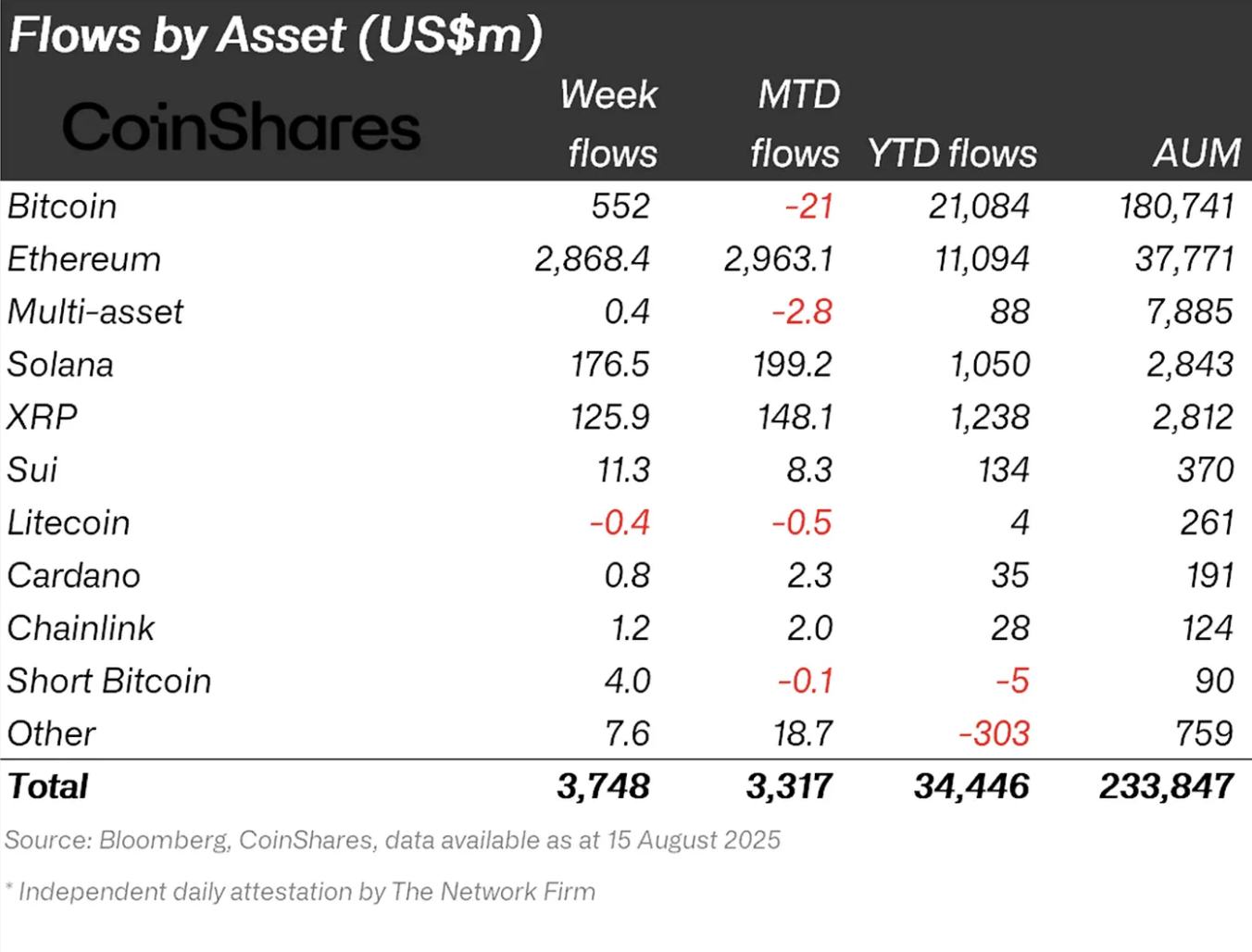

Digital asset funding merchandise posted $3.75 billion in inflows final week, the fourth-largest on report, in line with CoinShares’ newest report.

The surge drove complete belongings underneath administration (AuM) to a brand new all-time excessive of $244 billion on August 13, following a pointy rebound in digital asset costs.

Ethereum leads with record-breaking inflows

Ethereum emerged because the standout performer, attracting $2.87 billion in inflows-accounting for 77% of the whole. This pushed its year-to-date (YTD) inflows to a report $11 billion, far surpassing Bitcoin in proportional development. Ethereum’s inflows now characterize 29% of its complete AuM, in comparison with simply 11.6% for Bitcoin, underscoring the rising institutional urge for food for ETH.

Bitcoin recorded $552 million in inflows final week, a powerful determine however dwarfed by Ethereum’s dominance. Solana and XRP additionally noticed notable demand, attracting $176.5 million and $125.9 million respectively. In distinction, Litecoin and Ton posted minor outflows of $0.4 million and $1 million.

Regional breakdown exhibits U.S. dominance

The USA overwhelmingly led exercise, accounting for 99% of all inflows ($3.73B), primarily into iShares’ digital asset merchandise. Smaller contributions got here from Canada ($33.7M), Hong Kong ($20.9M), and Australia ($12.1M). In the meantime, Brazil (-$10.6M) and Sweden (-$49.9M) recorded modest outflows.

Implications for the crypto market

Ethereum’s outsized inflows spotlight its evolving position as greater than only a good contract platform-it’s more and more seen as a core institutional asset. The disparity between ETH and BTC inflows suggests shifting market dynamics, the place buyers may even see Ethereum as providing stronger upside potential within the present cycle. In the meantime, the continued inflows into Solana and XRP underline rising confidence in various Layer-1s and payment-focused belongings.

With AuM for digital asset merchandise now at report highs, institutional positioning seems to be strengthening forward of what many anticipate to be a decisive interval for crypto markets in late 2025.