Regardless of broader market weak spot, SEI, the native token of Sei blockchain, has stayed in uptrend mode, rising over 45% in three months and gaining 6.3% previously week.

The SEI rally may prolong additional, as a key bullish sample emerges and alternate flows sign sustained accumulation. Nonetheless, one buying and selling cohort could also be sitting in peril if costs maintain climbing.

SEI Alternate Outflows Proceed for the eighth Straight Week

SEI has been persistently pulled off exchanges for eight consecutive weeks. Final week alone, SEI noticed web outflows of $10.43 million, marking the second-largest weekly whole since July’s peak. These steady outflows mirror rising shopping for strain and long-term conviction.

This demand uptick coincides with Sei’s current push into institutional-grade choices. The launch of Monaco, Sei’s Wall Road-grade buying and selling layer, and the CBOE’s ETF submitting have sparked recent curiosity amongst big-ticket gamers.

Mixed with an enormous rise in lively addresses and the overall worth locked nearing $626 million, the on-chain fundamentals proceed to again the worth development.

Bullish Crossover Varieties as Shorts Load Up

On the each day chart, SEI is now flashing a traditional bullish sign. The 100-day EMA or Exponential Shifting Common is about to cross above the 200-day EMA, a transfer usually seen as a medium-term purchase set off. If confirmed, this crossover may speed up the continued uptrend.

EMA stands for Exponential Shifting Common — a trend-following indicator that provides extra weight to current costs. A crossover occurs when a shorter EMA (say, 100-day) strikes above or under an extended one (just like the 200-day), usually hinting at a shift in market momentum.

Institutional and long-term swing merchants use the 100-day/200-day crossover as a affirmation of a extra dependable uptrend.

That’s the place the chance to bears is available in. Over the previous 7 days, $37.34 million in brief positions have constructed up on Bitget alone, in comparison with $26.15 million in longs.

Liquidation maps reveal that many of those brief trades are stacked round $0.32 to $0.36. If the bullish crossover fuels a fast worth rise, these brief positions may face cascading liquidations, pushing SEI greater in a brief squeeze.

A brief squeeze occurs when merchants betting in opposition to a token are compelled to purchase it again at greater costs, pushing the worth up much more.

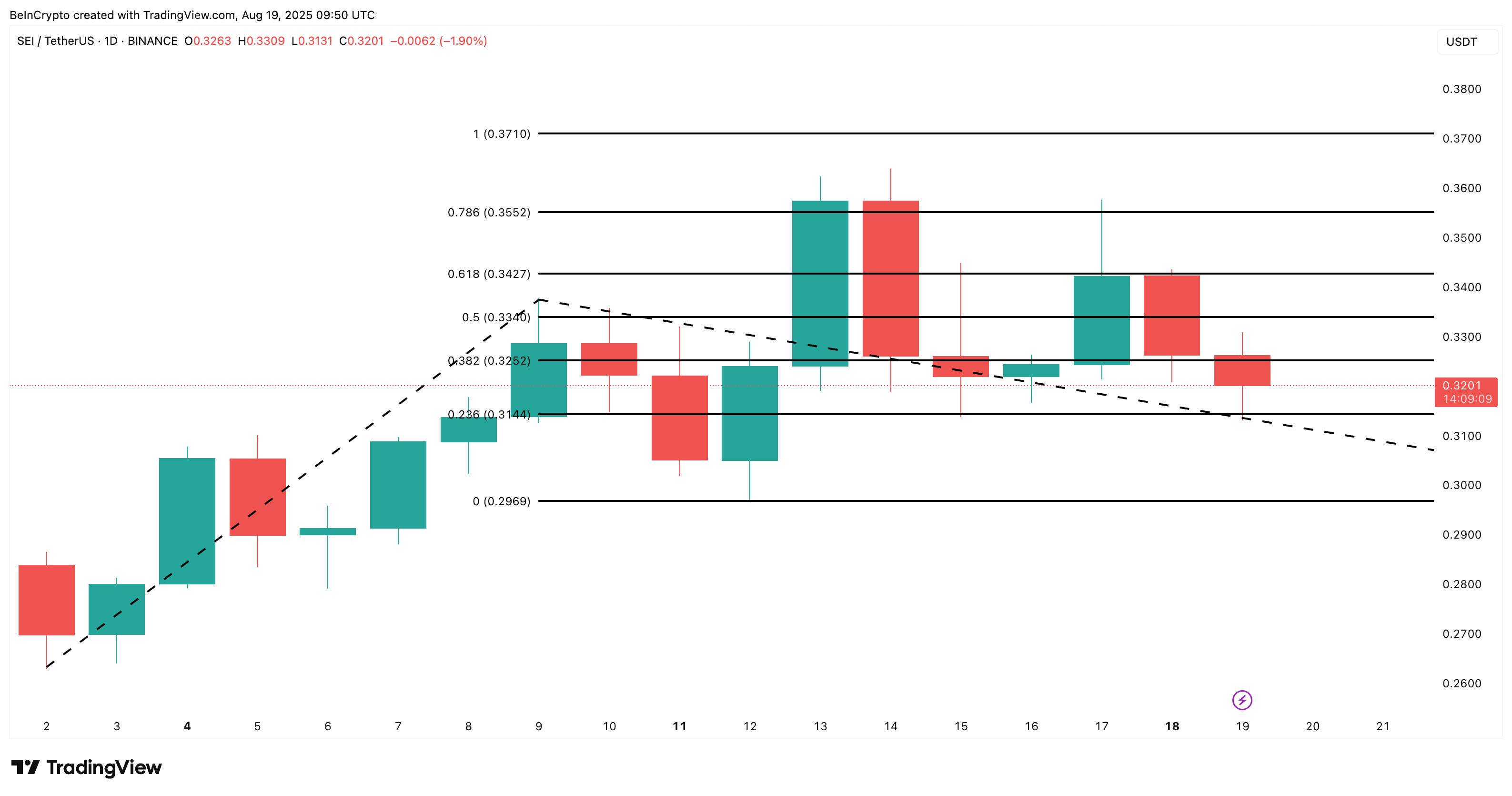

SEI Worth Must Beat $0.35 to Open Room to $0.37

SEI is at the moment buying and selling close to $0.32, simply above the native assist of $0.31. This vary has acted as a constant purchase zone for bulls. To substantiate the continuation of its rally, SEI should cleanly break by means of $0.35, a degree the place it was beforehand rejected a number of instances.

If this degree flips, $0.37 turns into the following probably resistance.

Given the macro momentum, bullish EMAs, and constant alternate outflows, the worth construction stays tilted to the upside. Nonetheless, any failure to flip $0.35 may give trapped shorts a short lived breather earlier than bulls reload.

Additionally, if the SEI worth dips beneath $0.31 and exams $0.29, the short-term bullish development may not maintain.

The put up SEI Worth Set to Rally as Bullish EMA Crossover Indicators Breakout appeared first on BeInCrypto.