Bitcoin’s value rally has hit turbulence over the previous 48 hours, and this has opened the door for bearish voices to resurface. After reaching a contemporary excessive of $124,128 simply three days in the past, the main cryptocurrency has since declined by about 4.8%, sliding again to the $117,000 to $118,000 value zone on the time of writing. This pullback has opened up a chance that the much-anticipated macro prime could already be in, and additional draw back could also be doable if there’s a lack of bullish momentum.

Associated Studying

Analyst Maps Out Bearish Bitcoin Wave Construction

Bitcoin confirmed indicators of constructing on in early August after bouncing off a low round $112,000. Nevertheless, after its newest excessive at $124,128, sellers rapidly stepped in, pulling the worth down. The decline has been accompanied by fading short-term momentum. Though it could be too early to conclude, relative energy index (RSI) readings are beginning to level to a bearish divergence on the 4-hour candlestick timeframe chart.

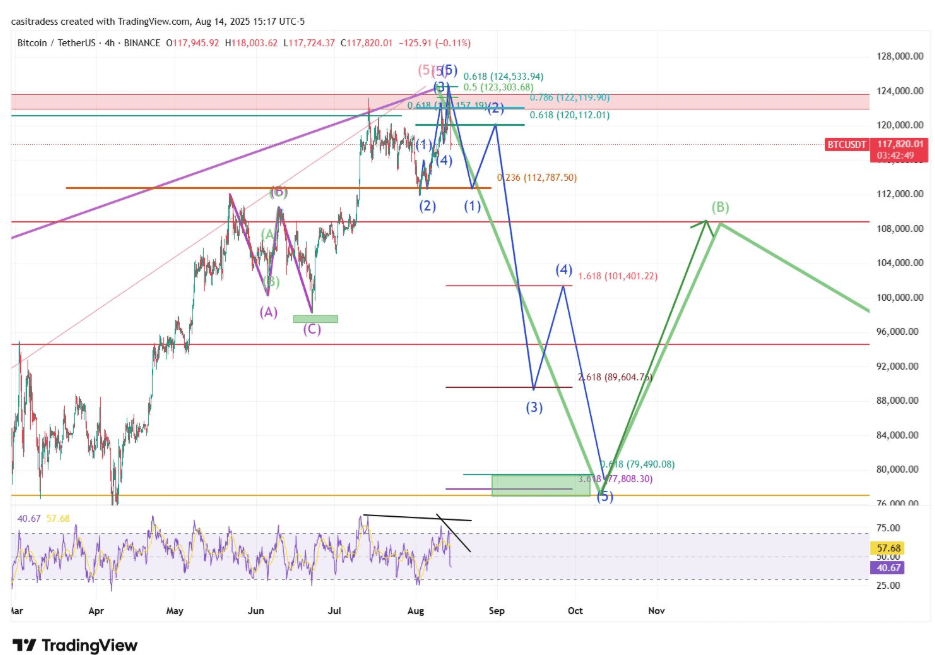

Taking to the social media platform X, crypto analyst CasiTrades outlined what they imagine might be the beginning of a bigger ABC corrective construction for Bitcoin. In accordance with the projection, Bitcoin could also be coming into Wave A, which consists of a five-wave corrective construction that would ship the worth to as little as $77,000 on the macro 0.382 Fibonacci retracement.

The roadmap of this value crash envisions an preliminary Wave 1 drop to $112,000, a quick Wave 2 restoration again to $120,000, after which one other Wave 3 decline into the $89,000 vary. After this, the following step is a Wave 4 retest break of $100,000 earlier than reversing into Wave 5, which brings the last word Wave A backside at $77,000.

Chart Picture From X: CasiTrades

The accompanying chart posted by the analyst exhibits the wave counts with subwave precision. Curiously, the analyst additionally identified that the last word macro goal for the top of this correction is at $60,000, proper on the golden 0.618 Fibonacci retracement. That is on the macro degree and might solely come to fruition if the ABC corrective waves play out to completion.

A Bearish Tone Amidst Bullish Predictions

This evaluation introduces a sobering counterpoint at a time when many forecasts proceed to color Bitcoin as being on monitor for $150,000 and past. Although robust institutional inflows and technical milestones, such because the realized value flipping above the 200-day transferring common are bullish indicators, the bearish situation from CasiTrades may nonetheless be legitimate.

If Bitcoin fails to reclaim bullish momentum, the present correction may become one thing deeper, making the $124,000 excessive not only a pause however the macro prime of this cycle.

Associated Studying

Though many cryptocurrencies have largely adopted Bitcoin’s actions this cycle, CasiTrade’s evaluation isn’t a bearish case for your complete crypto market. In accordance with the analyst, if this bearish case performs out, it may trigger the long-discussed capital rotation out of Bitcoin and into large-cap altcoins, a few of which can surge to new all-time value highs at the same time as Bitcoin retraces. On the time of writing, Bitcoin was buying and selling at $118,203.

Featured picture from Unsplash, chart from TradingView