Key Takeaways

Chainlink surged 12.32%, reaching $24.5 after efficiently holding to $21 assist. Whales bought 938,489 tokens value $21.23 million, driving the rally, however retail is absent.

Chainlink [LINK] surged 12.32% after efficiently defending the $21 assist, reaching an area excessive of $24.5.

As of this writing, Chainlink was buying and selling at $24.3, marking an 11.2% bounce on each day charts. Its buying and selling quantity surged 37.7% to $1.45 billion, indicating regular capital influx. What’s driving the upsurge?

Chainlink whales are again

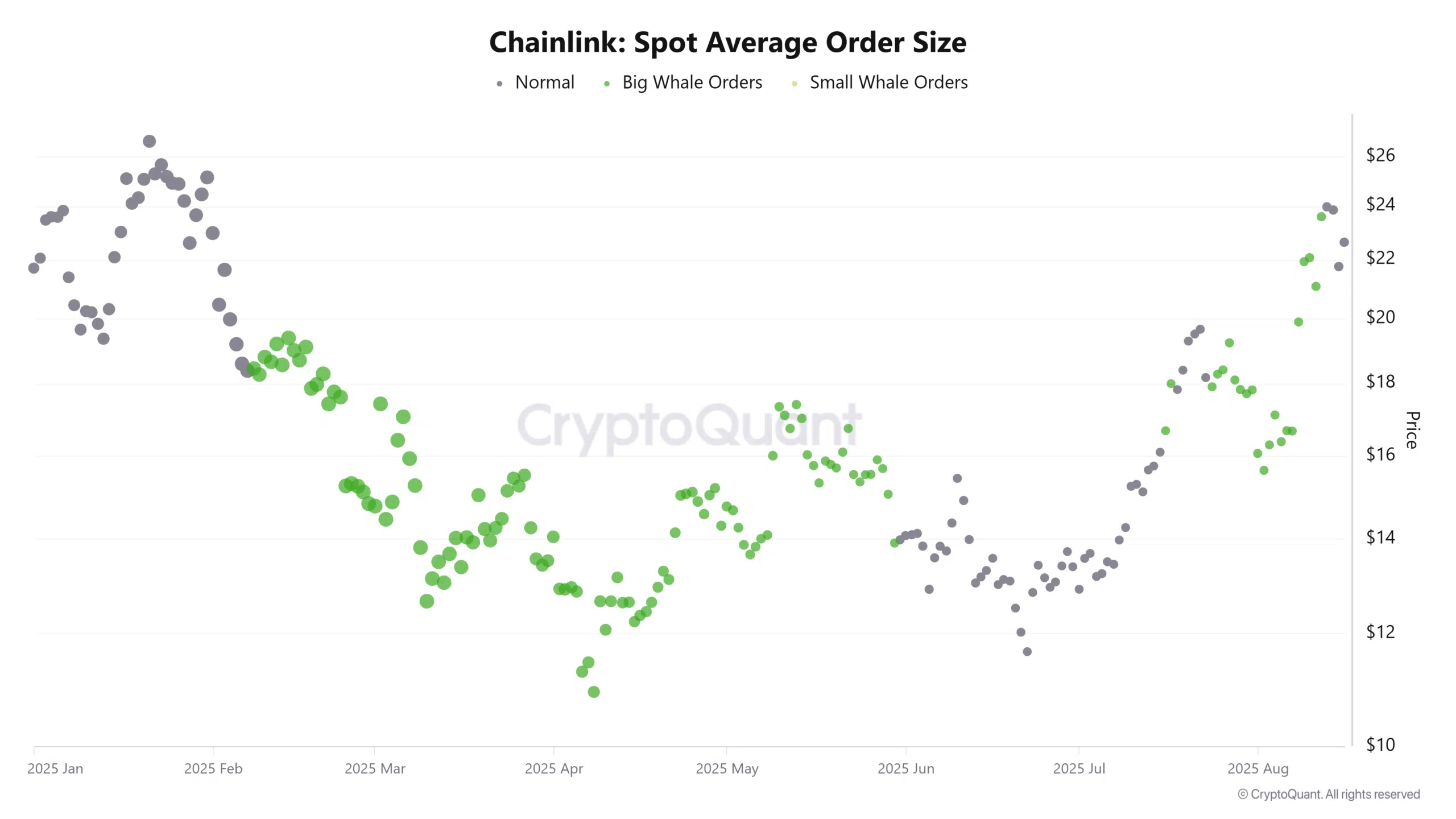

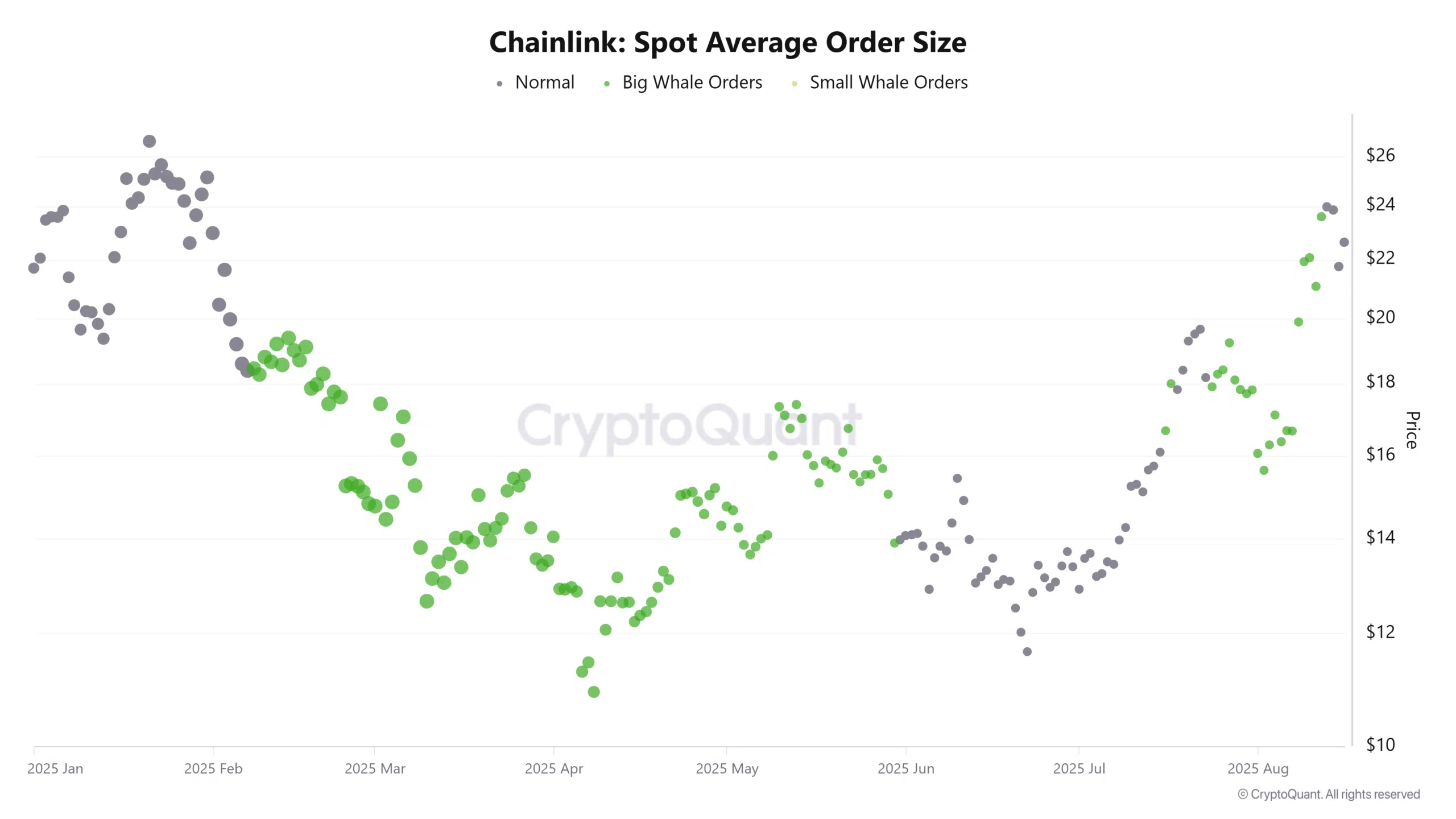

After taking a step again from the market, Chainlink whales have returned. Spot Common Order Dimension knowledge from CryptoQuant confirmed no whale orders between the twelfth to the seventeenth of August.

Supply: CryptoQuant

Now, market habits has shifted amongst whales, and they’re accumulating, as reported by Onchain Lens. 5 whale wallets spent 4,806 ETH tokens value $21.23 million to buy 938,489.

When whales accumulate, it alerts agency conviction with the market and anticipates the asset to realize additional.

Supply: Coinalyze

Along with these wallets, Chainlink’s spot market recorded substantial shopping for quantity for 2 consecutive days. The altcoin noticed 6.38 million in Purchase Quantity cumulatively, in comparison with 6.04 million in promote quantity.

Due to this fact, the altcoin buy-sell delta held inside the optimistic zone for 2 consecutive days. Trade flows echoed market habits.

Based on CoinGlass, Chainlink’s spot netflow dipped considerably, hitting a month-to-month low of—$935k. Such a dip means that exchanges recorded extra outflows than inflows, an indication of aggressive accumulation.

Supply: CryptoQuant

Traditionally, elevated accumulation supported by low change inflows has preceded larger costs as stress on belongings eases.

Community exercise flash warning indicators

Surprisingly, whereas Chainlink recorded vital shopping for stress, community exercise has didn’t preserve tempo. Based on Santiment, the altcoin’s Value DAA Divergence dipped into adverse territory, hitting a low of -138.3%.

Supply: Santiment

Usually, when DAA Divergence drops to such low ranges, it means that the worth upswing just isn’t backed by natural demand.

As such, fewer lively customers are engaged with the community, and thus, worth energy isn’t confirmed by on-chain utilization.

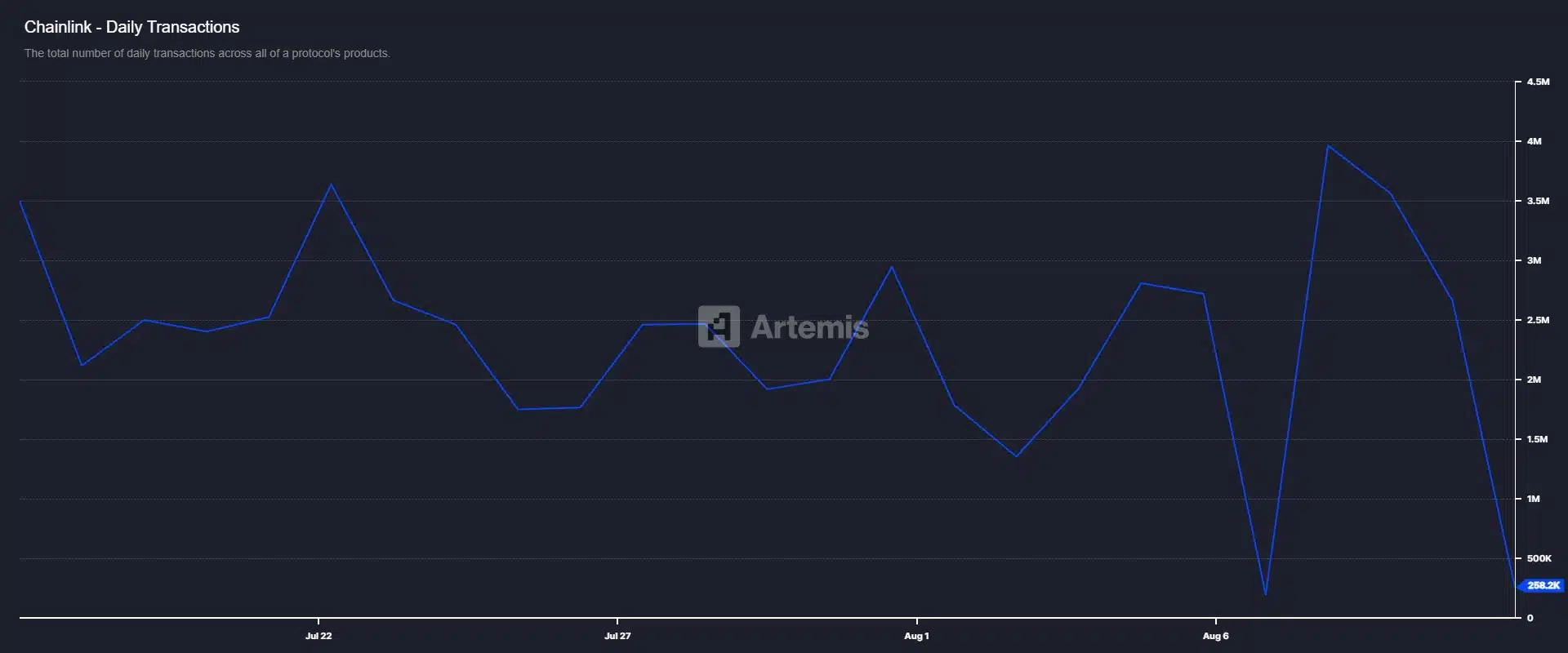

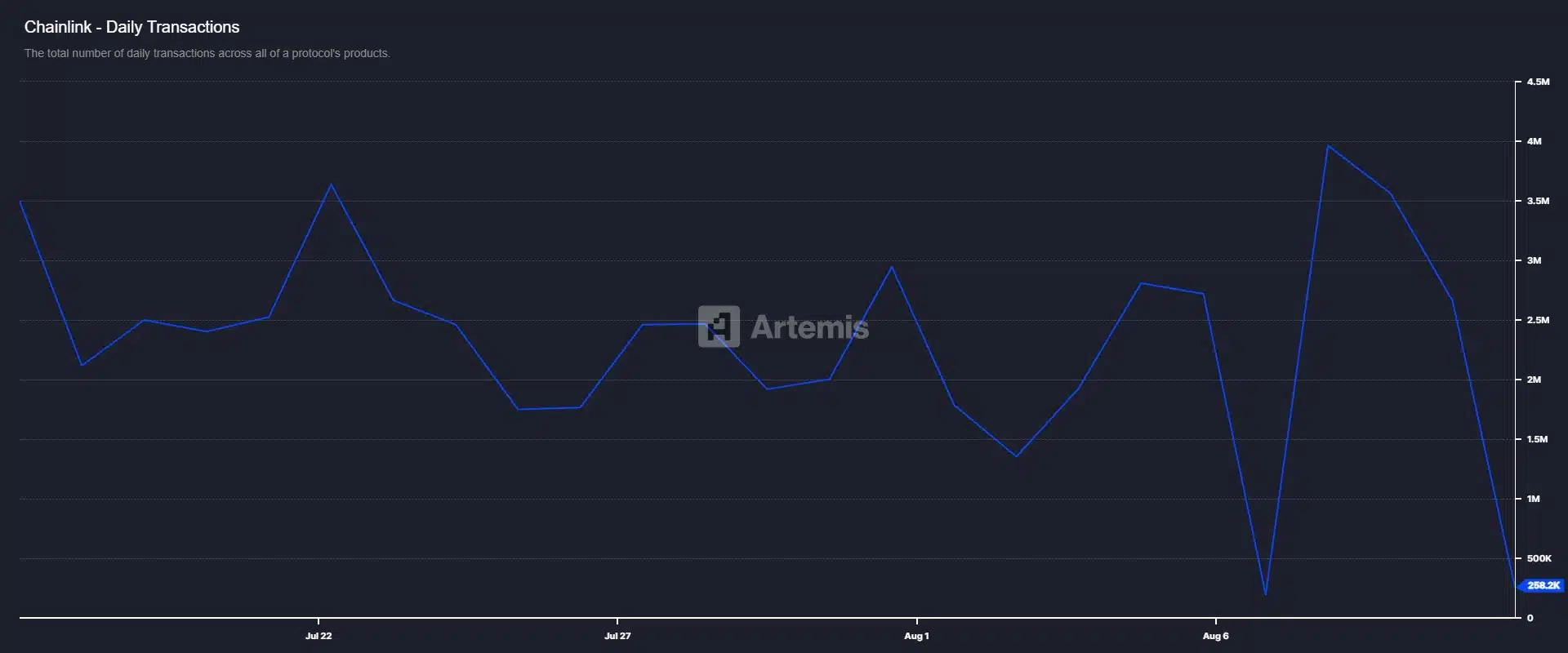

The declining variety of each day transactions additional evidences this reality. There have been 258.2k each day transactions at press time, a major drop from the 4 million recorded per week in the past.

Supply: Artemis

Usually, such a drop in community utilization signifies the present rally is pushed by whales or speculative as an alternative of actual adoption. Though not bearish, it’s a significant pink flag that momentum might fade.

Can LINK’s uptrend maintain with out retail?

Based on AMBCrypto’s evaluation, Chainlink rallied as whales returned to the market to build up it.

Consequently, the altcoin flipped its short-term Transferring Common MA9 after closing beneath for 2 consecutive days. Likewise, the Relative Energy Index (RSI) surged to 68, comfortably edging into bullish territory.

Supply: TradingView

Usually, such momentum confirms a powerful upward bias and signifies its potential to proceed. If whales can maintain the market and proceed accumulating, LINK’s uptrend will proceed, reclaiming $24.7 and eyeing $26.4.

Nevertheless, declining community utilization is a trigger for alarm, and low demand might trigger costs to dip if whale and speculators’ momentum fades. In such a case, Chainlink will pull again to $21.