A latest Financial institution of America (BofA) World Fund Supervisor Survey reveals that institutional traders stay largely absent from crypto discussions.

The BofA survey polled 211 managers overseeing $504 billion in belongings, suggesting that crypto allocations stay extra symbolic than strategic.

Financial institution of America Survey: 97% of Large Cash Nonetheless Dodges Crypto

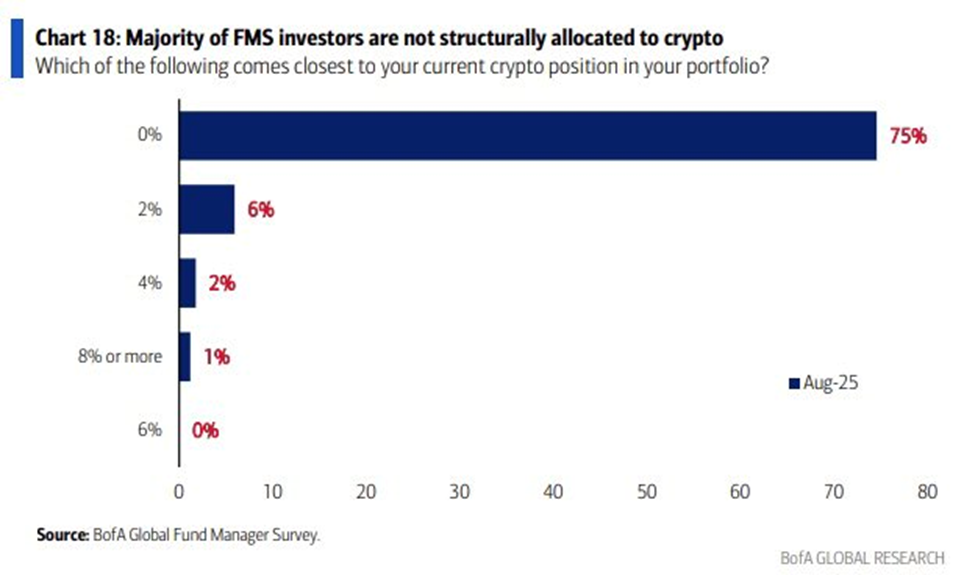

In response to the August survey, an amazing majority of fund managers reported zero crypto publicity. Among the many small fraction who do maintain digital belongings, the common allocation was simply 3.2% of their portfolios.

The typical allocation dropped to solely 0.3% when weighted throughout all the survey group.

In response to ETF analyst Eric Balchunas, the individuals, principally institutional traders with minimal crypto publicity (75% at 0% and a median 3.2% allocation), might lack foresight.

His comment comes given their previous misjudgment of promoting US belongings in Q1 2025, a interval when US markets later rebounded strongly.

“Aren’t these the identical ‘world managers’ who mentioned they have been promoting America in Q1? Perhaps they need to begin surveying folks with higher returns,” Balchunas remarked.

The shortage of institutional conviction comes whilst crypto adoption good points traction in mainstream finance. Earlier this month, new 401(okay) choices added Bitcoin publicity for retirement savers within the US.

Regardless of such developments, BofA discovered that solely 9% of fund managers have structurally allotted to crypto, reflecting Wall Avenue’s cautious stance.

In contrast, fairness sentiment improved notably within the August survey. A internet 14% of portfolio managers have been chubby world equities, in comparison with simply 2% the earlier month.

Allocation to world rising markets climbed to the very best degree since early 2023. In the meantime, US equities remained broadly underweighted amid report considerations about overvaluation.

Ought to Macro Warning Form Portfolios?

Past crypto, the survey confirmed broad warning amongst institutional traders. 41% of respondents anticipated weaker world progress over the subsequent 12 months, up from 31% in July.

Inflation fears additionally ticked increased, with 18% forecasting stronger value pressures than 6% the prior month.

Money ranges remained regular at 3.9%, just under the 4.0% BofA beforehand flagged as a “promote sign” for US equities. Such alerts have preceded a median four-week S&P 500 decline of two%.

The survey additionally recognized the largest perceived dangers. Amongst them are renewed world recession triggered by commerce wars (29%), inflation derailing Federal Reserve (Fed) charge cuts (27%), and a disorderly rise in bond yields (20%).

Whereas equities and bonds stay the normal focus, crypto continues to take a seat on the fringes of institutional portfolios.

With Wall Avenue seemingly comfy watching from the sidelines, specialists allude to crypto’s steadily outpacing conventional markets.

In response to Ryan Rasmussen, head of analysis at Bitwise Make investments, fund managers might quickly be compelled to rethink their 3.2% downside.

The put up Financial institution of America Survey Reveals Large Cash Retains Dodging Crypto appeared first on BeInCrypto.