High Tales of The Week

SharpLink shares drop 12% on Q2 crypto impairment loss

SharpLink Gaming, a web-based gaming firm with the second-largest company Ether treasury, introduced a internet lack of $103 million for the second quarter of 2025, pushed by a paper loss from accounting for liquid staked Ether (LsETH). The loss marks a steep drop from a $500,000 loss in the identical interval of 2024 — a year-over-year change of -25,980%.

Based on a Friday announcement, SharpLink now holds 728,804 Ether price roughly $3.5 billion at this writing. The one publicly traded firm with extra ETH is BitMine Immersion Applied sciences, which holds somewhat greater than 1.15 million ETH price roughly $5.1 billion.

Of SharpLink’s Q2 loss, $87.8 million — or 85% — is said to the corporate’s LsETH. A SharpLink consultant instructed Cointelegraph that the corporate nonetheless has all its LsETH and that the impairment “displays accounting guidelines, not a sale or lack of ETH.”

“Below US GAAP, LsETH is at present handled as a digital intangible asset, which is recorded at value and topic to impairment,” a SharpLink spokesperson stated. “In Q2, the bottom market value of LsETH was $2300, triggering the $87.8M non-cash impairment.”

US Fed to finish oversight program for banks’ crypto actions

The Federal Reserve Board stated that it might finish a “novel actions supervision program” arrange in 2023 to oversee sure actions associated to crypto belongings and distributed ledger expertise.

In a Friday discover, the Fed stated it should sundown this system created in August 2023 and return to “monitoring banks’ novel actions via the traditional supervisory course of.” The 2023 program stated it might be “risk-focused” and embrace supervision of banks offering “deposits, funds, and lending to crypto-asset-related entities and fintechs.”

“Because the Board began its program to oversee sure crypto and fintech actions in banks, the Board has strengthened its understanding of these actions, associated dangers, and financial institution danger administration practices,” stated the Fed. “Because of this, the Board is integrating that data and the supervision of these actions again into the usual supervisory course of and is rescinding its 2023 supervisory letter creating this system.”

Coinbase says a ‘full-scale altcoin season’ could also be simply forward

Altcoins have seen important current development, whereas crypto market circumstances counsel there may quickly be a shift towards cryptocurrencies outdoors of Bitcoin, in keeping with Coinbase.

“We predict present market circumstances now counsel a possible shift in direction of a full-scale altcoin season as we method September,” Coinbase’s world head of analysis, David Duong, wrote in a month-to-month outlook report on Thursday.

The Coinbase analyst joined a rising refrain of merchants and market observers tipping for an imminent altcoin season.

The agency defines altcoin season as when not less than 75% of the highest 50 altcoins by market capitalization outperform Bitcoin over the previous 90 days.

Duong added that there was “important retail capital sitting on the sidelines” in cash market funds, and Federal Reserve easing may “unlock larger retail participation within the medium time period.”

FBI warns of ‘fictitious regulation companies‘ concentrating on crypto rip-off victims

The US Federal Bureau of Investigation (FBI) has issued a public service announcement for victims of crypto scams on the lookout for authorized recommendation to get better their funds.

In a Wednesday discover, the FBI stated that fictitious regulation companies have been concentrating on people who had beforehand been scammed out of some or all of their crypto holdings, placing them at further danger. Based on the bureau, the scammers’ actions left victims liable to compromising their private knowledge and different funds.

The announcement, primarily based on an replace for related warnings from the FBI in August 2023 and June 2024, cautioned individuals towards accepting help from anybody recommending a “crypto restoration regulation agency” or any regulation agency “requesting fee in cryptocurrency or pay as you go reward playing cards.”

“Be cautious of regulation companies contacting you unexpectedly, particularly when you’ve got not reported the crime to any regulation enforcement or civil safety businesses,” the discover reads.

Justin Solar, Bloomberg in authorized dispute over billionaires index

Justin Solar, founding father of the Tron blockchain, has sued Bloomberg and sought a short lived restraining order, alleging it revealed false and personal monetary info in its billionaires record.

Solar’s representatives stated on Tuesday in a weblog put up by Tron that his profile on the Bloomberg Billionaires Index launched on Monday had “revealed inaccurate knowledge that dramatically and dangerously misrepresents Mr. Solar’s belongings.”

Solar sued Bloomberg in a Delaware federal court docket on Monday, asking a decide to cease it from publishing the knowledge, claiming the motion was to stop the outlet from “recklessly and improperly disclosing his extremely confidential, delicate, non-public, and proprietary monetary info.”

Attorneys for Bloomberg stated in a letter to the court docket on Tuesday that the corporate will oppose Solar’s software for a restraining order and asserted “your complete foundation” of the appliance was moot because the outlet had revealed the knowledge earlier than the appliance was filed.

Most Memorable Quotations

“ETH is arguably the largest macro commerce for the following 10 to fifteen years as AI creates a token economic system on the blockchain and as Wall Avenue financializes on the blockchain.”

Tom Lee, co-founder and head of analysis at Fundstrat International Advisors

“Has anybody else seen that the topping value motion in 2021 seems precisely the identical as present value motion?”

Nebraskangooner, pseudonymous crypto dealer

“We predict present market circumstances now counsel a possible shift in direction of a full-scale altcoin season as we method September.”

David Duong, world head of analysis at Coinbase

“It doesn’t matter what, it’s inconceivable that Ethereum is price 4,600,000 BTC.”

Samson Mow, CEO of Jan3

“With key stakeholders accumulating free cash that small ETH merchants are keen to half with proper now, costs are displaying little or no sentiment resistance from breaking via and making historical past within the close to future.”

Santiment, sentiment platform

“It’s a Darwinian stage for Web3 gaming: robust for small gamers, however doubtlessly wholesome for long-term stability.”

Sara Gherghelas, analyst at DappRadar

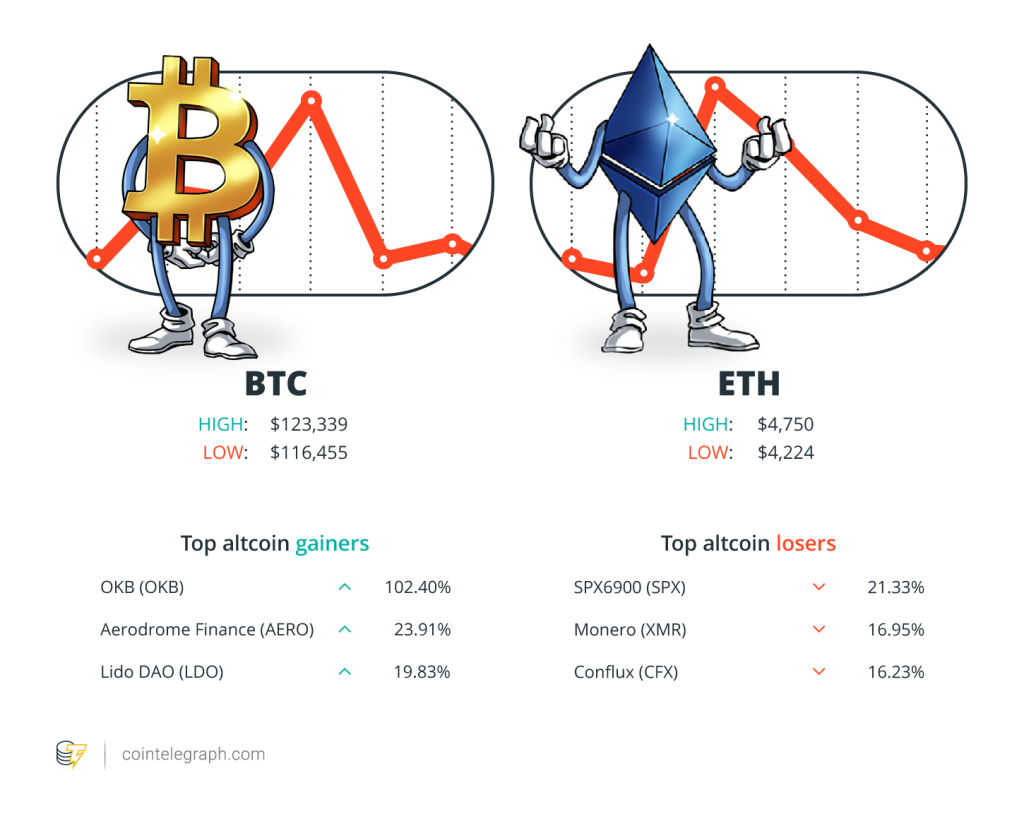

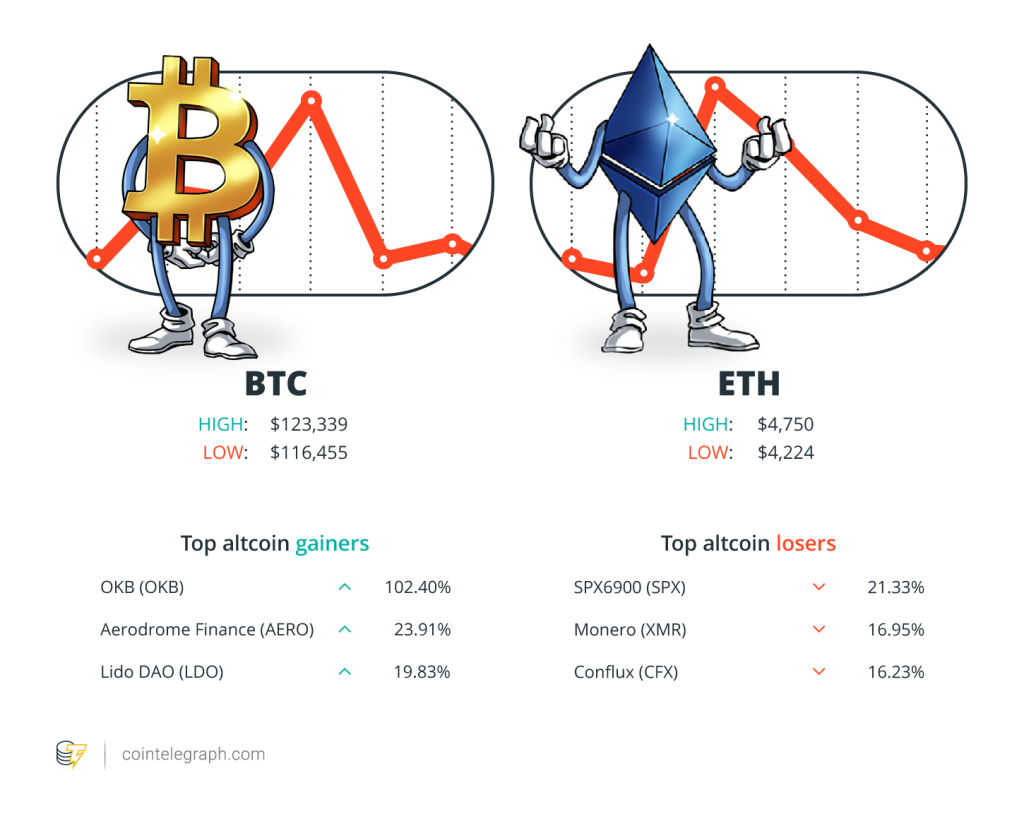

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $117,594, Ether (ETH) at $4,445 and XRP at $3.11. The whole market cap is at $3.97 trillion, in keeping with CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are OKB (OKB) at 102.40%, Aerodrome Finance (AERO) at 23.91% and Lido DAO (LDO) at 19.83%.

The highest three altcoin losers of the week are SPX6900 (SPX) at 21.33%, Monero (XMR) at 16.95% and Conflux (CFX) at 16.23%. For more information on crypto costs, make sure that to learn Cointelegraph’s market evaluation.

High Prediction of The Week

Ether bull flag targets $6K as ETH provide on exchanges falls to 12%

Ether value registered a multi-year excessive of $4,792 on Thursday after a forty five% rise from its Aug. 3 low at $3,354. The worth is now consolidating under its $4,867 all-time excessive after validating a basic bullish continuation sample.

Can Ether’s value rise 34% within the subsequent few days?

Learn additionally

Options

Bitcoin 2023 in Miami involves grips with ‘shitcoins on Bitcoin’

Options

Promote or hodl? Learn how to put together for the tip of the bull run, Half 2

ETH rallied greater than 126% between June 22 and Thursday to succeed in a multi-year excessive just under $4,800. The most recent rally noticed the worth breach the resistance offered by the higher boundary of a bull flag at $3,770 on the every day chart, confirming a bullish breakout.

A bull flag is a continuation sample that happens after a big rise, adopted by a consolidation interval on the larger value finish of the vary.

Ether has confirmed a “textbook bull flag” within the every day timeframe, stated dealer Mister Crypto in an earlier evaluation on X.

High FUD of The Week

New BIS plan may make ‘soiled’ crypto tougher to money out

The Financial institution for Worldwide Settlements (BIS) has proposed a provenance-based danger rating system for crypto-to-fiat off-ramps.

In its Wednesday BIS Bulletin, the establishment outlined “an method to anti-money laundering compliance for cryptoassets,” recommending {that a} compliance rating be assigned to crypto holdings earlier than they’re exchanged for fiat foreign money.

“An AML compliance rating primarily based on the probability {that a} explicit cryptoasset unit or steadiness is linked with illicit exercise could also be referenced at factors of contact with the banking system,” the doc stated. The rating would then be used to stop inflows of illicit funds and encourage a “responsibility of care” amongst crypto market members.

The BIS stated current Anti-Cash Laundering (AML) approaches counting on trusted intermediaries have “restricted effectiveness” within the context of crypto. Public blockchain transaction histories may present helpful instruments for compliance monitoring, it stated.

BtcTurk halts withdrawals amid suspected $48M crypto hack

Turkish cryptocurrency alternate BtcTurk has halted withdrawals amid studies suggesting that the platform has suffered a serious lack of funds on account of a hack.

Cybersecurity agency Cyvers took to X on Thursday to report that it had detected $48 million price of digital belongings, together with Ether, concerned in uncommon exercise.

Learn additionally

Options

Learn how to forestall AI from ‘annihilating humanity’ utilizing blockchain

Options

Learn how to cease your crypto group from imploding

“Our system detected a number of alerts throughout ETH, AVAX, ARB, BASE, OP, MANTLE and MATIC networks,” Cyvers reported, including that the attacker had moved the belongings to 2 addresses and begun swapping them.

BtcTurk subsequently halted deposits and withdrawals, citing a “technical situation” with sizzling wallets, reporting that buying and selling and native foreign money withdrawals and deposits remained intact.

Ether rally turns Radiant Capital exploit into $103M windfall for hacker

The trove stolen from decentralized lender Radiant Capital in October 2024 has almost doubled in worth as Ether climbed, blockchain knowledge reveals.

Decentralized finance protocol Radiant Capital was hacked in mid-October 2024 when the crosschain lending protocol suffered a $58 million cybersecurity breach on BNB Chain and Arbitrum.

Radiant Capital misplaced about $58 million within the breach. The attacker later swapped proceeds into Ether and now holds 21,957 ETH price about $103 million, in keeping with Lookonchain, up from an estimated $58 million on the time of the exploit.

Ether closed Oct. 15, 2024, above $2,300, and was buying and selling above $4,700 Thursday.

High Journal Tales of The Week

All people hates GPT-5, AI reveals social media can’t be mounted: AI Eye

OpenAI’s GPT-5 has debuted to a wave of hatred, however right here’s what its critics get mistaken. Plus, AI proves social media can’t be mounted.

Altcoin season 2025 is sort of right here… however the guidelines have modified

Ignore all earlier calls, “altcoin season” is lastly upon us. Possibly.

South Koreans dump Tesla for Ethereum treasury BitMine: Asia Categorical

South Korea’s retail traders dump Tesla for Ethereum treasury corporations. Thai crypto mule account crackdown.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.