BitMine, a publicly traded firm famend for its daring treasury technique, has formally turn out to be the second-largest crypto treasury firm on the planet. The agency now holds greater than $6.6 billion price of Ethereum (ETH), totaling 1.52 million tokens — a staggering 1.26% of the entire ETH provide.

This milestone underscores BitMine’s aggressive accumulation technique, which has set it aside from different establishments and company treasuries within the crypto area. What makes this transfer much more vital is BitMine’s long-term imaginative and prescient: the corporate has set a goal of holding 5% of Ethereum’s complete provide, that means they’re already 25% of the best way towards their bold objective.

The announcement sends a robust sign to markets and institutional traders. Ethereum’s rising function as each a monetary and technological spine of Web3 is attracting companies to deal with ETH not simply as an asset, however as a strategic reserve. BitMine’s method mirrors the conviction as soon as seen in Bitcoin-focused treasury methods, however it locations Ethereum entrance and heart within the evolving digital asset financial system.

BitMine Turns into The Main Ethereum Treasury

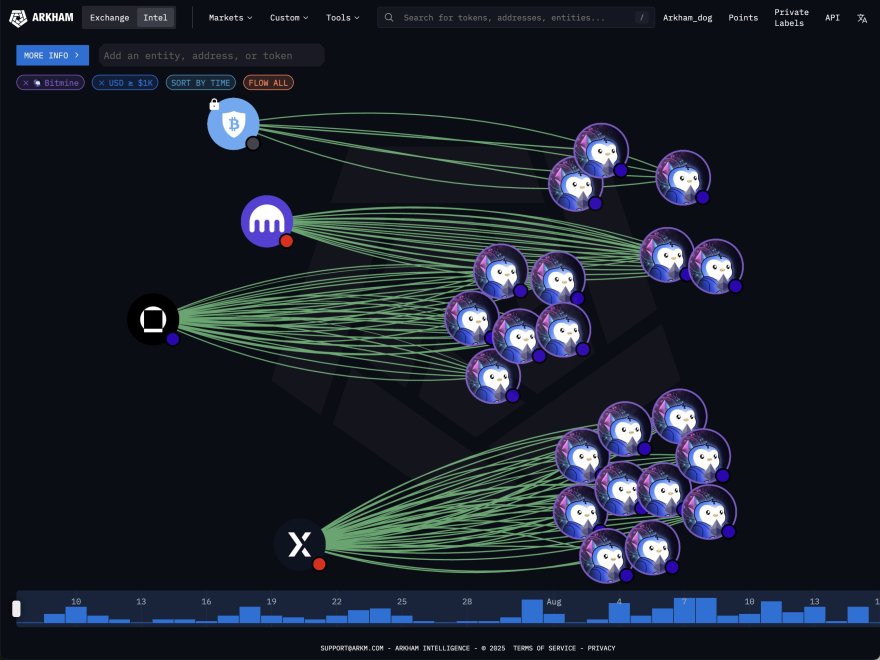

BitMine has cemented its place as the most important Ethereum treasury on the planet, now holding over $6.6 billion price of ETH, up from $4.9 billion simply final week. This fast improve highlights the corporate’s aggressive accumulation technique and its conviction in Ethereum’s long-term worth. The treasury at present accounts for 1.52 million ETH, making BitMine the undisputed chief in Ethereum company holdings.

Globally, BitMine now ranks because the second crypto treasury firm total, second solely to Michael Saylor’s Technique, which dominates Bitcoin holdings. This milestone underscores the shifting panorama of institutional crypto adoption, the place Ethereum is more and more being acknowledged as extra than simply the main sensible contract platform — it’s turning into a core reserve asset.

Notably, BitMine now holds extra ETH than Sharplink Gaming, The Ether Machine, and The Ethereum Basis mixed. This marks a turning level within the treasury race, the place companies are now not competing on Bitcoin alone however are diversifying into Ethereum at unprecedented ranges.

This rising pattern is more likely to proceed as ETH positive aspects momentum, supported by sturdy institutional demand, ETF inflows, and broader adoption throughout decentralized finance and real-world asset tokenization. Analysts imagine that if BitMine maintains its present tempo, its treasury technique may reshape how firms handle long-term reserves within the digital financial system.

ETH Going through Important Check

Ethereum is at present buying and selling close to $4,310 after a pointy retrace from its latest peak above $4,790. The chart highlights that ETH has entered a consolidation part after weeks of sturdy bullish momentum, with worth now testing key assist ranges.

The 50-day shifting common is trending upward and at present sits close to $3,560, properly under present worth ranges, signaling that the broader bullish construction stays intact. In the meantime, the 100-day and 200-day shifting averages at $3,048 and $2,575, respectively, additionally affirm sturdy long-term assist. This alignment means that regardless of the pullback, Ethereum’s broader pattern remains to be positioned for progress.

If ETH manages to carry this stage, a rebound again towards resistance at $4,600–$4,800 is probably going within the brief time period. Nevertheless, a breakdown under assist may open the door for a deeper retrace towards $3,800. The approaching periods might be key to figuring out course.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.