Chainlink value has moved forward of the market once more. Whereas most altcoins are struggling to carry positive aspects, LINK value has climbed greater than 5% within the final 24 hours and over 140% up to now 12 months.

The Oracle community’s use in DeFi retains it related, however this newest rally isn’t simply natural; it’s backed by heavy wallets shopping for in. But, one refined metric would possibly now trace at a pause.

Whale Exercise Explains the Chainlink Value Rally

Up to now seven days, whale wallets have added over 1.1 million LINK to their positions. On the present value of $24.80, this equals round $27.2 million in inflows. That form of capital isn’t random; it normally displays conviction. And it reveals within the Chainlink value motion.

Sensible cash wallets, which normally monitor market entries effectively, have additionally elevated their holdings by 12.6% over the week.

In the meantime, the highest 100 LINK addresses have resumed accumulation, regardless that barely. The truth that all three segments are transferring collectively is a transparent motive why the LINK value has damaged away from broader market weak point.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

The Lacking Hyperlink? Alternate Reserves Inform a Totally different Story

Regardless of this robust whale help, one metric suggests the Chainlink value would possibly cool off within the quick time period: alternate reserves.

On August 16, LINK’s alternate steadiness dropped to a month-to-month low of 162.59 million LINK, proper because the rally picked up velocity. That was signal. It meant fewer LINK tokens had been sitting on exchanges, so promoting strain was probably low.

However that has modified at press time.

As of in the present day, reserves have elevated to 162.90 million LINK; an increase of greater than 300,000 LINK, or round $7.4 million at present costs. That tells us some merchants are transferring LINK again to exchanges, presumably making ready to e book earnings.

Furthermore, within the final 24 hours, whale pockets balances have dipped barely, that means that some whales are not shopping for into power. The highest 100 LINK addresses have additionally proven delicate distribution; not large, however sufficient to help the concept profit-taking could also be shut.

Do word that Sensible Cash continues to build up, hinting at mid-term value conviction.

So whereas the broader accumulation explains the latest positive aspects, this shift in reserves and pockets habits is the lacking hyperlink which may interrupt the rally and trigger a fast consolidation.

Chainlink Value Caught Between Two Key Ranges

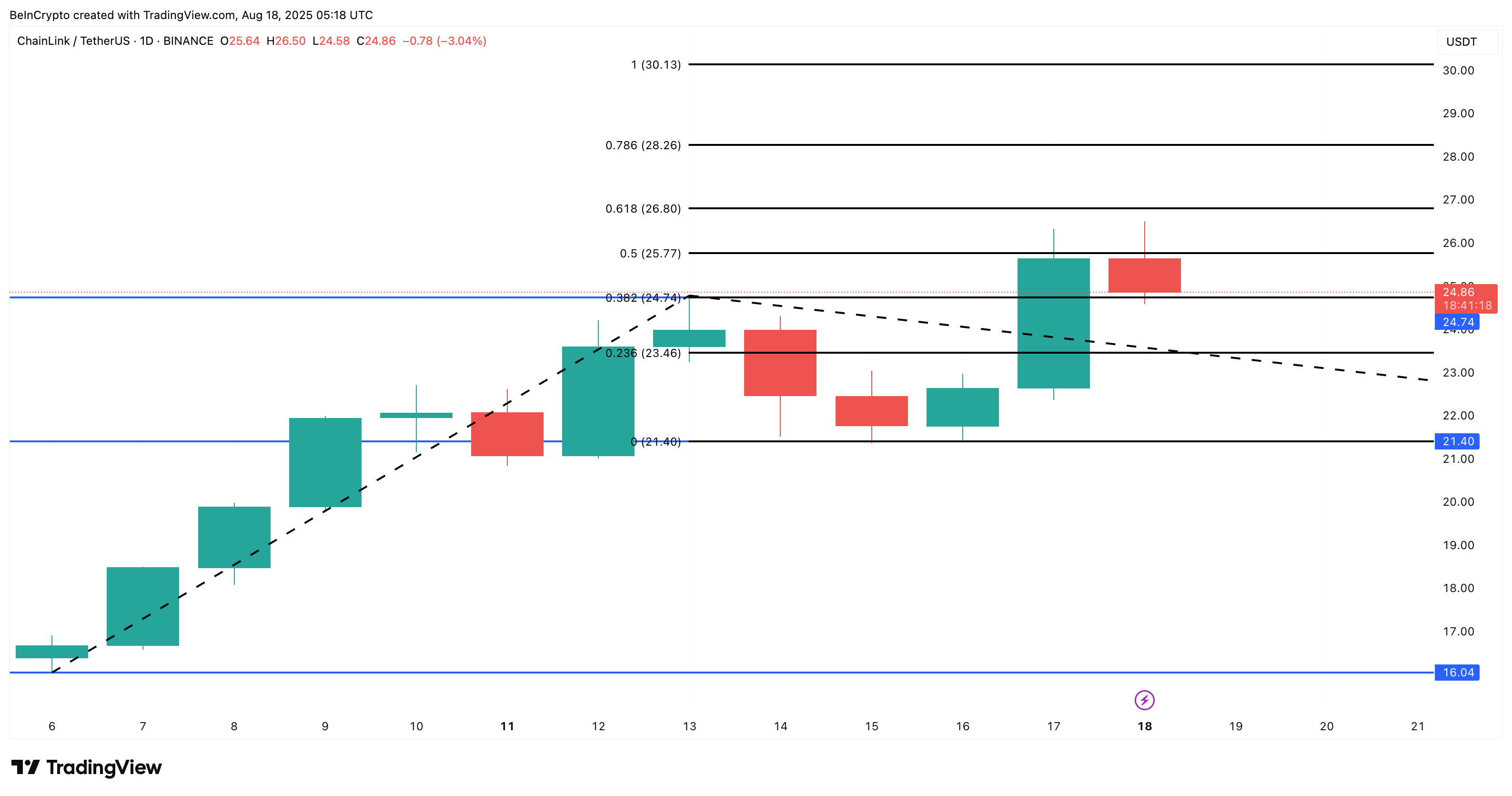

The Chainlink value is at present buying and selling round $24.80, caught between key zones. The closest resistance is at $25.70, and a break above that might ship LINK towards $28.20 and even $30.10; a degree mapped by Fibonacci projections.

However there are key zones on the draw back too.

If short-term promoting builds, the primary two help ranges are at $24.70 and $23.40, adopted by $21.40. These ranges might maintain if the alternate reserves stabilize or begin dropping once more.

To date, the bullish case nonetheless holds, supplied the Sensible Cash accumulation continues and whales resume shopping for. But when reserves proceed to climb, the LINK value would possibly cool off earlier than attempting for brand spanking new highs once more. A dip below $21.40 might defeat the present uptrend and switch the Chainlink value construction bearish within the quick time period.

The submit Chainlink Value Surges on Whale Buys—But a Key Metric May Derail the Rally appeared first on BeInCrypto.