Asian IPOs are transferring into the highlight. Throughout the area, exchanges and fintech companies more and more view Wall Avenue as the perfect venue to boost capital, enhance valuations, and achieve world legitimacy.

Analysts additionally observe that these listings may ship deep liquidity and credibility whereas exposing firms to heavy compliance calls for. Understanding the evolving motives and pitfalls of this development is vital for buyers and regulators alike.

OKX, Animoca, Bithumb Rush for US Debut

Newest Replace:

OKX IPO studies sparked a 5% rise in its OKB token. The change, a significant Asian participant, has overhauled its compliance construction and now seeks to check U.S. markets.

Coincheck Nasdaq is now not hypothesis. In December 2024, the Japanese change started buying and selling publicly underneath the ticker CNCK after finishing its de-SPAC merger. It turned the primary Japan-based crypto change to succeed in Nasdaq, elevating funds earmarked for know-how and acquisitions.

Animoca itemizing discussions proceed. The Hong Kong-based Web3 investor goals to increase its model from gaming and NFTs into the broader monetary ecosystem, with Wall Avenue serving as a gateway to institutional capital.

Bithumb spin-off confirms its bid to streamline operations. By separating its change enterprise, the Korean platform hopes to offer buyers with a clear earnings profile earlier than contemplating a US debut.

In the meantime, LBank IPO ambitions spotlight the dedication of mid-sized gamers to hitch the race. Though smaller in scale, LBank’s growth in Southeast Asia positions it as a candidate for buyers searching for publicity to emerging-market crypto adoption.

2014 Alibaba IPO Left an Exemplary Case

Background Context: The precedent is robust. Alibaba’s IPO in 2014 demonstrated how Asian companies can thrive within the U.S., whereas Coinbase’s debut in 2021 legitimized crypto firms by proving that exchanges may face up to regulatory scrutiny and entice institutional demand. However, Asia’s dwelling rules stay fragmented and infrequently restrictive, making the U.S. probably the most clear and liquid venue for formidable crypto companies.

Deeper Evaluation: A number of components clarify the surge, and collectively they present why the present momentum is so vital:

- Market sentiment: A broad restoration in IPO urge for food is underway. “These are the perfect market circumstances the crypto area has seen in years, and firms wish to make the most of that,” mentioned Matt Kennedy, senior strategist at Renaissance Capital. Investor optimism, mixed with a pro-crypto regulatory posture in Washington, is fueling the increase.

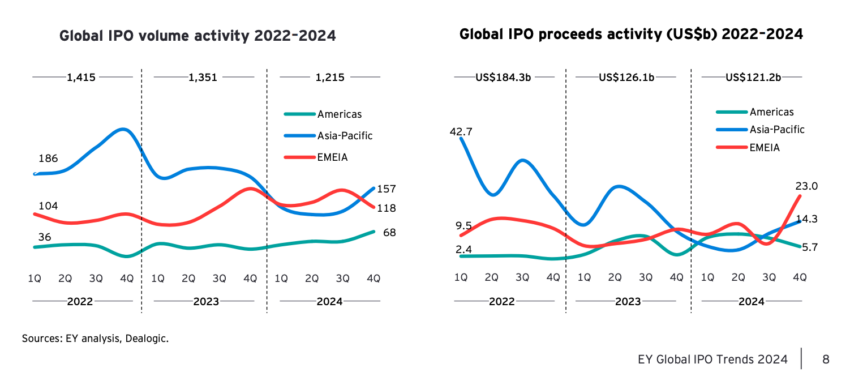

- Asia’s progress function: The area hosts one of many fastest-growing crypto sectors. EY studies present that Asia-Pacific IPO values rebounded in double digits in late 2024, underscoring its momentum. Furthermore, world information emphasizes the US market’s attraction for international firms. In line with EY, 55% of all U.S. public listings in 2024 got here from international issuers.

- Capital and valuation: OKX itemizing may command multiples unimaginable in regional markets.

- Regulatory credibility: Animoca’s compliance with SEC requirements would sign sturdy belief.

- Versatile routes: Coincheck’s de-SPAC confirmed how different constructions can shorten time-to-market.

- World branding: Bithumb IPO ambitions mirror the ceiling on home progress.

Sovereignty and Slowing Concern

Behind the Scenes: For OKX, IPO speak is as a lot about reputational reset as funding. Coincheck’s transfer ensures battle chests for M&A, whereas Bithumb’s reorganization underscores self-discipline. LBank, against this, seeks new funds to broaden into rising markets like Latin America. Regardless of their totally different methods, all these companies see Wall Avenue as the last word stage for legitimacy.

Wider Impression: These strikes ripple outward. Because of this, institutional buyers usually tend to allocate capital as soon as disclosure requirements align with US norms. On the similar time, Asian regulators could face stress to regulate frameworks to stay aggressive. But dependency on Wall Avenue may additionally weaken native markets, elevating sovereignty issues throughout Asia’s monetary facilities.

Challenges of Disclosure: Whereas advantages are clear, burdens stay. PwC and EY warning that ongoing reporting, compliance, and governance prices devour sources and scale back agility. Consequently, these constraints may gradual innovation and responsiveness for exchanges competing in fast-moving markets.

Information Highlights:

- Asia-Pacific IPO market rebounded with double-digit progress in late 2024 (EY).

- U.S. crypto market cap topped $4 trillion in mid-2025 (Reuters).

- OKB token rose 5% after IPO hypothesis.

- Coincheck buying and selling as CNCK on Nasdaq from Dec. 2024.

- 55% of U.S. public listings in 2024 have been international issuers (EY).

The put up Asian Crypto Companies Eye US IPOs Amid Alternatives and Dangers appeared first on BeInCrypto.