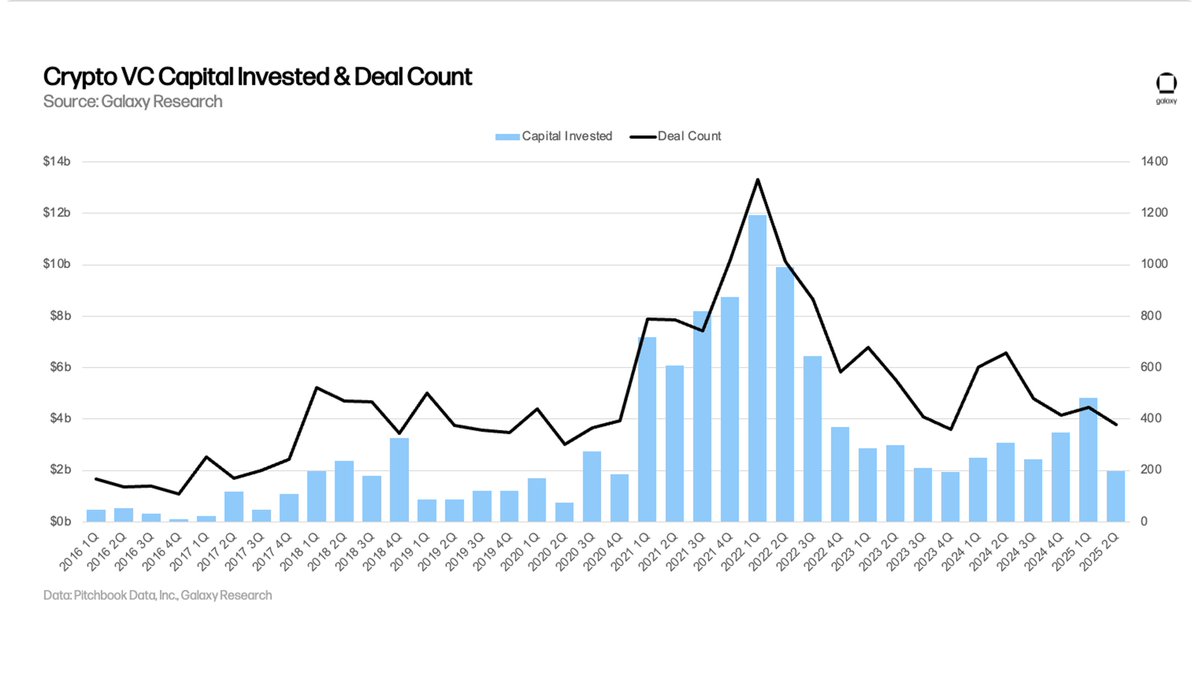

Crypto enterprise funding continued its downward development in Q2 2025, with traders committing $1.97 billion throughout 378 offers, based on information from Galaxy Analysis.

The quarter marked the second-lowest stage of funding since 2020, underscoring the cautious stance of enterprise capital companies towards blockchain and Web3 startups.

The slowdown follows a pointy decline from the record-breaking funding cycle of 2021–2022, when quarterly totals peaked at over $13 billion.

Deal depend has additionally fallen considerably, with simply 378 offers closed in Q2 in comparison with greater than 1,200 on the cycle’s peak.

Analysts recommend that the weak enterprise atmosphere displays a mixture of regulatory uncertainty, tighter liquidity circumstances, and investor choice for profitability over speculative progress. Whereas capital stays accessible, it’s more and more concentrated in tasks targeted on infrastructure, tokenization platforms, and AI-integrated crypto functions.

Regardless of the slowdown, Galaxy famous that traditionally, intervals of muted enterprise funding usually precede the subsequent wave of market growth. With Bitcoin and Ethereum costs stabilizing, many count on capital flows to re-accelerate as soon as readability round regulation and broader adoption strengthens.