16.9 billion—an 84% collapse. Alongside that, price accrual dropped from $530 million at its peak to $72.3 million as we speak, portray a transparent image of how memecoin-driven exercise inflated revenues. However the kicker right here is that even with buying and selling and costs falling off, capital continues to be flowing into Solana’s DeFi protocols, holding its TVL momentum intact.

What This Means Transferring Ahead

In a means, Solana’s file TVL feels totally different this time. It’s not simply frothy hypothesis from meme merchants; it’s deeper liquidity from established gamers and protocols. The ecosystem is proving it will possibly maintain development even when speculative mania cools down. If buying and selling quantity finds new catalysts to bounce again, Solana could also be setting itself up for one more highly effective leg greater, with extra endurance than earlier than.