- Investing $200 month-to-month into XRP via dollar-cost averaging might construct long-term wealth, with potential upside if adoption mirrors Bitcoin’s development.

- XRP’s real-world utility in cross-border funds and Ripple’s increasing partnerships strengthen its case as a long-term maintain.

- Dangers stay from regulation, competitors, and unstable market sentiment, so diversification and endurance are key.

Crypto investing has all the time been a mixture of excessive danger and excessive reward. Most individuals chase quick earnings, leaping out and in of trades, however there’s one other path that doesn’t get as a lot hype—regular, long-term accumulation. XRP, the token tied to Ripple, isn’t nearly fast transactions or world funds anymore; it’s slowly turning into a part of that long-term wealth dialog.

A number of chatter in the neighborhood suggests {that a} small however constant funding—say $200 each month—may develop into one thing life-changing if XRP follows a path wherever near Bitcoin’s historic run. The numbers may sound daring, however the technique behind it’s easy.

The Case for Greenback-Value Averaging

This entire thought is predicated on dollar-cost averaging (DCA). As a substitute of stressing over timing the market, you simply put the identical quantity in at common intervals. When costs dip, you get extra tokens. When costs are excessive, you purchase fewer. Over time, that evens out volatility and avoids the panic-buy/promote cycle that wrecks most merchants.

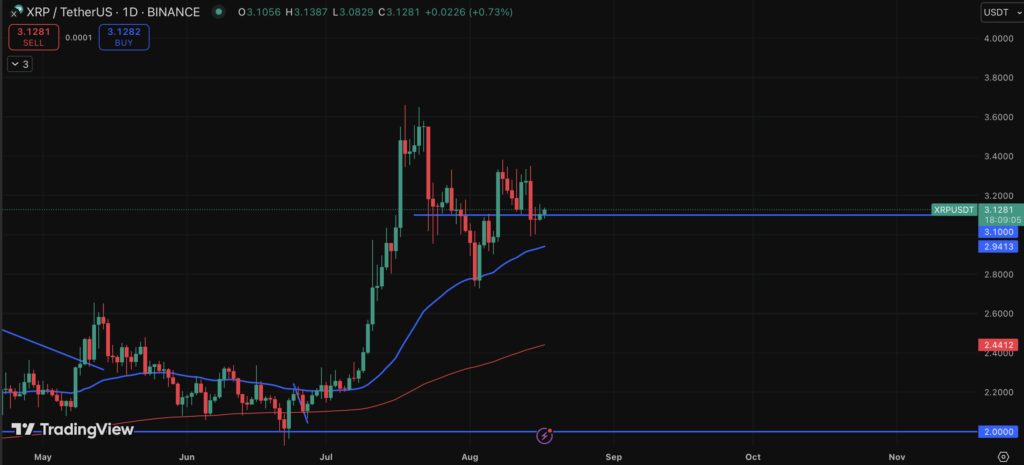

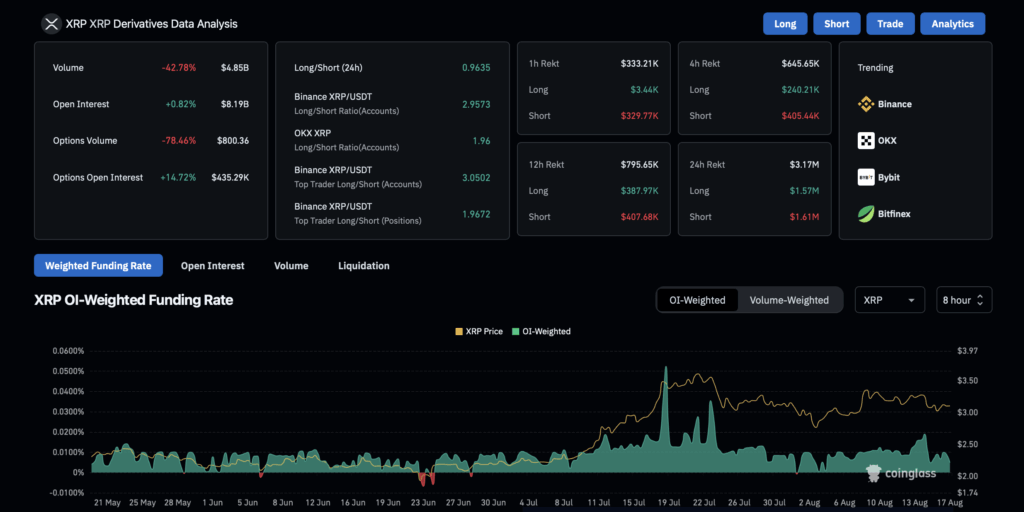

In conventional finance, DCA has confirmed itself, and crypto markets have proven it could work right here too. For XRP—with its wild swings, rallies, and pullbacks—DCA may very well be one of many few methods to trip the wave with out dropping your head alongside the best way.

The Math Behind the Dream

When you make investments $200 each month for 15 years, that’s $36,000 out of pocket. On the floor, not groundbreaking. But when XRP grows like Bitcoin did throughout its adoption part, the upside may very well be staggering. That sort of consistency, paired with compounding development, might realistically flip into a whole bunch of 1000’s—and even push towards the $1M mark if adoption explodes.

After all, that is hypothetical. No ensures. However it exhibits why endurance and self-discipline can generally outperform making an attempt to hit residence runs in a unstable market.

Why XRP Stands Out

In contrast to meme cash or purely speculative performs, XRP has one thing tangible going for it—real-world utilization. Ripple is actively partnering with banks and establishments to overtake cross-border funds, aiming to switch clunky techniques like SWIFT. Quicker, cheaper transfers aren’t simply concept; they’re occurring.

If Ripple wins extra partnerships and clears its authorized hurdles, XRP may very well be positioned as one of many few digital belongings with each utility and adoption. That’s the sort of basis long-term traders wish to see.

Dangers That Can’t Be Ignored

It’s not all upside. Regulatory fights, particularly Ripple’s long-running SEC battle, stay a cloud. Competitors from Stellar, Solana, and even government-backed digital currencies might chip away at XRP’s position. And let’s not neglect the market itself—crypto sentiment can swing from euphoria to despair in a single day.

That’s why the golden rule holds: by no means make investments greater than you’re ready to lose. DCA helps scale back stress, however it doesn’t erase the dangers.

Balancing Technique and Endurance

The smarter strategy? Combine DCA into XRP with diversification throughout different belongings—each crypto and conventional markets. Crypto wealth usually rewards the cussed holders who can abdomen years of uncertainty. When you’re placing in $200 a month, resisting the urge to panic-sell throughout downturns might make all of the distinction.

Ultimate Take

The concept of turning $200 a month into $1 million may sound like a dream, however it displays an even bigger reality: crypto rewards consistency, endurance, and perception in adoption. XRP, with its mix of utility and potential for world attain, makes for a compelling candidate.

Wealth on this area not often comes from chasing fast wins. It comes from displaying up month after month, using the storms, and being there when the tide lastly turns.