The marketplace for tokenized belongings has quietly reached a brand new milestone, with belongings underneath administration (AUM) hovering to an all-time excessive.

This surge highlights how Ethereum’s infrastructure more and more turns into the settlement layer of alternative for stablecoins and institutional-grade tokenization.

Tokenization Reaches Historic Scale

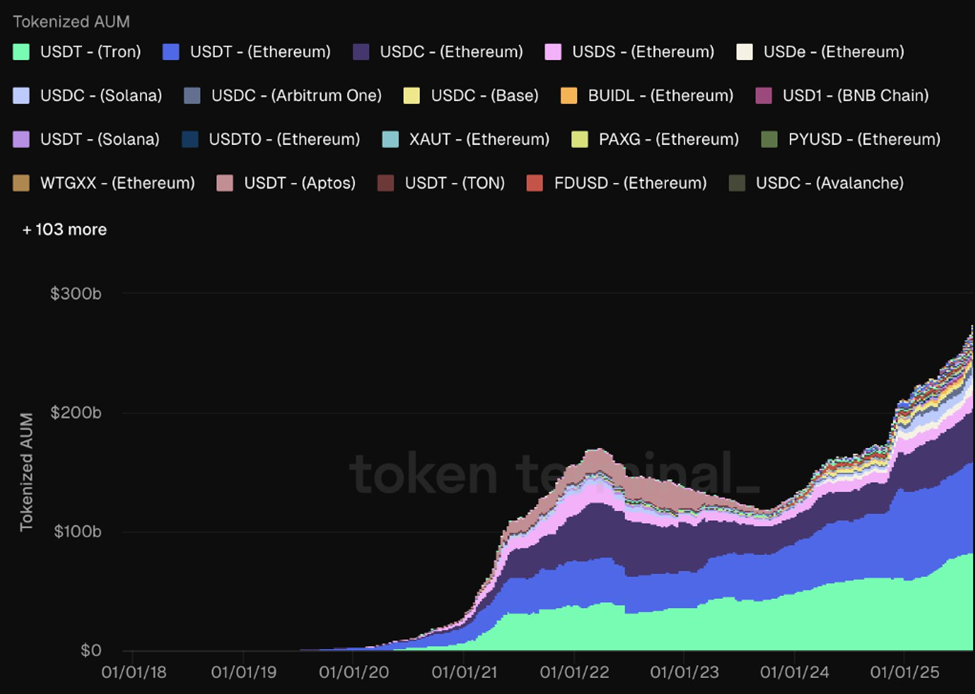

Token Terminal reviews that the AUM of tokenized belongings is at an all-time excessive of roughly $270 billion.

The on-chain information platform highlights tokenized belongings spanning a large spectrum, starting from currencies and commodities to treasuries, personal credit score, personal fairness, and enterprise capital.

A lot of this development is pushed by establishments adopting blockchain rails for effectivity and accessibility, with Ethereum rising because the dominant platform.

Ethereum hosts roughly 55% of all tokenized asset AUM, ascribed to its sensible contract ecosystem and extensively adopted token requirements.

Tokens like USDT (Ethereum), USDC (Ethereum), and BlackRock’s BUIDL fund signify among the largest swimming pools of worth, constructed on the ERC-20 framework.

In the meantime, specialised requirements equivalent to ERC-3643 allow tokenization of real-world belongings (RWA) like actual property and effective artwork.

With $270 billion already tokenized, continued momentum might see tokenized asset markets swell into the trillions as Ethereum cements its function because the spine of tokenized finance.

Monetary Giants Quietly Again Ethereum

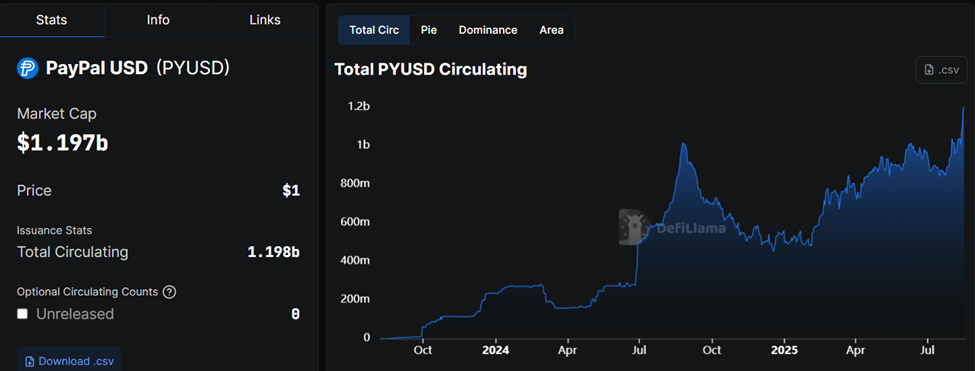

One of the crucial telling indicators of this shift is the rise of PayPal’s PYUSD stablecoin, which has exceeded the $1 billion market in provide whereas solely issued on Ethereum.

For establishments, PYUSD’s quick development proves that Ethereum’s rails are liquid, safe, and trusted sufficient for a world fintech chief to scale on.

“PayPal’s PYUSD exceeding $1 billion provide cements Ethereum because the settlement layer for main finance. Stablecoin scale like this deepens liquidity and utility. Establishments are quietly standardizing on ETH,” one consumer noticed in a put up.

Past PayPal, conventional asset managers are additionally leaning into Ethereum. BlackRock’s tokenized cash market fund, BUIDL, has been cited as a landmark case of institutional adoption. This demonstrates how conventional monetary (TradFi) devices will be issued and managed seamlessly on-chain.

In the meantime, Ethereum’s dominance in tokenization comes right down to its community results and developer ecosystem. The ERC-20 normal has grow to be the lingua franca for digital belongings, guaranteeing compatibility throughout wallets, exchanges, and DeFi protocols.

In the meantime, Ethereum’s safety, liquidity, and scalability enhancements by upgrades like Proof-of-Stake (PoS) and rollups improve establishments’ confidence.

Ethereum’s flexibility permits it to serve retail and institutional wants. Stablecoins like USDT and USDC gasoline international funds and DeFi liquidity. In the meantime, tokenized treasuries and credit score devices enchantment on to institutional portfolios in search of yield and effectivity.

Nevertheless, analysts urge warning for Ethereum merchants, with the biggest altcoin on market cap metrics going through the second-highest promote wave. Equally, warning indicators are flashing regardless of 98% of the Ethereum provide sitting in a worthwhile state.

The put up Tokenized Belongings Hit $270 Billion Document as Establishments Standardize on Ethereum appeared first on BeInCrypto.