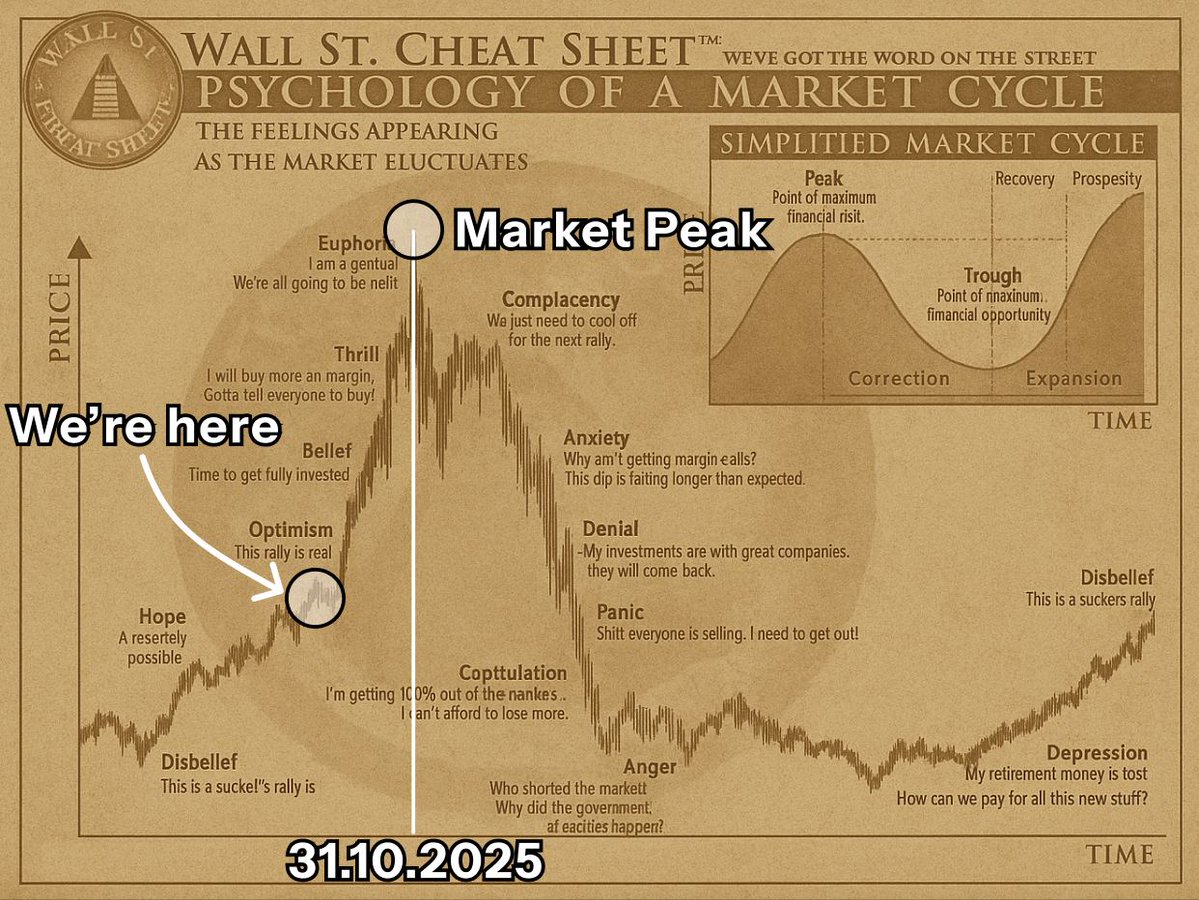

Properly-known crypto analyst Atlas has launched his newest cycle outlook, warning that the market might be coming into its closing bullish stage earlier than a significant high.

Whereas sentiment stays robust throughout Bitcoin, Ethereum, and altcoins, he believes the present setup resembles late-phase conduct seen in 2017 and 2021.

In keeping with Atlas, the approaching weeks will possible carry heightened volatility as liquidity rotates between majors and smaller tokens. He identified that Bitcoin has already secured robust positive factors, whereas Ethereum is getting ready for a closing push towards the $6,000 area. As soon as ETH dominance takes maintain, he expects capital to stream into secondary Layer-1s corresponding to Solana and Avalanche earlier than spilling into low-cap tokens – a basic sign of cycle maturity.

Atlas emphasised that October might show decisive. The anticipated Federal Reserve price reduce might act as a short lived liquidity injection, fueling one final parabolic surge. On the similar time, he cautioned that altcoin season metrics are already approaching overheated ranges, with the Altseason Index closing in on the hazard zone above 65. This mixture, he argued, might give merchants a slim window to take income earlier than the development reverses sharply.

His technique focuses on scaling out methodically relatively than chasing each closing transfer increased. Atlas suggested trimming publicity to meme cash and illiquid tokens first, then step by step locking in positive factors from larger-cap performs because the rotation progresses. The last word step, he famous, is securing income from Bitcoin and Ethereum into stablecoins earlier than mid-October, forward of what he expects to be a harsh correction.

Atlas warned that the most important mistake merchants make at this stage is assuming dips will preserve getting purchased. In previous cycles, late entrants have been caught holding by way of 50%–70% drawdowns when momentum abruptly shifted. This time, he believes the setup isn’t any totally different: a euphoric ending section adopted by steep retracements.

Regardless of the cautionary tone, Atlas isn’t bearish but. He nonetheless sees upside within the brief time period, particularly for Ethereum and choose altcoins, however pressured that timing is now every thing. “The final 10% upside isn’t price risking all of your positive factors,” he concluded, underscoring October because the important month to exit well.