Crypto inflows surged final week, exceeding the one earlier than sixfold. Amidst the capital inflow into digital asset funding merchandise, two names dominated the charts: BlackRock and Ethereum.

It marks a gradual collection of optimistic flows, driving property beneath administration (AuM) to an all-time excessive (ATH) of US$244 billion.

Crypto Inflows Surge Sixfold as BlackRock and Ethereum Lead

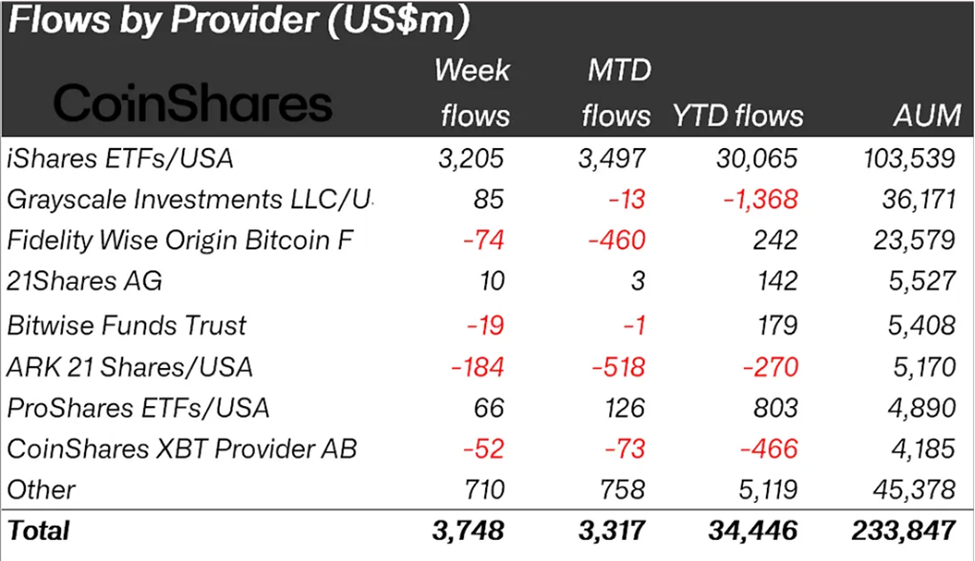

Based on the most recent CoinShares report, crypto inflows soared to $3.75 billion within the week ending August 16. In comparison with the week ending August 9, when crypto inflows reached $578 million, this marked a 6.4x improve.

CoinShares’ head of analysis, James Butterfill, highlights final week’s crypto inflows because the fourth-largest on file. He additionally lauds it as a powerful rebound after a number of weeks of tepid sentiment, as revealed in latest CoinShares stories.

Nonetheless, as crypto inflows soared to $3.75 billion, BlackRock’s iShares was an outlier, accounting for the lion’s share of the flows. With as much as $3.2 billion in optimistic flows to the monetary instrument, BlackRock’s monetary instrument introduced in over 86% of final week’s crypto inflows.

“Unusually, virtually all inflows had been concentrated in a single supplier, iShares, and one particular funding product,” learn an excerpt within the report.

BlackRock’s dominance comes as its monetary automobile, iShares, stays one of the vital common devices providing institutional traders entry to crypto not directly.

For perspective, Harvard College, one of many world’s most prestigious establishments of upper studying, selected BlackRock’s IBIT ETF (exchange-traded fund) as its gateway into the crypto market.

In the identical tone, latest stories indicated that 75% of BlackRock’s Bitcoin ETF clients had been first-time consumers. This factors to the asset supervisor’s attract and the arrogance degree it evokes even amongst novice gamers.

Barely a month in the past, BlackRock’s Ethereum ETF inflows surpassed its Bitcoin fund. The turnout explains why BlackRock’s dominance in crypto inflows is available in tandem with Ethereum’s heft.

Ethereum Contributed 77% To Final Week’s Crypto Inflows

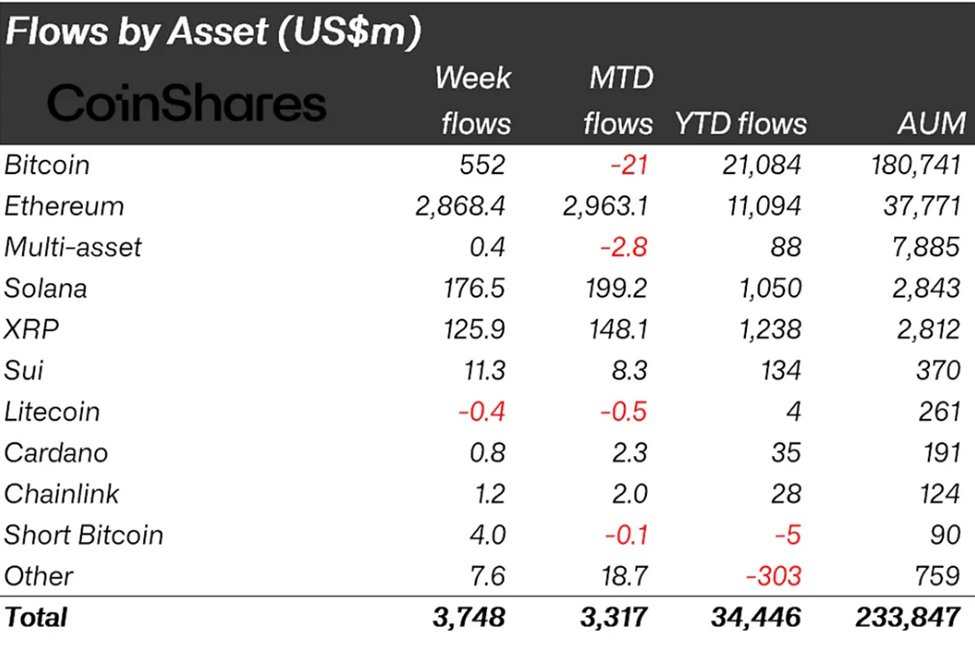

Whereas BlackRock accounted for over 86%, Ethereum was additionally a major participant, bringing in 77% of complete weekly inflows.

“Ethereum continues to steal the present, with inflows totalling a file US$2.87bn final week…the inflows far outstrip Bitcoin, with YTD inflows representing 29% of AuM in comparison with Bitcoin’s 11.6%,” Butterfill added.

Notably, Bitcoin noticed modest inflows compared to Ethereum, bringing in $552 million in optimistic flows.

It provides to the collection of weeks Ethereum has dominated crypto inflows on asset metrics, successfully outshining Bitcoin. Amongst different situations, Ethereum not too long ago propelled crypto inflows to a file $4.39 billion weekly excessive.

Over the previous a number of weeks, investor sentiment has been favoring Ethereum over Bitcoin. The eye drew tailwinds from the latest frenzy round Ethereum, catalyzed by establishments adopting ETH-based company treasuries.

Tokenized property additionally soared to a $270 billion file as establishments progressively standardize on Ethereum.

In opposition to this backdrop, analysts say the Ethereum worth could also be on the right track to succeed in the $5,000 milestone, almost 20% above present ranges.

The submit BlackRock and Ethereum Drive Crypto Inflows to $3.75 Billion appeared first on BeInCrypto.