Be part of Our Telegram channel to remain updated on breaking information protection

The crypto market slid a fraction of a % prior to now 24 hours with Bitcoin and Ethereum tumbling forward of Fed Chair Jerome Powell’s Jackson Gap speech on Friday

OKB (OKB) led gainers with a ten% surge as of 4:07 a.m. EST, pushing its weekly soar to 174%, whereas Pump.enjoyable was the largest loser amongst main cryptos after slumping 10%. Bitcoin fell 0.3% and Ethereum 0.25%

Mantle (MNT), AB (AB), and POL (POL) have been amongst different main gainers, recording 9.9%, 8%, and three% will increase, respectively, in keeping with CoinMarketCap.

On CoinGecko, Wiki Cat (WKC) was the highest trending crypto after a 94% surge within the final 24 hours, and is now up 371% in per week to prime pattern on DexScreener.

SPX6900 (SPX), Arbitrum (ARB), and Injective (INJ) recorded drops of 6%, 5.8%, and 5.2%, respectively, in keeping with CoinMarketCap knowledge.

These losses mirror a broader pullback from threat property. Total, over 101,400 merchants have been liquidated, with complete liquidations coming in at $333.39 million, in keeping with knowledge from Coinglass.

Crypto Merchants Eye Jackson Gap Summit

The crypto sector’s market cap dropped a fraction to $3.87 trillion as merchants flip to Federal Reserve Chairman Jerome Powell’s anticipated speech on the Jackson Gap Financial Symposium on Friday for extra steerage on the place rates of interest are headed.

I am ignoring the day by day chart noise this week

My whole focus is on one occasion that would set the market’s route for the remainder of the quarter

The Jackson Gap Financial Symposium

For many who do not know, Jackson Gap is the place central bankers from around the globe collect, and… pic.twitter.com/EAgYSucatH

— Bobby (@0xchainBob) August 18, 2025

One yr in the past, a hawkish tone from Powell triggered a large 29% drop within the BTC value, which took months to recuperate. Because the market plunged, threat property additionally tumbled, with a number of cryptos recording vital losses.

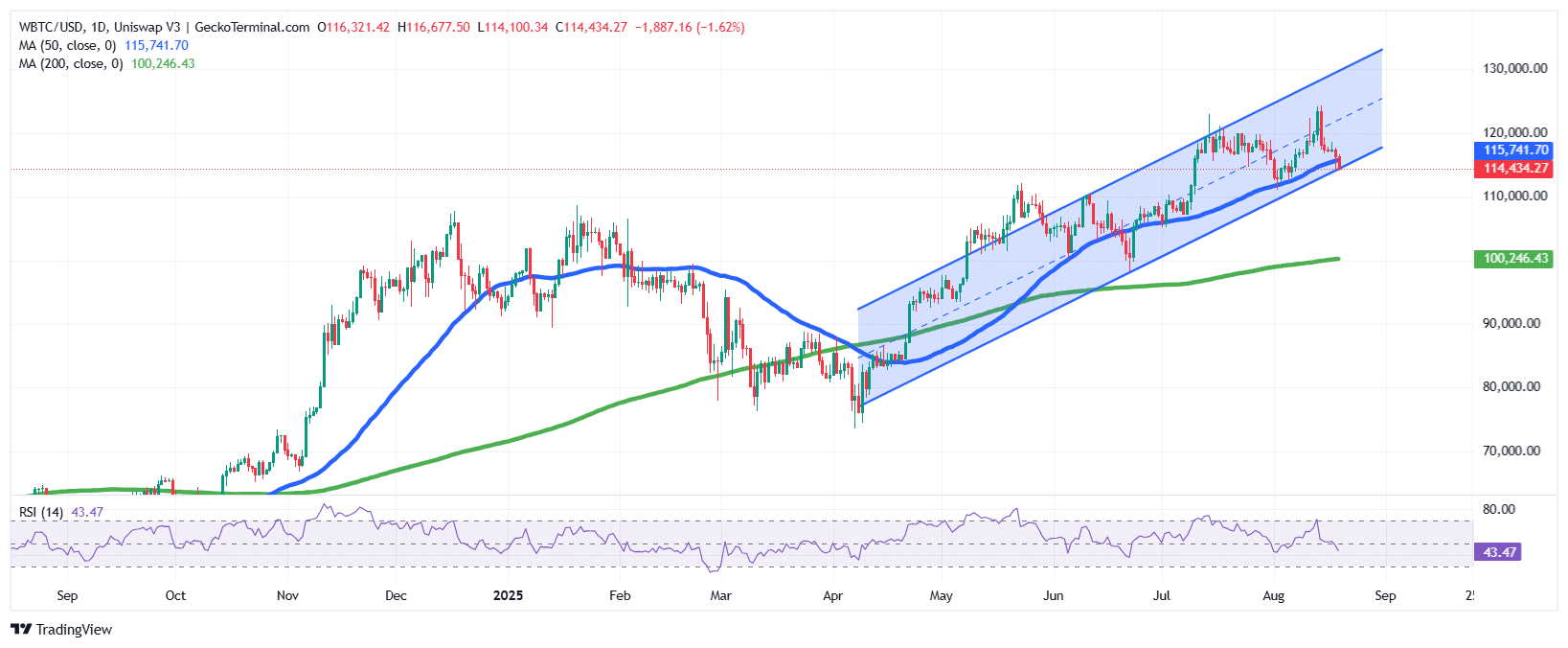

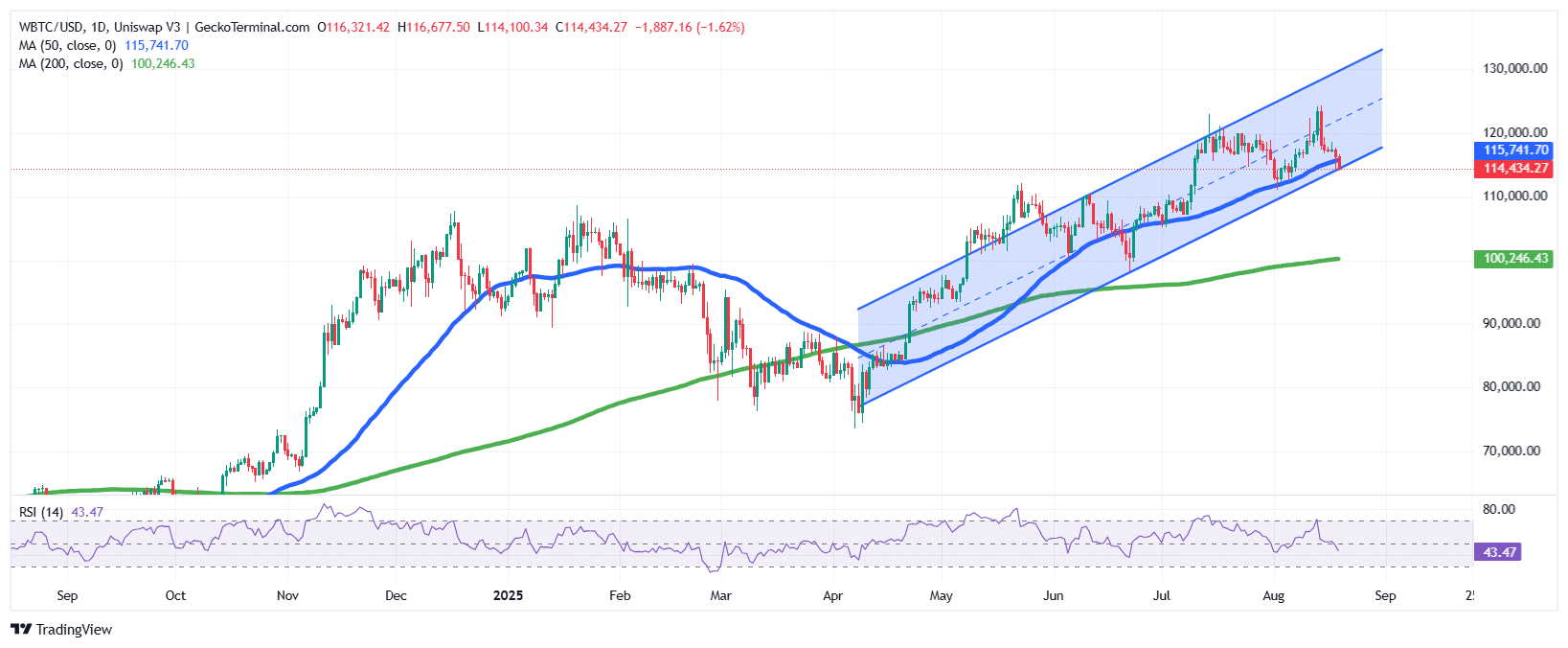

Bitcoin Value At A Vital Level

From a technical perspective, Bitcoin’s value motion is at a vital level, with a number of key ranges more likely to dictate its near-term trajectory.

BTC has touched the decrease boundary of the rising channel on the day by day timeframe and is at present testing assist round $114,000, slightly below the 50-day Easy Transferring Common (SMA).

Nevertheless, it stays far above the 200-day SMA, cementing the bullish outlook in the long run.

But, the Relative Energy Index (RSI) at 43 signifies weakening momentum, leaning towards bearish territory with out being oversold.

If value holds above the decrease channel assist and rapidly recovers the 50-day SMA, BTC might resume its upward trajectory towards the $120,000–$125,000 zone.

In accordance with a crypto analyst on X, Bull Principle, with over 15K followers, “A weekly shut above $120K will affirm continuation towards $140K–$150K.”

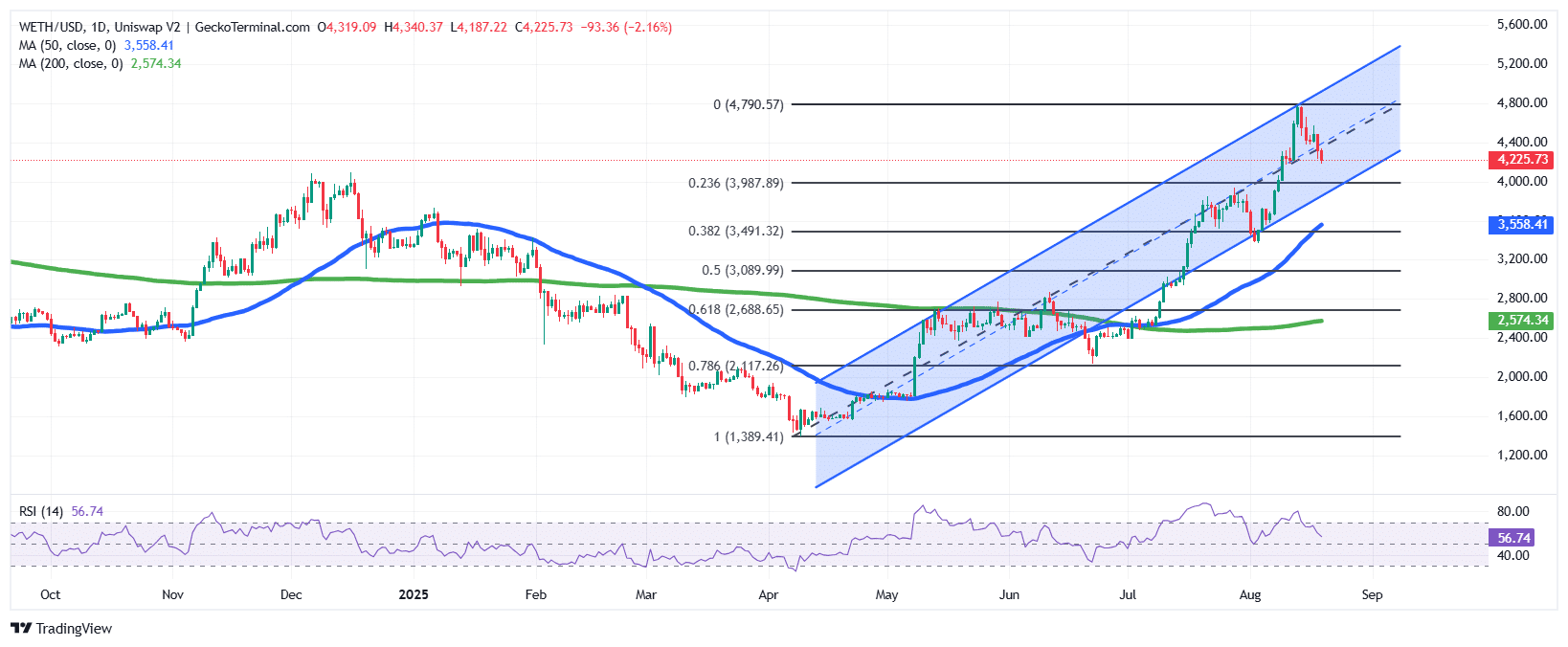

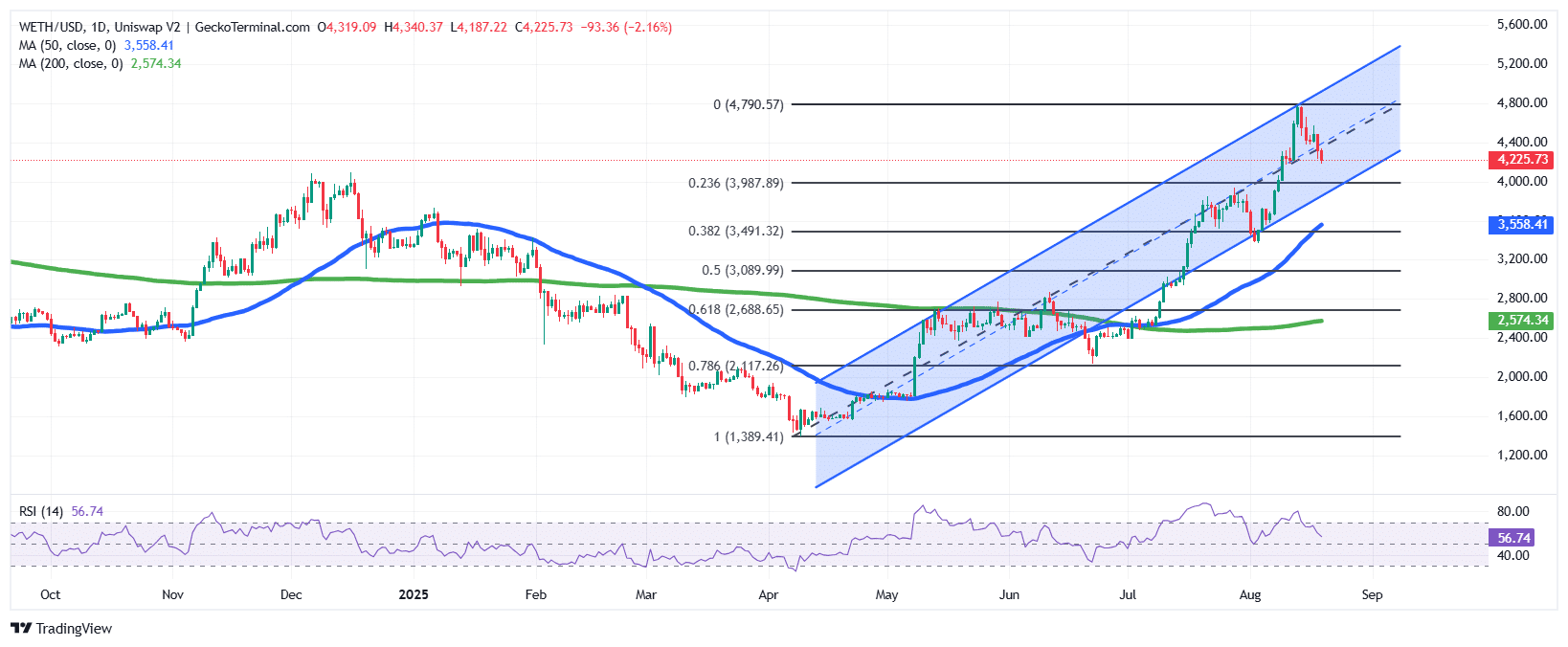

The ETH day by day chart reveals a robust bullish restoration since April 2025, transferring constantly inside a rising channel sample.

After a pointy rally towards $4,800, the worth of ETH is now retracing however stays nicely throughout the channel, suggesting that the broader uptrend is undamaged. The Fibonacci retracement ranges point out speedy assist close to $3,987, which aligns carefully with the decrease channel boundary.

The 50-day SMA at $3,558 is trending above the 200-day SMA at $2,574, confirming medium-term power. In the meantime, the RSI at 56 reveals neutral-to-bullish momentum, leaving room for additional upside.

If the worth holds above the $4,000 area, the Ethereum token might quickly retest the $4,800 resistance zone and doubtlessly break increased towards $5,200.

If Powell adopts a dovish tone, Bitcoin and ETH might regain momentum and check increased resistance ranges. Conversely, a hawkish outlook might push BTC and different main cryptos to a cheaper price.

Within the meantime, Michael Saylor’s Technique acquired one other 430 BTC for $51.4 million to push its complete hoard to 629,376 BTC.

Technique has acquired 430 BTC for ~$51.4 million at ~$119,666 per bitcoin and has achieved BTC Yield of 25.1% YTD 2025. As of 8/17/2025, we hodl 629,376 $BTC acquired for ~$46.15 billion at ~$73,320 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/FLRjCKDMQO

— Michael Saylor (@saylor) August 18, 2025

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection