- Institutional highlight: AVAX ranks second in BlackRock’s BUIDL Fund with $53.8M tokenized, trailing solely Ethereum.

- Bullish fractal setup: Value consolidation mirrors previous breakout cycles, with $27.40 as the important thing resistance earlier than $50–$55 targets.

- On-chain increase: 7.3M month-to-month energetic addresses in July mark file development, with sustained consumer engagement since Could.

Avalanche is beginning to look much less just like the “up-and-coming” chain and extra like a critical participant, because it continues to rack up each institutional consideration and uncooked on-chain exercise. With AVAX lately locking in second place on BlackRock’s BUIDL Fund rankings—proper behind Ethereum—eyes are shifting as to whether the token can lastly escape above key resistance ranges.

AVAX Catches BlackRock’s Highlight

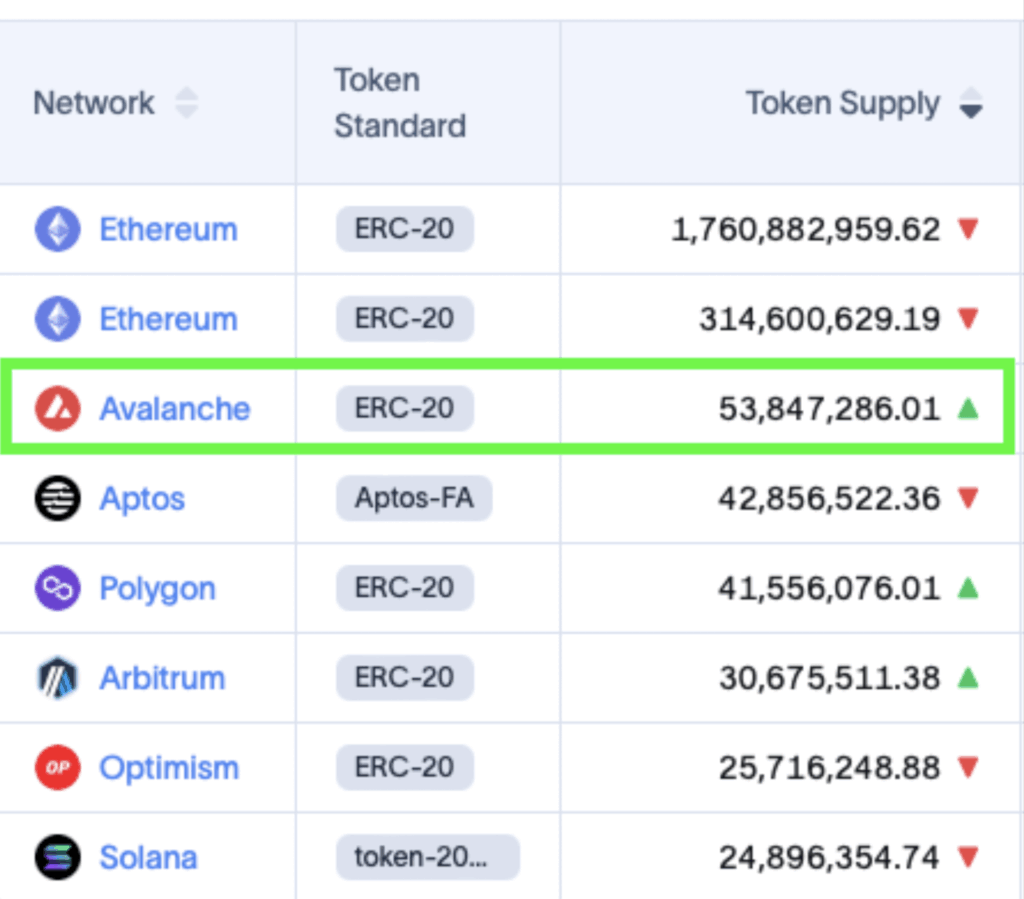

The most important headline for Avalanche proper now could be its new standing with BlackRock. AVAX has climbed to the second-largest blockchain within the BUIDL Fund with over $53.8 million tokenized on-chain, trailing solely Ethereum. For a community that’s been pushing the “real-world asset” narrative, this can be a massive validation. Analyst mdnhakann famous that establishments are choosing Avalanche not only for hype, however for its confirmed scalability and observe file with complicated operations.

And right here’s the kicker: BlackRock’s BUIDL Fund sits inside a $10 trillion ecosystem. That sort of visibility isn’t simply bragging rights—it’s probably a pipeline for critical institutional inflows.

Value Construction, Fractals, and Altseason Speak

Some merchants assume Avalanche may very well be gearing as much as lead the subsequent altcoin season reasonably than simply tagging alongside. Analysts like JRNYcrypto are already leaning bullish, mentioning that AVAX is now firmly tied to real-world asset tokenization whereas nonetheless buying and selling at traditionally low ranges in comparison with BTC and ETH.

Towards Bitcoin and Ethereum, AVAX seems to be bottomed-out. Bollinger Bands are tightening, value motion is consolidating, and repeated help ranges have held—basic circumstances earlier than a volatility breakout. Crypto analyst Xavier even referred to as this one of many cleanest risk-reward setups available in the market proper now.

Including gasoline to the hearth, AVAX’s chart construction is mirroring a previous bullish cycle. Analyst Chris highlighted that consolidation zones are shaping up equally to the final breakout section. If the fractal performs out, clearing $27.40 may put $50–$55 firmly on the desk.

Avalanche’s On-Chain Exercise at Report Highs

It’s not simply hypothesis both—on-chain knowledge is booming. Avalanche recorded 7.3 million month-to-month energetic addresses in July, the best ever. Extra importantly, exercise has held above 6 million since Could, exhibiting that this isn’t only a random spike. That consistency hints at increasing adoption and deeper consumer engagement reasonably than short-term hype.

While you mix this regular community development with BlackRock-level validation and bullish technical setups, it’s not arduous to see why AVAX is being watched as a high contender for the subsequent market rotation.

Closing Take

Avalanche feels prefer it’s sitting on the intersection of two highly effective forces: rising institutional recognition and natural community adoption. If value can lastly clear the $27.40 resistance, the $50–$55 zone immediately seems to be sensible. Whether or not altseason arrives this fall or not, Avalanche has lined up the sort of momentum that might make it a standout chief when the subsequent crypto wave kicks off.