Bitcoin has seen a modest decline in latest classes, with costs holding simply above key help ranges. Regardless of this pullback, analysts recommend the dip might pave the way in which for contemporary capital inflows.

Quick-term holders (STHs) coming into at present ranges might present gas for a rally towards greater worth targets.

Bitcoin Buyers Are Awaiting Good points

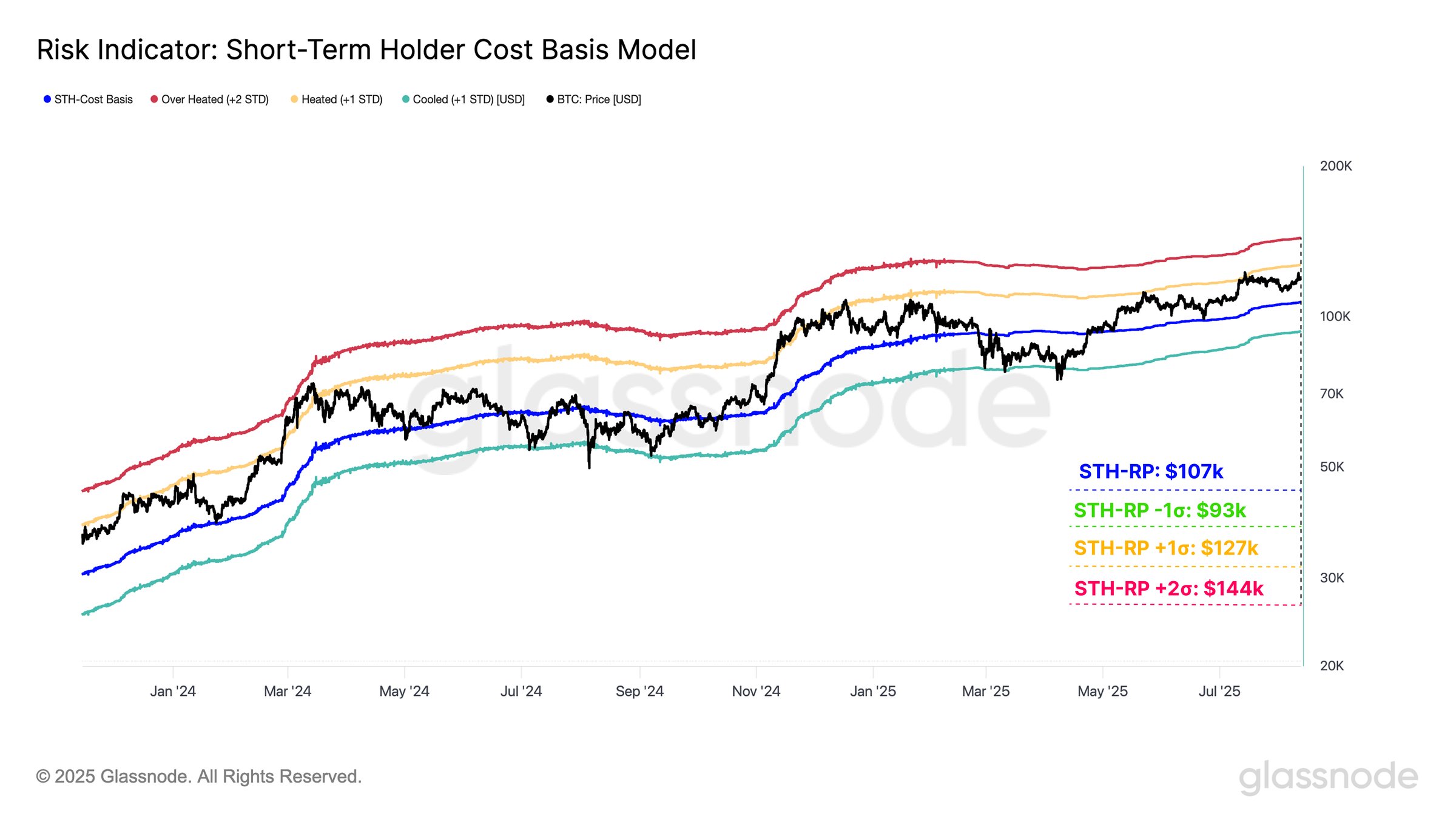

The STH Price Foundation Mannequin serves as a helpful framework for understanding investor habits. It establishes a median entry worth for newer Bitcoin wallets whereas making use of commonplace deviation bands to spotlight overheated zones. These zones typically align with profit-taking factors, the place merchants start to exit as costs stretch greater.

Primarily based on this mannequin, $127,000 emerges as the primary main ceiling. Traditionally, this degree has preceded native tops, as early profit-taking happens. The +2σ band round $144,000 is usually the place euphoria peaks, triggering sharp corrections. Till then, sentiment suggests there should be upside room earlier than main promoting strain.

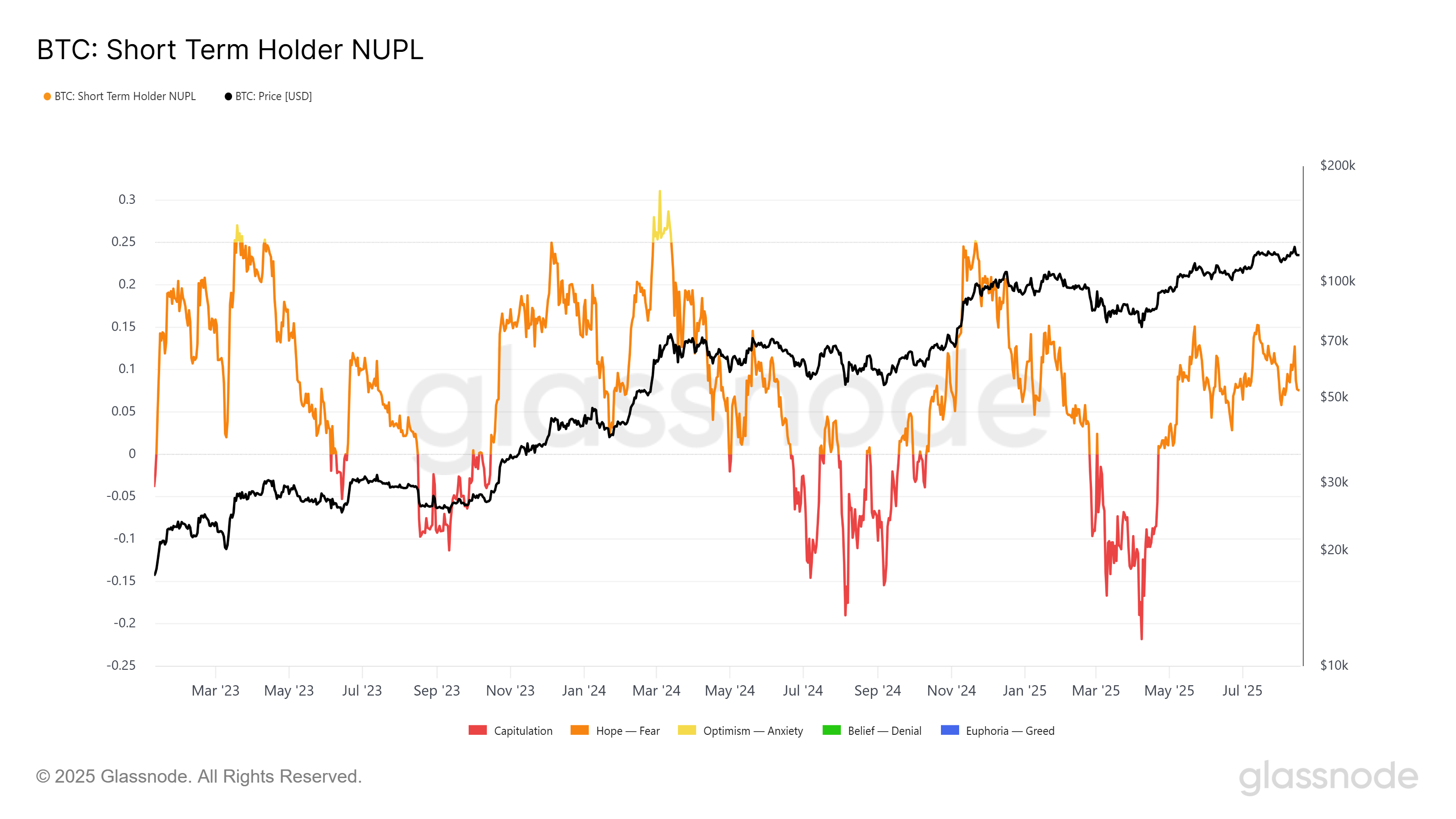

The STH Web Unrealized Revenue/Loss (NUPL) gives further insights into broader momentum. Traditionally, the 0.25 threshold has marked saturation factors for STH earnings, typically adopted by intervals of consolidation or delicate corrections. This pattern helps spotlight when markets change into overheated and weak to reversals.

Presently, the NUPL sits at simply 0.07, far beneath the saturation mark. This means there may be nonetheless room for revenue growth earlier than a reversal turns into probably. As costs rise, this might validate the associated fee foundation mannequin, reinforcing expectations that Bitcoin can advance additional earlier than encountering heavy promoting strain.

BTC Value Is Holding On

On the time of writing, Bitcoin trades at $115,448, holding firmly above the $115,000 help. The fashions recommend that promoting by STHs will stay restricted till BTC approaches $127,000, which sits above the earlier all-time excessive of $124,474 and marks the subsequent main profit-taking degree.

For Bitcoin to achieve this goal, broader market help might be essential. Geopolitical tensions stay a drag on sentiment, however renewed investor confidence might help momentum. Reclaiming $117,261 as help and pushing to $120,000 would set the stage for a possible new all-time excessive within the close to time period.

If circumstances worsen, Bitcoin dangers dropping $115,000 help, with a potential decline to $112,526 or decrease. Such a transfer would invalidate the bullish thesis and spotlight the vulnerability of BTC to exterior pressures, reinforcing warning amongst merchants whereas the market reassesses its trajectory.

The put up Bitcoin Pullback, Not Peak? Quick-Time period Income Far From ‘Scorching’ Zone appeared first on BeInCrypto.