Bitcoin (BTC) enters the brand new week with uncommon calm, whilst macro forces loom that would outline the market’s course by way of the rest of August.

Regardless of low buying and selling volumes attribute of weekends, the pioneer crypto has exhibited low volatility

Bitcoin Holds Regular as Fed Minutes and Jackson Gap Loom

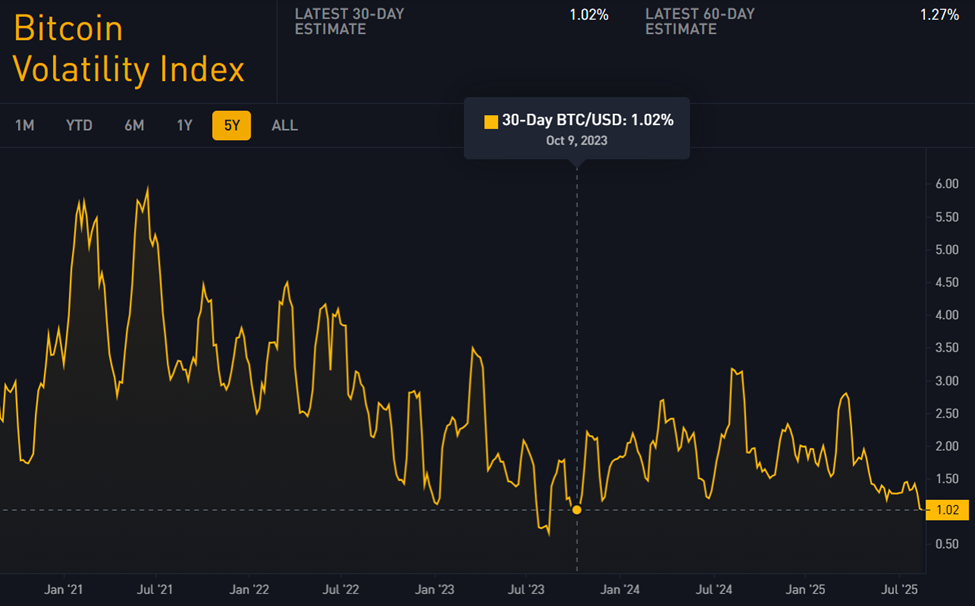

As of this writing, Bitcoin traded for $117,600, sustaining a horizontal consolidation by way of the weekend. Knowledge on BiTBO additionally exhibits that the volatility index has descended to 1.02%, ranges final seen in October 2023.

Bitcoin investor Mike Alfred factors to market restraint amongst merchants and traders, noting the absence of speculative froth.

“Nice to see zero exuberance in Bitcoin this weekend. No futures gaps to shut,” he wrote on X.

The remark highlights a maturing cycle through which retail hype has cooled, and institutional flows more and more form Bitcoin value motion. Analysts at Bitcoin Archive reinforce this theme, pointing to traditionally low ranges of volatility.

“Bitcoin’s volatility is close to all-time lows. Institutional patrons are compressing Bitcoin’s volatility to simply double gold’s. Double the volatility for 10x returns? I’ll take it!” they posted.

However, the subdued weekend backdrop could not final lengthy, with a number of market-moving US financial indicators already within the pipeline.

On Wednesday, policymakers will launch Federal Open Market Committee (FOMC) minutes, after the most recent CPI (Client Value Index) report revealed inflation rose at an annual price of two.7% in July.

This knowledge level will supply a transcript of July’s assembly. It comes after the Fed left charges unchanged at 4.25–4.50% with a 9–2 vote. Notably, this marked the primary twin dissent pushing for cuts since 1993. Powell’s subsequent press convention was imprecise, leaving markets trying to find readability.

The minutes may expose how divided the committee actually is. A dovish tone would doubtless push shares increased, yields decrease, and weaken the greenback, all bullish turnouts for Bitcoin.

A hawkish message, nonetheless, would strain progress and reinforce warning heading into Friday’s major occasion.

The week culminates on the Jackson Gap Symposium, the place Fed Chair Jerome Powell will ship his keynote handle on Friday at 10 AM ET.

His remarks carry outsized weight as a result of previous Jackson Gap speeches have reset expectations round charges and progress. Because it occurred, ripple results unfold throughout equities, bonds, and crypto.

If Powell stresses slowing progress, it could signify a dovish tone. With price cuts priced in, yields may fall as progress shares rip, doubtlessly benefiting Bitcoin amid renewed danger urge for food.

Nonetheless, if the Fed chair leans towards sticky inflation, such a hawkish tone may increase yields, outperform cyclicals, and doubtlessly derail Bitcoin’s path increased.

Due to this fact, markets face a number of catalysts that would steer sentiment for the third quarter. These embrace the Fed minutes, Jackson Gap, and different US financial alerts.

The publish Bitcoin Reveals Low Volatility Forward of Fed-Fueled Week, Calm Earlier than the Storm? appeared first on BeInCrypto.