Information exhibits that two main mining swimming pools presently management over 51% of Bitcoin’s complete mining energy.

Bitcoin has lengthy been thought-about a logo of decentralization and monetary independence. Nonetheless, the most recent improvement reveals the draw back of focus inside the PoW mechanism.

Might Bitcoin face a 51% assault?

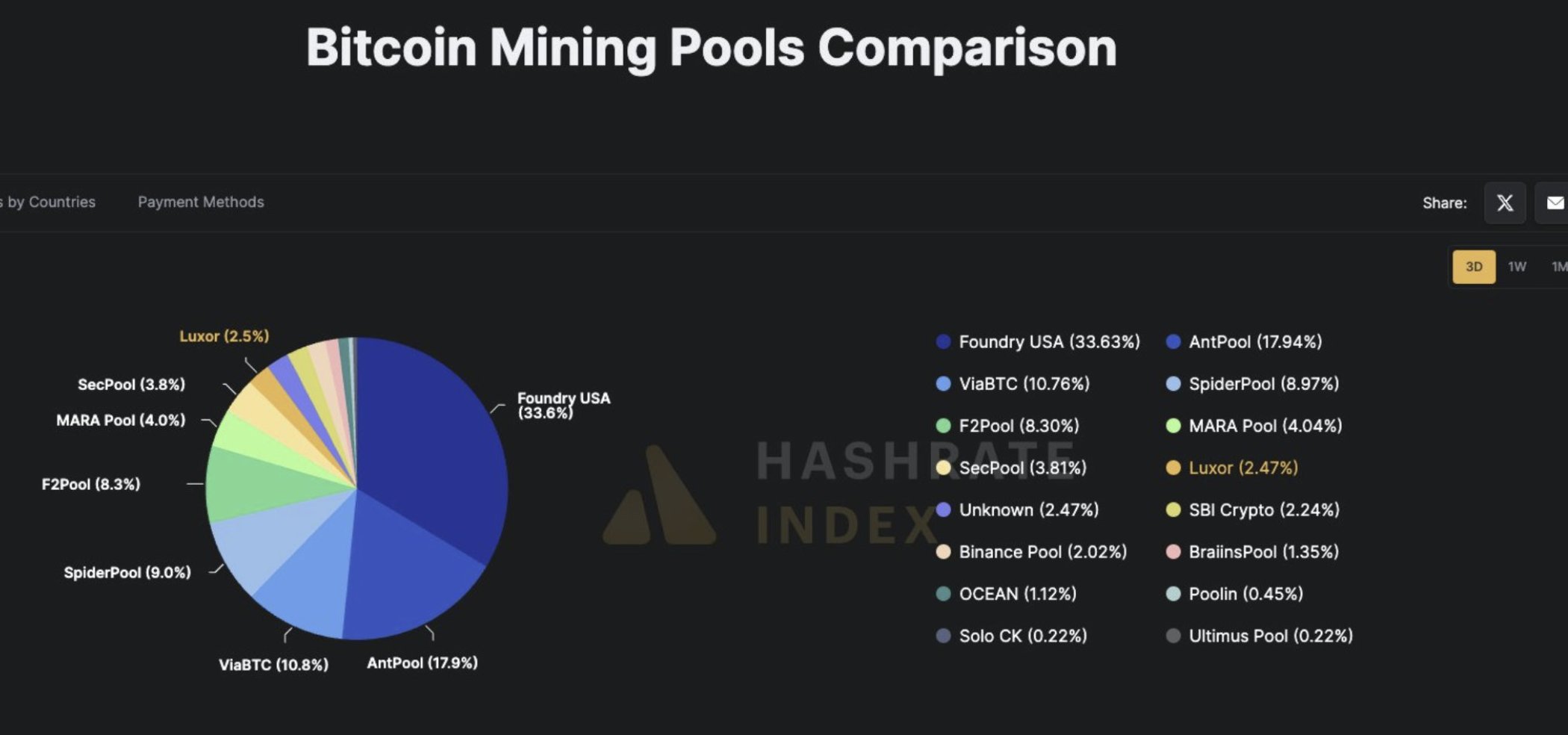

In keeping with analyst Jacob King, Foundry presently holds a 33.63% market share of Bitcoin’s mining hashrate, whereas AntPool accounts for 17.94%. Collectively, these two swimming pools dominate over 50% of the community’s hashrate, elevating considerations about centralization in Bitcoin mining.

Because of this if these two Bitcoin mining swimming pools have been to mix, they might surpass the 51% threshold of hashrate management. In principle, this is able to open the likelihood for an assault aimed toward manipulating the community.

“As soon as actuality units in about how centralized, manipulated, and ineffective Bitcoin actually is, the whole lot will collapse quicker than ever. It’s primarily an enormous sport of musical chairs!” Jacob shared.

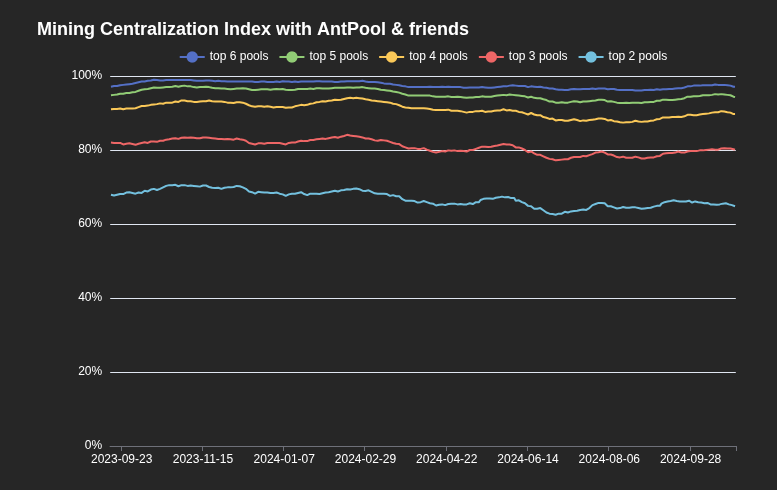

Some neighborhood members have additionally brazenly acknowledged that Bitcoin mining has change into “extraordinarily centralized.” Statistics from Evan Van Ness present that three mining swimming pools steadily maintain over 80% of the worldwide hashrate.

That is the primary time mining focus has reached such a harmful threshold in additional than a decade. It has shaken the neighborhood’s confidence in decentralization, Bitcoin’s basis. Many specialists are questioning whether or not the Proof-of-Work (PoW) mechanism stays appropriate to function the spine of the worldwide monetary system. Its vulnerabilities, equivalent to the chance of a 51% assault, elevate considerations about its long-term viability.

Some analysts warn that this example may rework Bitcoin from a decentralized asset right into a perceived “danger and burden” for institutional buyers. This shift may additionally impression the broader monetary system.

If a 51% assault have been to happen, the controlling mining swimming pools may manipulate transaction validation and block or reverse confirmed transactions. This might additionally allow double-spending, compromising the Bitcoin community’s integrity. Such a situation would trigger monetary losses and destroy confidence in Bitcoin as a safe-haven asset.

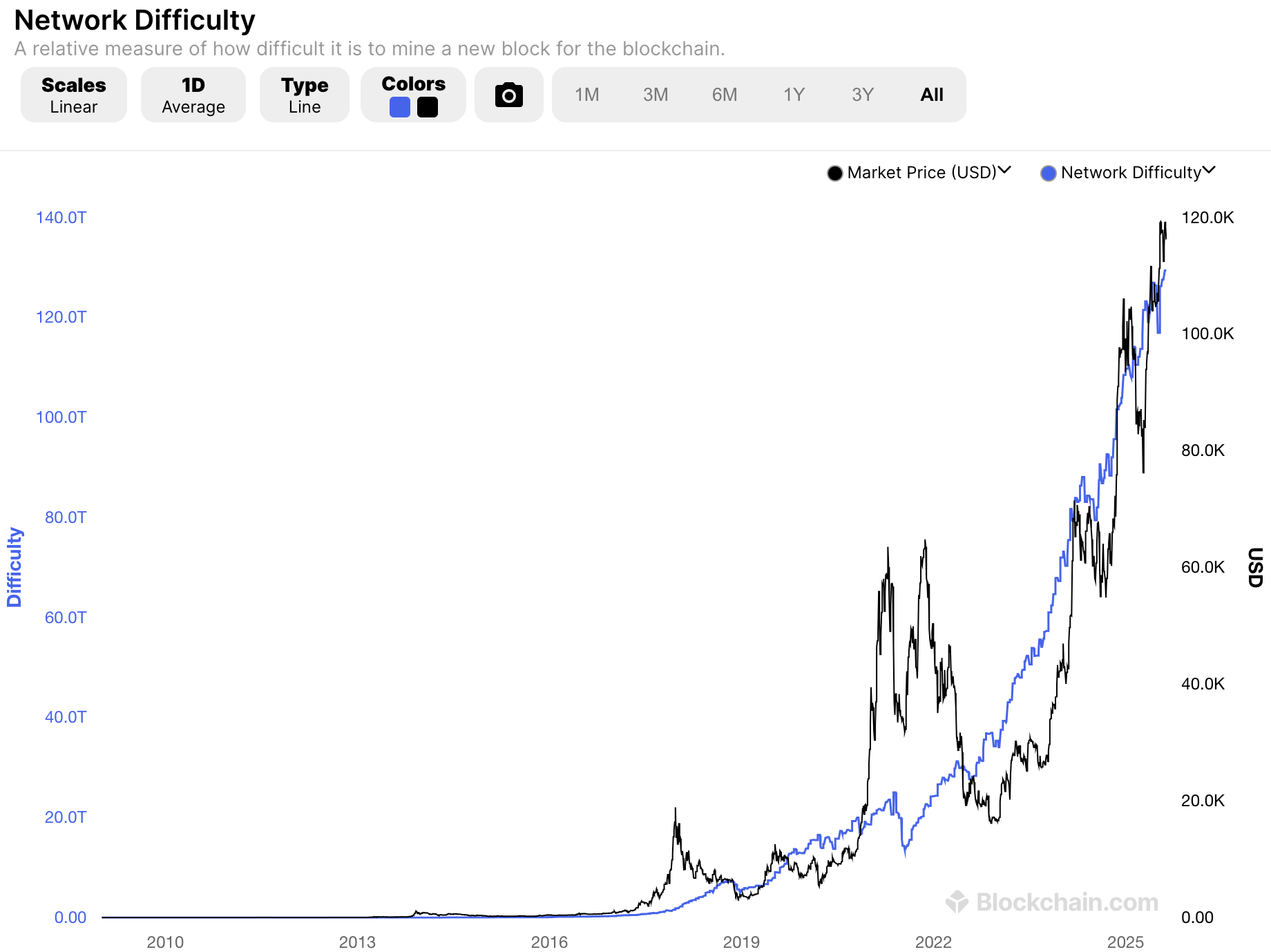

Though hashrate and issue are presently at a report excessive, considerations over a possible 51% assault have added psychological strain to the market.

Consultants observe that executing a 51% assault on Bitcoin is extraordinarily pricey, requiring substantial infrastructure and vitality assets. This excessive barrier makes such an assault logistically difficult regardless of the focus of mining energy.

Furthermore, the financial incentives of mining swimming pools might restrict the probability of a 51% assault, because it may trigger Bitcoin’s value to break down. Such a collapse would immediately hurt those that management the hashrate themselves.

However, the notion that Bitcoin is susceptible to a 51% assault can generate vital concern amongst buyers. This worry alone is adequate to boost worries about systemic danger.

The publish Consultants Warn Bitcoin Might Face a 51% Assault as Mining Centralizes appeared first on BeInCrypto.