Bitcoin’s smaller cousin, XRP, has drawn contemporary bullish bets after it held above the $3 mark in July. In response to buying and selling charts and public commentary, the token first pierced $3 in January 2025 — its highest level in seven years — then pulled again earlier than reclaiming that stage in mid-July.

The comeback has some analysts studying the transfer as a change in market construction, and value sits close to $3.12 as momentum checks proceed.

Trendline Breakouts And Help Flip

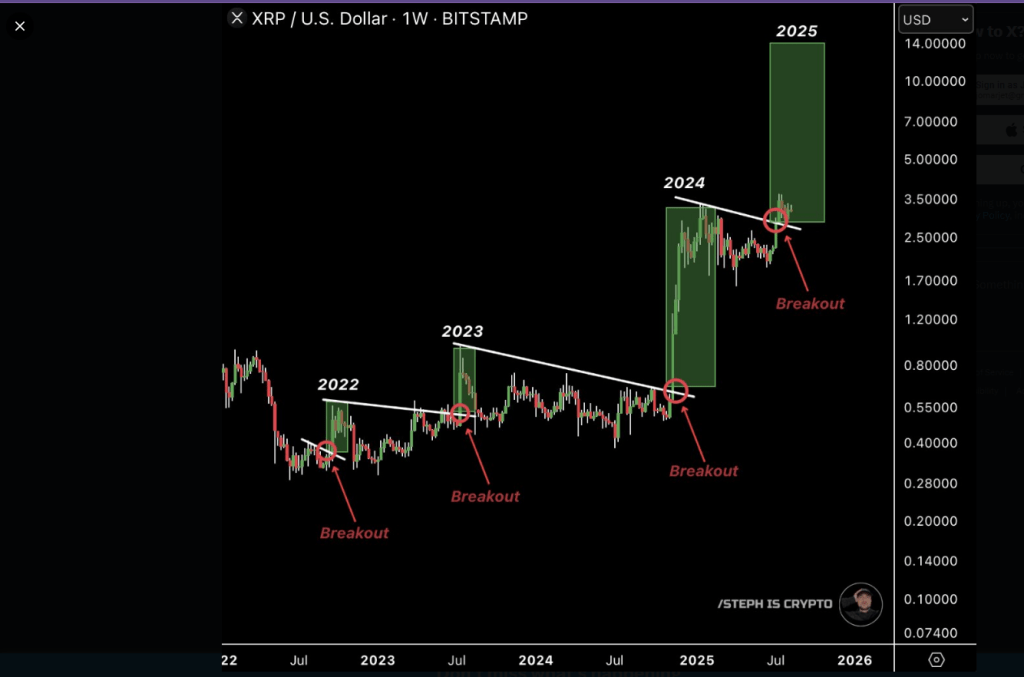

In response to analyst Steph, a breakout above a long-running descending trendline on the weekly XRP chart is what issues now.

Steph factors to the flip of $3 from resistance into help as a traditional technical cue. He used historic weekly charts to argue that previous breakouts from related trendlines typically led to robust rallies, and he highlighted that sample going again to 2022 when value motion started to shift extra visibly.

That is the toughest #XRP bull market ever.

Congratulations when you’re nonetheless right here.

We are going to get wealthy! pic.twitter.com/cLltUs7MQj

— STEPH IS CRYPTO (@Steph_iscrypto) August 12, 2025

A Sample Seen A number of Instances Since 2022

Reviews have traced the identical setup throughout a number of cycles. After the Terra collapse in Might 2022, XRP fell and fashioned a descending trendline that broke in September 2022, sending value to a excessive close to $0.55.

Later, a brand new trendline fashioned after which broke across the SEC vs. Ripple ruling in July 2023, which preceded a transfer towards $0.94.

The latest large run took XRP to about $3.4 in January 2025, after a breakout following the November 2024 US elections. These episodes type the spine of the “repeat sample” case.

Analyst Targets And Differing Calls

Steph tasks a possible rise to $14 from roughly $3.12 now, which might equal a couple of 340% achieve. In response to his messaging, some merchants who offered early took earnings, whereas others who held might see bigger returns if the thesis performs out.

Primarily based on studies, some commentators have voiced related targets, saying when XRP traded close to $2, that the token was poised for a serious breakout and pointed to Fibonacci ranges towards $14, whereas others put a $14 minimal goal on the desk final March.

What To Watch Going Ahead

Quantity on any push above current highs will inform the story. Control whether or not $3 stays as help and whether or not the weekly breakout holds as value strikes larger.

Additionally watch how lengthy consolidation round $2 lasted — greater than 5 months — as a result of lengthy flat bases can precede sharp strikes if patrons return in pressure. Derivatives flows and the place massive holders place promote orders will matter too.

Featured picture from Unsplash, chart from TradingView