- Ethereum slipped beneath $4,300, testing help close to $4,200–$4,250.

- File leveraged shorts at 18,438 contracts elevate danger of each draw back and a possible brief squeeze.

- Fundamentals—trade provide, institutional shopping for, adoption—nonetheless level to long-term power.

Ethereum has hit a tough patch recently, slipping beneath the $4,300 mark after weeks of regular good points and multi-year highs. Bulls, who appeared unstoppable not too way back, are actually struggling to defend key help zones. Dropping that degree has merchants fearful concerning the likelihood of a deeper pullback, although it’s price noting the larger image nonetheless leans bullish because of strong fundamentals.

Institutional demand continues to behave as a tailwind, with giant corporations steadily including publicity by ETFs, treasury allocations, and direct on-chain buys. This gradual however regular accumulation exhibits confidence in ETH’s long-term function within the crypto ecosystem. On the similar time, derivatives markets are heating up, with Open Curiosity climbing sharply, signaling heavy hypothesis. Whereas that type of leverage can enlarge strikes in each instructions, it additionally highlights the tug-of-war between bulls and bears at these ranges.

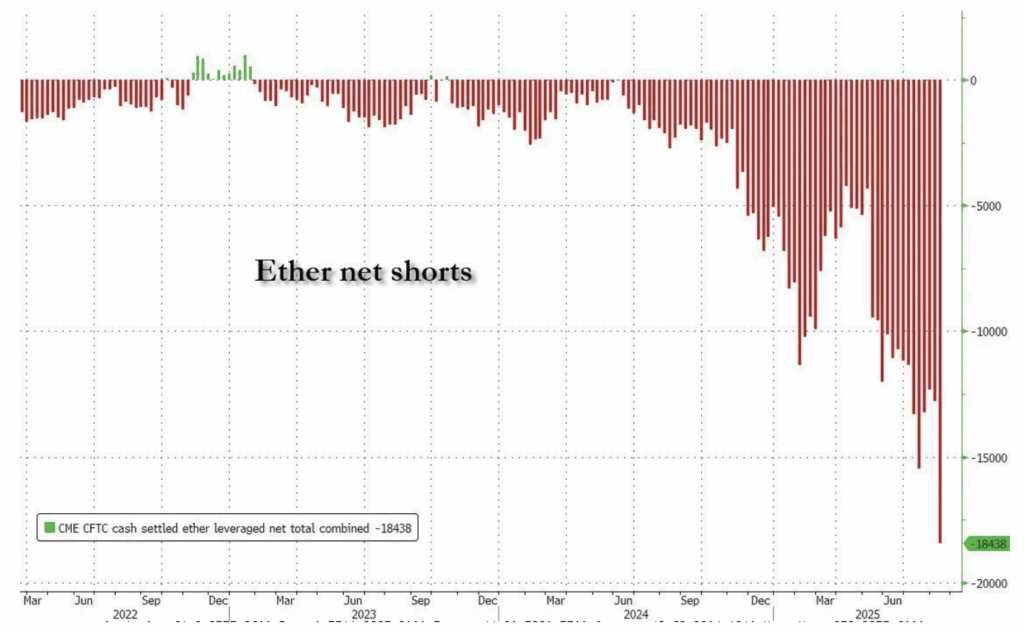

File Brief Positions Construct Up

In accordance with analyst Ted Pillows, Ethereum is now staring down the most important leveraged brief place in its historical past. Internet shorts have ballooned to 18,438 contracts, an enormous bearish wager fueled by ETH’s drop from $4,790. The market clearly expects extra turbulence, with merchants lining up aggressive draw back performs. However satirically, this build-up of shorts may set off the precise reverse: a brutal brief squeeze if worth bounces.

If ETH rallies from right here, bears could also be pressured to cowl shortly, pushing costs increased at a quicker tempo than standard. Historical past has proven these lopsided setups typically finish in explosive upside strikes, blindsiding brief sellers. Even with all this short-term noise, Ethereum’s fundamentals—like declining trade provide, rising institutional curiosity, and broader adoption—nonetheless paint a longer-term bullish outlook. For now, everybody’s watching to see if the report shorts spark the gasoline for ETH’s subsequent breakout.

Technical Image: Testing Key Help

Ethereum is buying and selling round $4,284 and exhibiting some fairly uneven motion after dropping again from the $4,800 area. The present battleground is the $4,200–$4,250 zone, which additionally traces up with the 100-day transferring common—a degree that’s acted as dependable help throughout earlier dips. Merchants are eyeing this space intently as a result of dropping it may open the door to a slide towards $4,000 and even $3,900.

Charts present that purchasing strain continues to be current, nevertheless it’s clear sellers are stepping up after weeks of constant inexperienced candles. Quantity bars have turned heavy purple, underscoring the latest promoting wave. That stated, so long as ETH stays above its 200-day transferring common (close to $3,920), the broader uptrend is undamaged. If consumers can defend the $4,200 demand zone, one other rally try towards $4,500–$4,600 appears to be like very a lot in play.

The Larger Image

Ethereum finds itself at a crossroads: on one aspect, report brief bets and rising volatility trace at turbulence, on the opposite, sturdy fundamentals and institutional urge for food maintain the bullish case alive. The subsequent few days could possibly be decisive in setting the tone, whether or not ETH cracks additional beneath strain or snaps increased in a squeeze. Both means, merchants are bracing for fireworks.