Bitcoin seems set for a pause. Costs climbed to a contemporary excessive, and now the market is displaying indicators of short-term cooling as some buyers lock in income.

Associated Studying

Value Pullback And Latest Rally

Bitcoin was buying and selling at $115,550 when this report was written, about 6% shy of its all-time excessive of $124,201 reached on Wednesday.

The highest crypto asset was up roughly 10% within the 9 days main as much as that peak. That fast run-up helped push costs greater, nevertheless it additionally left some merchants in search of a breather.

Analysts say the latest rally shortly fizzled out with out contemporary macro drivers to maintain it going.

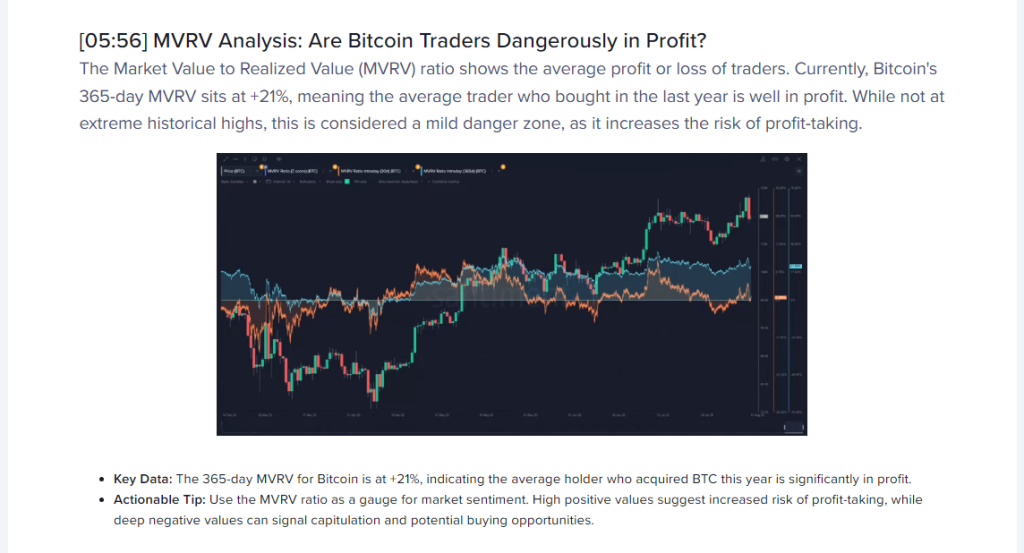

MVRV Indicators Some Warning

In response to Santiment, the Market Worth to Realized Worth (MVRV) ratio sits at +21%. Which means the common holder who purchased over the previous 12 months is in revenue, and plenty of may very well be tempted to promote.

That determine isn’t an excessive studying. However it is sufficient to increase the chances of profit-taking, which may gradual or stall additional beneficial properties.

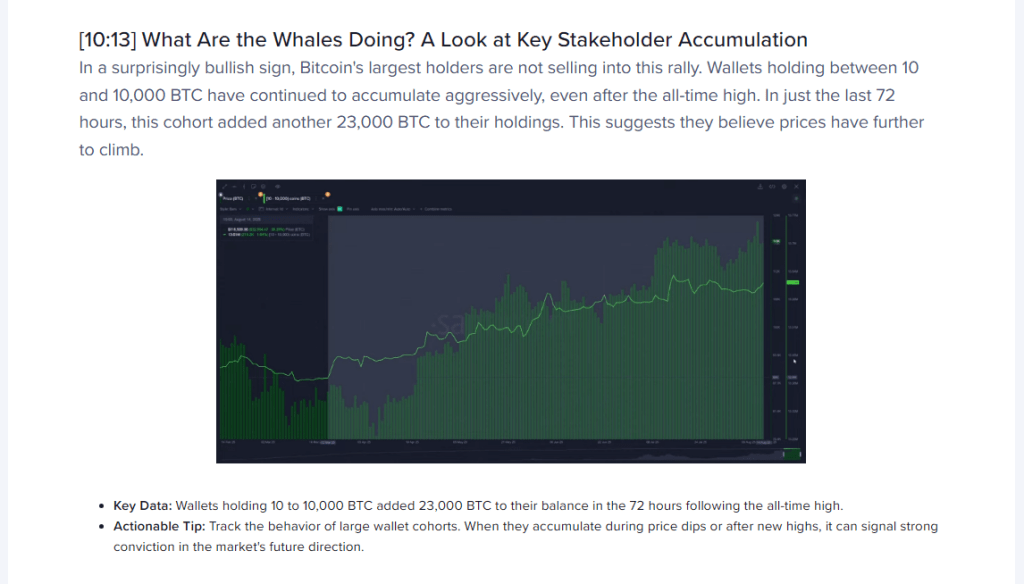

Revenue Taking Vs. Whale Accumulation

There’s pressure out there proper now. Primarily based on experiences, about $2 billion in brief positions could be in danger if Bitcoin returned to the $124,000 area. That creates a squeeze state of affairs on a giant upside transfer.

On the identical time, Santiment notes that wallets holding between 10 and 10,000 BTC have continued so as to add to their holdings even after the brand new excessive. So whereas many smaller gamers might take income, bigger holders seem assured and are stacking extra cash.

Macro Watch: Fed Minimize In Focus

Traders are additionally watching the US Federal Reserve. The Fed’s price lower resolution set for Sept. 17 is on many merchants’ calendars.

The CME FedWatch Device places the possibility of a lower at about 83%. That anticipated transfer is one motive some market contributors are sitting tight and ready, quite than pushing costs greater straight away.

What Merchants Are Watching Subsequent

Markets look to be in a consolidation section, with merchants adopting a wait-and-watch stance. If financial information or the Fed resolution surprises, value motion might decide up quick.

Associated Studying

However with no new catalyst, sideways motion appears extra possible within the close to time period. Primarily based on experiences, the mixture of modest MVRV stress, piled-up shorts, and regular whale shopping for paints a combined image — danger now, potential gasoline later.

In the meantime, short-term choppiness is believable. Some buyers will take income. Others — particularly bigger wallets — are nonetheless shopping for.

Watch the Fed date and any sudden shifts in brief positions; they might resolve which approach the subsequent transfer goes.

Featured picture from Meta, chart from TradingView