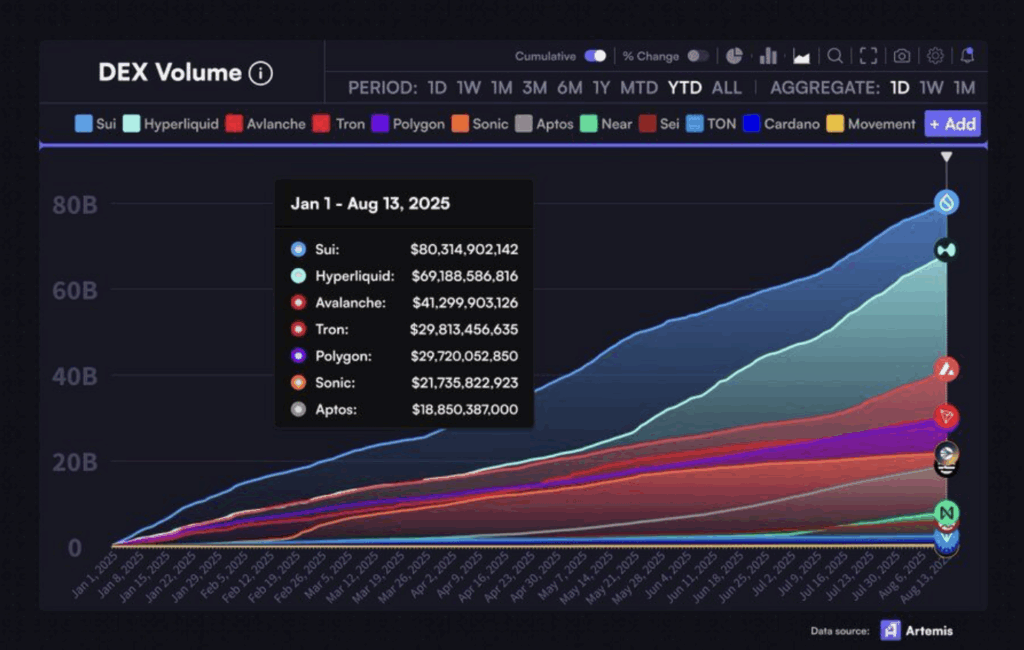

- $80B DEX milestone: Sui outpaced Avalanche, Aptos, and Hyperliquid in decentralized buying and selling quantity, signaling speedy ecosystem development.

- Bullish setup: Analysts eye resistance at $4.42 and $5.33 as key targets if SUI can preserve weekly bullish momentum.

- Derivatives cooldown: Buying and selling exercise eased, however funding charges stay balanced—hinting at cautious optimism moderately than bearish stress.

Sui is again within the highlight after smashing by means of $80 billion in DEX quantity this yr—a formidable milestone that locations it forward of different buzzy chains like Hyperliquid, Avalanche, and Aptos. Even with the broader market wobbling, SUI has managed to maintain merchants speaking. At press time, the token trades at $3.68, holding a market cap of $8.69 billion. The previous 24 hours noticed value dip 3.87%, however given the dimensions of quantity flowing throughout its ecosystem, buyers aren’t precisely panicking.

DeFi Development Surges Previous Rivals

The Sui neighborhood lately revealed that greater than $80 billion value of transactions have been processed by means of decentralized exchanges in simply the primary half of 2025. For context, that’s larger than a number of rivals that had been beforehand stealing the DeFi limelight. The takeaway right here? Exercise on Sui is rising quicker than many anticipated, exhibiting that person adoption and community demand are gaining critical traction.

Value Targets and Technical Momentum

On the charts, SUI is exhibiting indicators of heating up once more. Analysts at Altcoinpedia identified that the undertaking closed the week with a robust bullish candle, hinting that momentum may carry into the subsequent leg larger. The fast take a look at sits at $4.42 resistance. If bulls clear that degree, $5.33 comes into play, which might put SUI near retesting file highs. For long-term merchants, this sort of setup is precisely what they’ve been ready on—a clear breakout supported by robust fundamentals.

Derivatives Market Cools Off

Apparently, derivatives information is telling a barely completely different story. Buying and selling quantity has dropped over 20%, with open curiosity sliding 3.26% to $1.89 billion. That implies buyers could also be stepping again for the second, ready for a clearer course earlier than loading up once more. The OI-weighted funding charge, although, is sitting at 0.0087%—fairly balanced, exhibiting neither longs nor shorts are aggressively in management.

This cooling in leverage markets doesn’t essentially imply weak point—it would simply replicate merchants biding time whereas spot exercise leads the cost. Actually, with volatility ranges staying comparatively calm, the present setup might be priming SUI for its subsequent massive swing as soon as momentum builds once more.