The blockchain staking market has surged previous $300 billion in worth, positioning itself as some of the vital sources of yield in international finance.

In line with Jamie Coutts, Chief Crypto Analyst at Actual Imaginative and prescient and former Bloomberg Intelligence researcher, this progress might reshape how sovereign wealth funds (SWFs) handle prosperity within the digital period.

Coutts famous that sovereign wealth funds-often tasked with securing nationwide prosperity—could quickly transition into main holders of Bitcoin and adjoining industries like mining. Past functioning as a retailer of worth, these property might function a spine for vitality grid optimization and even stability AI-driven energy calls for.

Blockchain yield as the following sovereign wealth play

In his commentary, Coutts in contrast the potential of blockchain yield to the oil royalties of the twentieth century, which funded nationwide packages and social security nets. As an alternative of fossil gasoline extraction, nonetheless, yield would now be derived from on-chain staking operations that seize worth from a tokenized, digital financial system.

This idea means that sovereign wealth funds won’t solely accumulate property like Bitcoin and Ethereum but additionally interact in large-scale staking operations to generate sustainable returns. The yield might finally evolve right into a type of common fundamental earnings (UBI), or as Coutts describes it, a “sovereign digital dividend” redistributed on to residents.

AI, disruption, and blockchain stability

Coutts additionally highlighted a crucial backdrop: the disruptive pressure of synthetic intelligence throughout conventional industries. As AI accelerates automation and displaces jobs, blockchain-based yield might function a stabilizing counterweight. By offering governments with a predictable earnings stream from staking rewards, digital property would possibly assist fund welfare packages, vitality initiatives, and financial resilience.

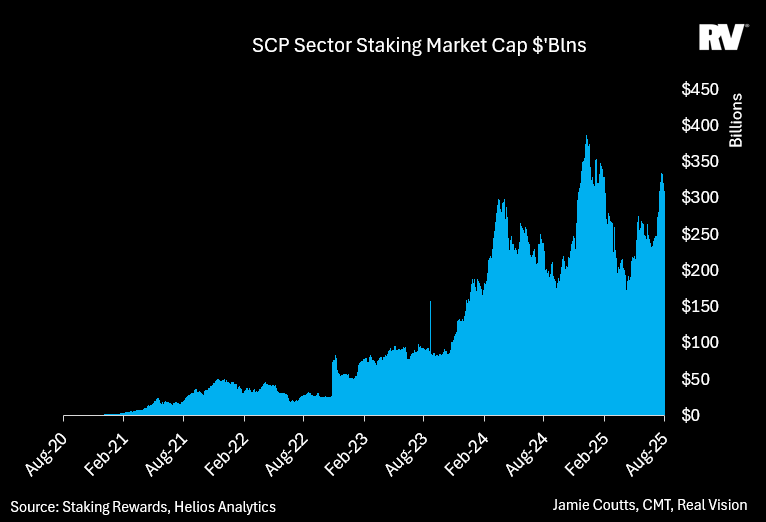

His chart illustrates the meteoric rise of staking market capitalization since 2020, with capital inflows climbing steadily to the current $300B+ base layer of yield. Regardless of cyclical volatility, the general trajectory has been upward, suggesting rising institutional recognition of staking as a long-term income stream.

From retailer of worth to earnings engine

For years, Bitcoin has been framed as digital gold-a hedge towards inflation and a reserve asset. Coutts’ evaluation pushes the narrative additional, envisioning a world the place staking yield turns into as essential as oil royalties as soon as have been. If adopted broadly by sovereign wealth funds, this might remodel digital property into each a wealth protector and an earnings generator, funding nationwide welfare within the twenty first century.

As Coutts put it, simply as oil formed the final century, blockchain yield could anchor prosperity within the subsequent.