- Wholesome Rally Indicators: ETH’s transfer previous $4.2K seems to be stronger than previous runs, with near-zero funding charges displaying it’s spot-driven somewhat than leverage-fueled.

- $4.7K Resistance Zone: The true check sits at $4.7K, a ceiling that has rejected Ethereum a number of instances since 2024—breaking it may affirm a brand new bullish section.

- Volatility Dangers: On-chain metrics like Inventory-to-Circulate and MVRV recommend sturdy holder confidence, but additionally rising profit-taking stress, making this stage a pivotal battleground.

Ethereum has powered its means over $4,200, a stage that sparks loads of pleasure—but additionally raises the large query of whether or not this run has sufficient gas left. Not like the overheated rallies we noticed in late 2020 and once more in early 2024, this breakout feels… calmer. Funding charges are holding near zero, displaying that the transfer is usually spot-driven, not some wild leverage chase. That’s usually more healthy—much less threat of sudden liquidations slamming the brakes. Nonetheless, analysts warn that if funding immediately climbs above 0.05, the market may flip quick into heavy promoting.

Resistance at $4.7K: The Actual Take a look at

For now, the elephant within the room is $4.7K. This stage has been like a ceiling, rejecting ETH each time it will get too shut. Final touched in March 2024, it’s been a recurring ache level throughout cycles. As Ethereum inches nearer once more, merchants are eyeing whether or not this zone will spark one other rejection—or lastly crack. A clear break may set off a brand new leg up, however rejection would possibly result in a cooling section earlier than bulls can strive once more.

Volatility Brewing Beneath the Floor

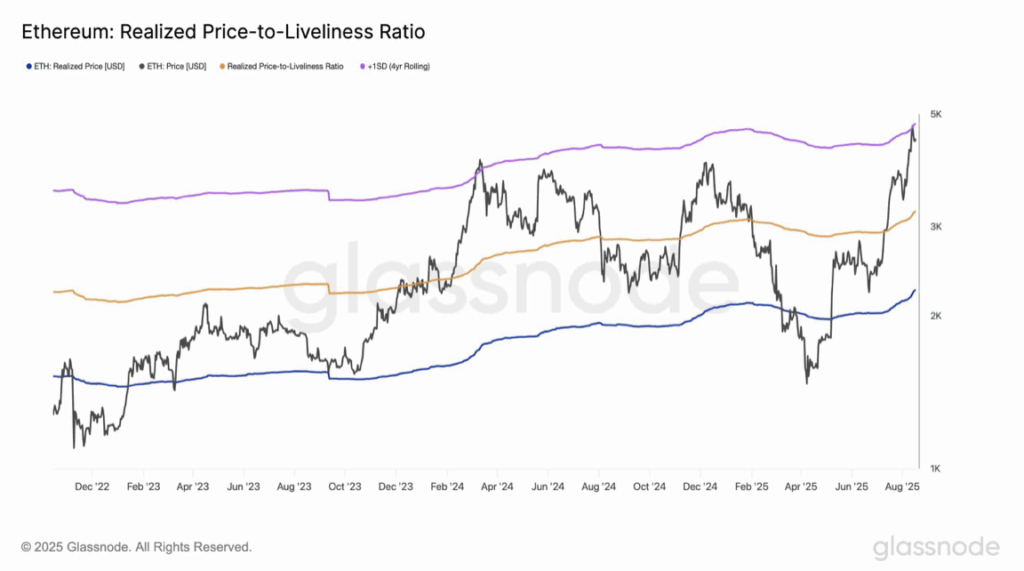

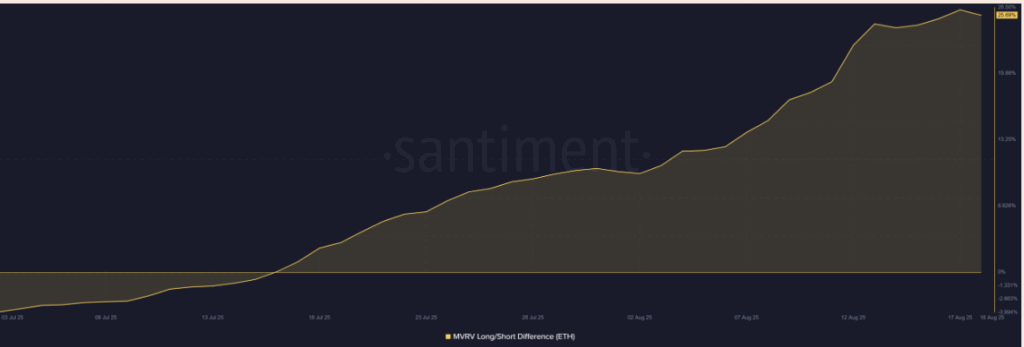

On-chain alerts present some fascinating contradictions. The Inventory-to-Circulate ratio has shot as much as 47.7, which highlights ETH’s shortage narrative—but additionally hints the market could be working a bit sizzling. Traditionally, spikes like this deliver volatility, both within the type of explosive rallies or sharp corrections. In the meantime, MVRV reveals long-term holders are sitting on fats income, a lot larger than short-term gamers. That confidence is bullish, however it additionally will increase the temptation to promote into power.

Holding the Line or Breaking By way of?

So, right here’s the image. Ethereum’s funding charges recommend the rally is strong, not frothy. However the $4.7K resistance is cussed, and profit-taking threat is creeping in as older holders see inexperienced. If ETH clears that wall with conviction, we could possibly be gazing a brand new section of the bull cycle. If not, nicely, a correction could be the pause that refreshes earlier than the following huge try. Both means, the battle at $4.7K seems to be set to outline the following chapter in ETH’s story.