- TRON trades round $0.3455, holding help as total market sentiment stays bearish.

- Zero-fee TRX and USDT transfers on TRC-20 might enhance adoption and long-term demand.

- Quantity and technicals counsel a breakout could also be shut, with $0.357 resistance and $0.33 help as ranges to look at.

TRON (TRX) has been caught in the identical market storm weighing down a lot of crypto, slipping barely regardless of displaying small weekly positive factors. Over the past 24 hours, TRX dropped 1.71% to commerce round $0.3455, although buying and selling exercise stayed scorching with quantity climbing above $1.11 billion. Market cap, in the meantime, dipped by 1.75% to $32.7 billion, reflecting how fragile sentiment has been as Bitcoin drags the broader market down.

Zero-Charge TRX Transfers Spark Optimism

Amid the chop, TRON DAO rolled out what some are calling a breakthrough in crypto usability: zero-fee deposits and withdrawals for each TRX and USDT on TRC-20. This transfer wipes out hidden prices and delays that often frustrate retail customers, whereas additionally providing lightning-fast transactions. Analysts see it as greater than a pleasant perk—it’s a structural change that might make TRON extra engaging to each particular person buyers and bigger establishments. Safety, transparency, and velocity stay the cornerstones, and if adoption picks up, it’d assist TRX shrug off short-term bearish momentum.

TRX Value Caught Between Help and Resistance

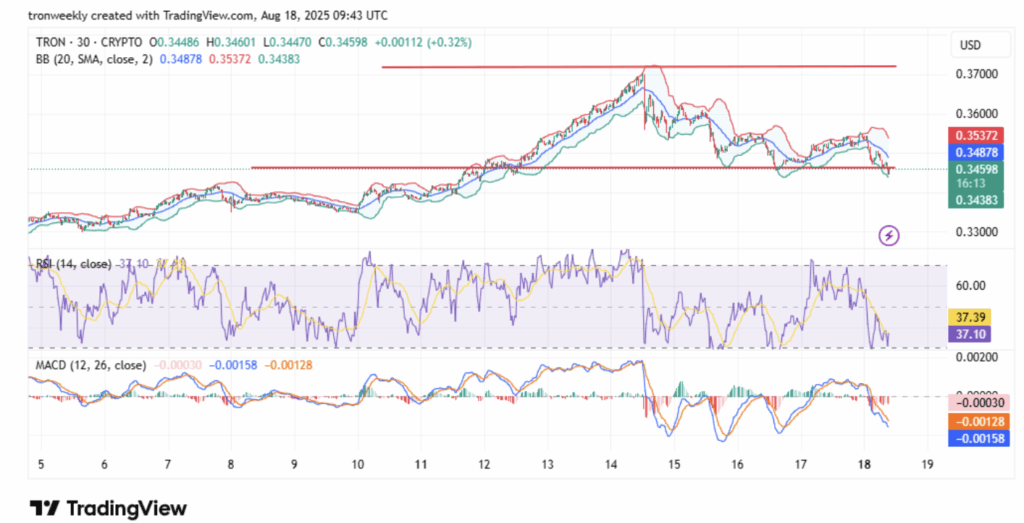

On the charts, TRON is hovering simply above its key help at $0.3438. Technical indicators paint a combined image: RSI is nearing oversold territory at 37, hinting at attainable rebound energy, however MACD continues flashing short-term bearish bias. If TRX can maintain the road, a push again to $0.357 appears possible, and clearing that degree might open the trail towards $0.372. On the flip facet, dropping $0.3438 help might set off a sharper correction all the way down to $0.33.

Rising Quantity Hints at Breakout Potential

Curiously, buying and selling quantity jumped over 11% to $415.6 million whilst open curiosity slipped practically 4%. This exhibits merchants are rotating positions reasonably than abandoning the market, with sentiment balanced between cautious optimism and lingering worry. The weighted funding fee stays barely constructive at 0.0049%, reinforcing the concept that a breakout might arrive quickly—both above resistance or beneath help.