The cryptocurrency market faces a important juncture because the Folks’s Financial institution of China (PBOC) considers stimulus measures in response to slowing financial exercise.

Analysts counsel that if Beijing injects liquidity into the system, altcoins may expertise a big rally, probably surpassing earlier all-time highs.

China Stimulus Attainable in Subsequent Month

Whereas headlines typically give attention to the US Federal Reserve, China’s financial coverage exerts an equally essential affect on international threat property, together with cryptocurrencies. A March 2025 21Shares report highlighted a 94% correlation between Bitcoin’s worth and international liquidity, surpassing the S&P 500 and gold. This correlation underscores the importance of central financial institution insurance policies in shaping investor sentiment towards crypto markets.

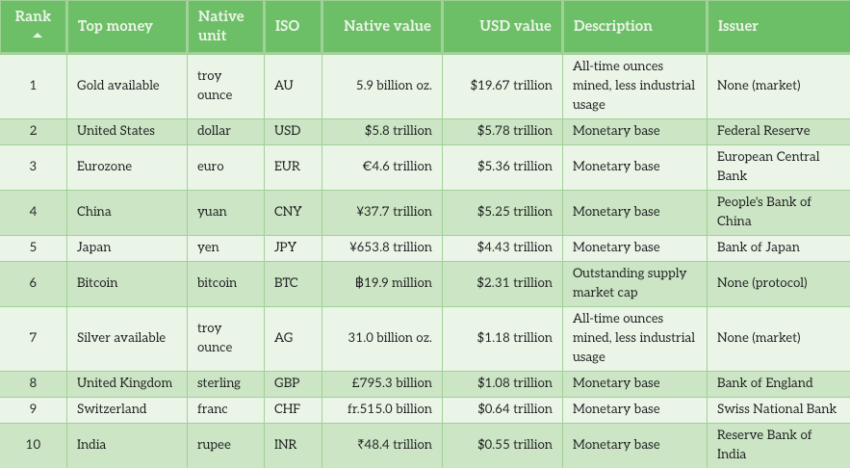

In line with Porkopolis Economics, the U.S. M0 financial base presently stands at $5.8 trillion, adopted by $5.4 trillion within the eurozone, $5.2 trillion in China, and $4.4 trillion in Japan. On condition that China accounts for practically 19.5% of worldwide GDP, the PBOC’s coverage selections carry weighty implications for worldwide capital flows, even when the Fed dominates market consideration.

China’s financial information in July 2025 highlighted a number of areas of weak spot. Retail gross sales fell 0.1% month-on-month, whereas fixed-asset funding declined 5.3% year-on-year, the steepest contraction since March 2020, in line with estimates from Goldman Sachs. Industrial manufacturing, in the meantime, inched up 0.4%, indicating restricted development momentum.

Unemployment additionally confirmed indicators of stress, with the survey-based city jobless fee climbing to 5.2% in July, up from 5.0% in June. Bloomberg famous that the PBOC may introduce stimulus measures “as quickly as September,” whereas economists at Nomura and Commerzbank echoed the expectation of imminent assist insurance policies.

Central banks sometimes deploy stimulus via rate of interest cuts or particular financing circumstances, successfully increasing the cash provide. Such interventions traditionally enhance threat property, together with shares and cryptocurrencies, by making liquidity extra accessible and decreasing financing prices. Within the crypto context, this might translate into renewed demand for altcoins, which have traditionally been delicate to shifts in international liquidity.

US Market Indicators Present Context

Regardless of rising fears of a recession in the USA, markets have remained remarkably resilient. The College of Michigan’s client survey, launched in early August, revealed that 60% of Individuals anticipate unemployment to worsen over the subsequent 12 months, a sentiment final recorded in the course of the 2008–09 monetary disaster.

But, buyers proceed to show optimism. The S&P 500 closed above 6,400 for the primary time ever, whereas 5-year U.S. Treasury yields rebounded from 3.74% on August 4 to three.83% on Friday, signaling decreased threat aversion. Increased Treasury yields typically point out a willingness amongst buyers to embrace riskier property, as demand for government-backed devices diminishes when confidence improves.

For the cryptocurrency market, this mix of things—resilient equities, rebounding yields, and potential Chinese language stimulus—creates a fertile setting for altcoin restoration. Ought to the PBOC comply with via with expansionary measures, the inflow of liquidity might catalyze a broad rotation into cryptocurrencies, driving costs greater throughout a variety of tokens.

Altcoins: Navigating the Uncertainties

Earlier than the 2017 crackdown, China was one of many world’s largest markets for crypto and altcoins, with vital grassroots and institutional curiosity. Altcoins like NEO and VeChain, which have robust Chinese language roots, have been particularly well-liked amongst native buyers.

Though China’s crypto possession fee has dropped to about 5.2%, reflecting declining retail participation resulting from authorities restrictions, Chinese language blockchain initiatives and altcoins proceed to have robust enterprise and technical assist, and lots of Chinese language residents reportedly interact in crypto markets by way of offshore platforms or proxies regardless of restrictions.

Regardless of favorable liquidity circumstances, a number of uncertainties stay. World recession fears, geopolitical tensions, and evolving regulatory frameworks may mood investor enthusiasm. Furthermore, whereas China’s stimulus might inject liquidity, the effectiveness of such measures will rely upon market notion and execution. If stimulus insurance policies are inadequate or non permanent, the altcoin market might reply solely modestly.

Analysts additionally emphasize the significance of US financial circumstances. Rising Treasury yields point out that buyers are more and more pricing inflation and development expectations. These alerts work together with Chinese language liquidity insurance policies, creating a posh backdrop by which altcoins might flourish or expertise headwinds. Traders must also monitor the Trump administration’s China tariffs, which have been delayed for one more 90 days.

The publish China Stimulus May Spark Altcoin Rally as Financial Knowledge Weakens appeared first on BeInCrypto.