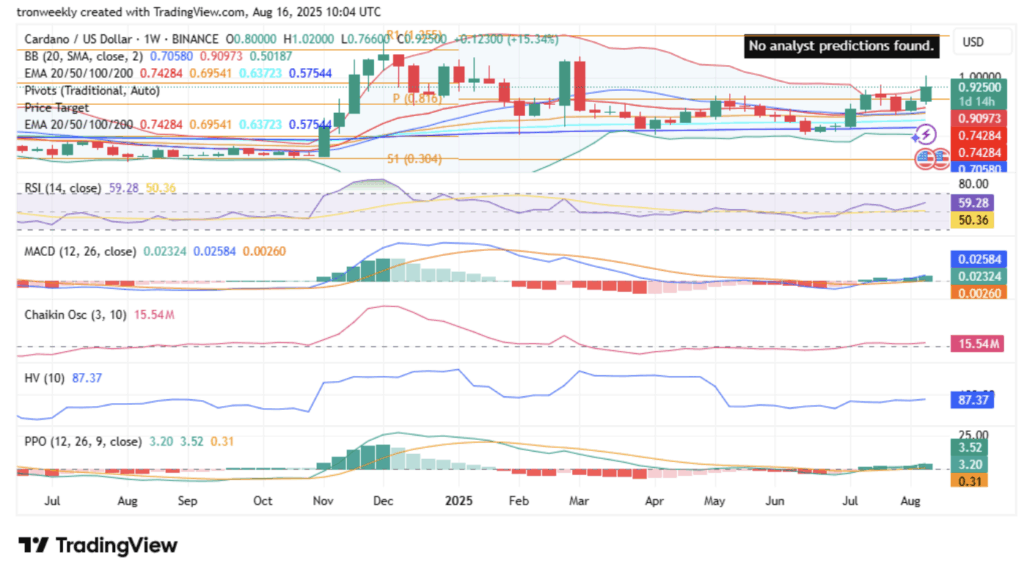

- ADA is buying and selling just below $1, urgent resistance after reclaiming $0.90 and holding above key shifting averages.

- Momentum indicators like RSI (59) and MACD stay bullish, with regular inflows displaying accumulation.

- A weekly shut above $1 may set off targets at $1.11, $1.20–$1.25, and even $1.30+, whereas failure dangers a pullback to $0.82–$0.86.

Cardano (ADA) is hanging out just below the massive psychological wall at $1, buying and selling round $0.9198 on the time of writing. The $0.93–$1.00 zone has been cussed, however ADA is urgent onerous, sitting above its 20-week EMA at $0.743 and even nudging the highest Bollinger Band close to $0.909. That setup normally indicators robust demand making an attempt to push increased.

The weekly Bollinger Bands are stretching wider, which tends to trace at an even bigger transfer forward. The midline rests down at $0.705, whereas the highest is up close to $0.909. If this growth retains rolling, technical projections level towards $1.11 as the following doubtless goal. Merchants are laser-focused on whether or not ADA can truly shut every week above $1, which might principally affirm consumers are operating the present.

Momentum Indicators Nonetheless Favor the Bulls

Momentum paints the same image. All the massive shifting averages—20, 50, 100, and 200 weeks—are trending upward, with ADA comfortably buying and selling above each. That makes $0.74 the important thing first line of help if issues cool off.

RSI is sitting at 59, a wholesome degree displaying energy however not but overheated. The MACD is optimistic and nonetheless widening, backing the bullish case. Even the Share Value Oscillator histogram has flipped inexperienced, and Chaikin Cash Move exhibits round $15 million flowing into ADA every week—proof that accumulation is going on steadily.

Nonetheless, volatility sits at 87, that means merchants shouldn’t get too comfy. Huge swings can come out of nowhere, so place sizing turns into crucial in such a setup.

Targets and Doable Situations

If ADA can punch by and maintain above $1, analysts see $1.11 as the following cease, adopted by ranges at $1.20–$1.25, and ultimately $1.30–$1.35. There’s a couple of 60% likelihood that this continuation performs out. But when worth slips again under $0.90 after breaching increased, the bullish outlook weakens quick.

A pullback state of affairs may additionally come into play if ADA stalls round $0.95–$1.00. In that case, merchants might search for help between $0.82 and $0.86 earlier than one other try increased. So long as RSI stays over 50 and MACD stays inexperienced, the broader uptrend doesn’t break.

The bearish case? Analysts give it solely a couple of 15% likelihood. That may require ADA to fall beneath the 20-week EMA at $0.74. A drop beneath $0.70 would principally affirm development weak point and open the door to $0.65–$0.60 ranges.