Since July 17, Hedera Hashgraph’s native token, HBAR, has trended largely sideways. Regardless of a number of makes an attempt at an upward breakout, market volatility and rising bearish sentiment have repeatedly prevented this.

Now, with Hedera exhibiting indicators of weakening consumer demand, HBAR dangers prolonged consolidation and even deeper losses.

Falling TVL and DEX Volumes Put HBAR’s Worth Stability at Danger

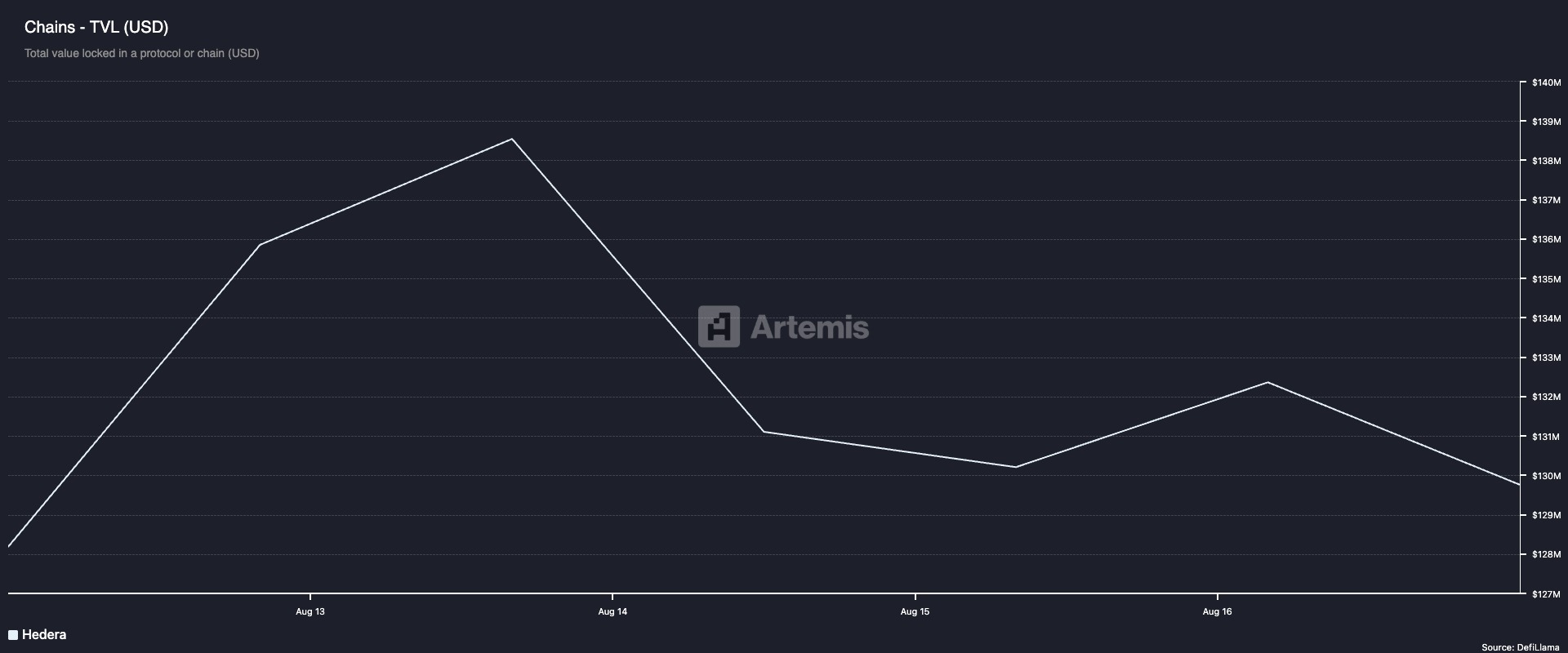

Over the previous few days, consumer exercise on the Hedera community has declined, marked by a drop in its complete worth locked (TVL). Per Artemis knowledge, this presently sits at $129 million, down 5% since August 14.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

TVL measures the whole capital deposited throughout a community’s decentralized finance (DeFi) protocols, making it a key gauge of investor confidence and consumer demand. A rising TVL displays rising exercise and demand, as extra customers lock property into lending, staking, or liquidity swimming pools.

Conversely, a falling TVL indicators declining participation, diminished liquidity, and waning confidence. Subsequently, Hedera’s falling TVL suggests a dip in customers participating with its DeFi ecosystem, including strain to HBAR’s already stagnant value motion.

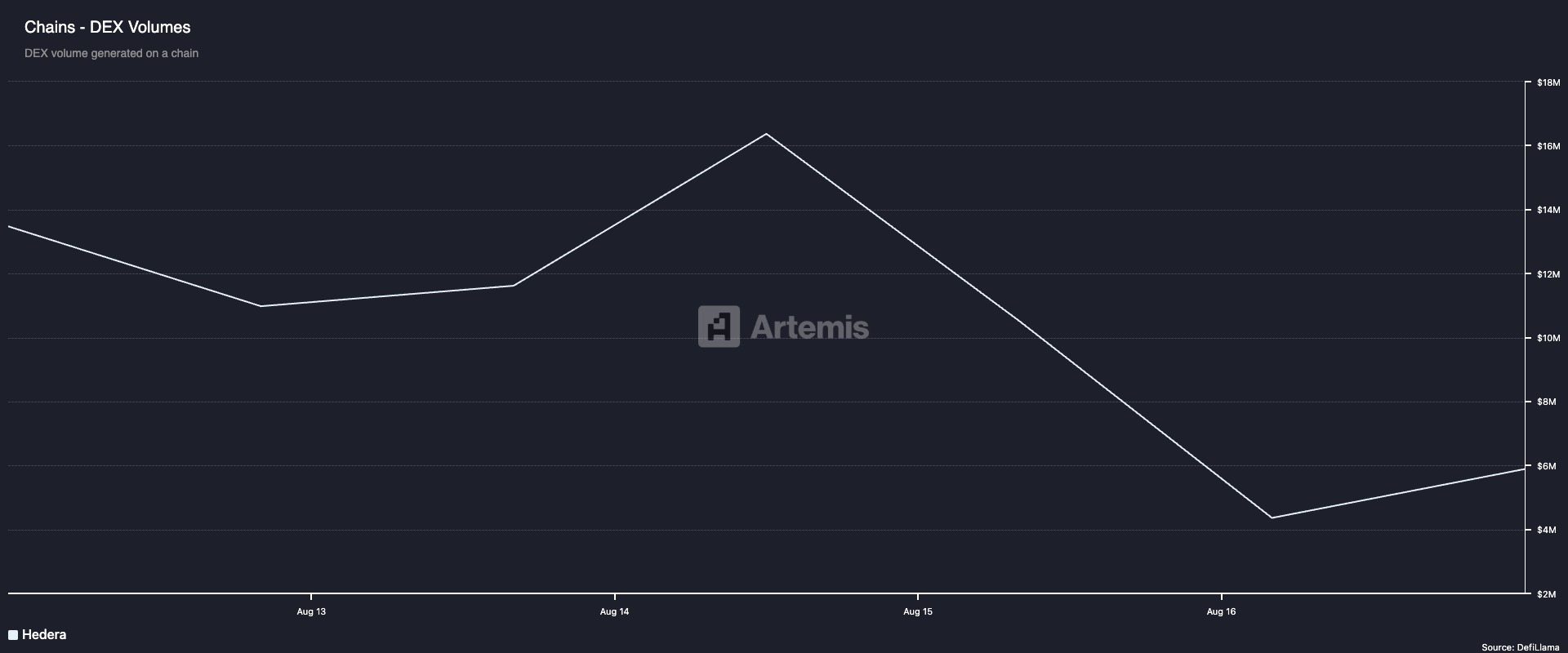

Additional, the autumn in decentralized alternate (DEX) volumes on Hedera confirms the plummeting consumer exercise on the community. Up to now week, this has dropped by practically 60%, in line with Artemis.

A decline in DEX quantity displays weakening transaction move, with fewer customers swapping, buying and selling, or offering liquidity throughout the community’s protocols.

This discount in buying and selling momentum limits Hedera’s on-chain exercise and highlights diminished speculative curiosity in its native token. It dampens short-term value restoration hopes and will increase the chance of prolonged stagnation or a bearish breakdown if demand stays absent.

Can HBAR Maintain $0.227?

On the day by day chart, readings from HBAR’s Transferring Common Convergence Divergence (MACD) verify the potential for a bearish breakout of its present vary.

At press time, HBAR’s MACD line (blue) rests beneath the sign line (orange), an indication that sell-side strain is gaining dominance.

The MACD indicator identifies developments and momentum in its value motion. It helps merchants spot potential purchase or promote indicators via crossovers between the MACD and sign traces.

When the MACD line rests beneath the sign line, it signifies declining shopping for strain and rising selloffs. If this continues, it might set off a breach of the assist shaped at $0.227. A break beneath this key assist might result in a deeper drop towards $0.196.

Nevertheless, HBAR’s value might break above $0.266 if sentiment improves and shopping for resumes.

The publish HBAR Worth Dangers Breakdown as Hedera Community Exercise Plunges appeared first on BeInCrypto.