Be part of Our Telegram channel to remain updated on breaking information protection

Tom Lee’s BitMine has change into the second-biggest crypto treasury firm globally after Michael Saylor’s Technique after it added 373,110 Ethereum tokens to its reserves over the previous week.

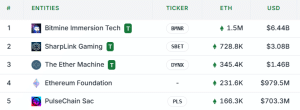

That collection of buys has pushed the corporate’s complete ETH holdings to 1,523,373 tokens valued at $6.44 billion at present costs, in line with knowledge from StrategicETHReserve.

BitMine now holds 1.26% of the entire ETH provide, and has greater than double the quantity of ETH on its steadiness sheets in comparison with its nearest rival, SharpLink Gaming.

High 5 largest ETH treasury corporations (Supply: StrategicETHReserve)

SharpLink Gaming holds 728.8K ETH valued at $3.08 billion, whereas the third-biggest ETH treasury firm is The Ether Machine with as stockpile of 345.4K ETH valued at $1.46 billion.

BitMine Now Solely Behind Technique In Crypto Holdings

BitMine shared an replace on its ETH holdings by way of an Aug. 18 X thread to say its ETH holdings gained $1.7 billion in worth in simply over the previous week.

🧵

1/6

BitMine at the moment introduced ETH holdings of 1,523,373 tokens:– ETH holdings of 1,523,373 is valued at $6.6 billion ($4,323 ETH)

– 373,110 extra ETH than per week in the past

– $1.7 billion larger than per week in the pasthyperlink ⛓️:https://t.co/xUgJ1TadQ6

— Bitmine BMNR (@BitMNR) August 18, 2025

On the time of the replace, ETH’s value had pegged the general worth of BitMine’s ETH reserves at $6.6 billion. Nevertheless, the most important altcoin by market cap retraced over 2% within the final 24 hours to commerce at $4,225.03 as of 1:15 a.m. EST.

Nonetheless, BitMine nonetheless has extra crypto on its books than the Bitcoin mining agency MARA Holdings when it comes to greenback worth.

Information from BiTBO exhibits MARA presently has 50,639 BTC on its steadiness sheets, valued at $5.84 billion at present costs.

Now, the one firm that’s forward of BitMine when it comes to crypto holdings is Technique, the agency led by Bitcoin bull Saylor that pioneered the large-scale company crypto treasury technique.

Technique presently holds 629,376 BTC valued at $72.53 billion at present costs. That’s after Technique introduced it purchased one other 430 BTC for $51.4 million yesterday.

Technique has acquired 430 BTC for ~$51.4 million at ~$119,666 per bitcoin and has achieved BTC Yield of 25.1% YTD 2025. As of 8/17/2025, we hodl 629,376 $BTC acquired for ~$46.15 billion at ~$73,320 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/FLRjCKDMQO

— Michael Saylor (@saylor) August 18, 2025

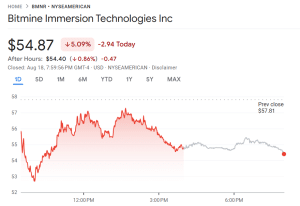

BitMine Inventory Plummets 5%, Continues To Slide In After-Hours Buying and selling

Regardless of the milestone, BitMine’s inventory plunged over 5% up to now 24 hours, and continued to slip in the course of the after-hours buying and selling session, knowledge from Google Finance exhibits.

BMNR share value (Supply: Google Finance)

That was a part of a longer-term adverse pattern that noticed BMNR plunge 15% within the final week. The inventory continues to be up greater than 38% up to now month.

In keeping with BitMine’s X thread, the inventory value doesn’t inform the complete story.

3/6

BitMine additionally advantages from being a extremely liquid inventory:

– BitMine ranks #10 among the many 5,700 US listed shares

– $BMNR trades $6.4 billion day by day – BMNR trades extra day by day than JPMorgan $JPM (rank #27)

– BMNR buying and selling quantity is simply forward of Alphabet (Google) $GOOG… pic.twitter.com/jiP0K6HdWh— Bitmine BMNR (@BitMNR) August 18, 2025

BitMine presently ranks tenth among the many 5,700 US-listed shares, BitMine stated. It additionally has round $6.4 billion in day by day buying and selling quantity, which ranks it forward of JPMorgan (JMP) and simply above Alphabet (Google), it added.

Ethereum ETFs Undergo Second-Greatest Outflows Since Launch

BitMine’s continued accumulation of ETH has not been in a position to positively influence the altcoin chief’s value in latest days. That is doubtless because of the outflows from US spot Ethereum ETFs (exchange-traded funds) this week.

On Aug. 18, buyers pulled $59.3 million out of the merchandise, marking the tip of a multi-day inflows streak, Farside buyers knowledge exhibits. It was additionally their second-biggest internet day by day outflows since launch final 12 months.

On the day, $196.6 million was withdrawn from the funds. The one day the funds recorded extra outflows was Aug. 4, when $465.1 million was pulled from the merchandise.

BlackRock’s ETHA posted the most important outflows yesterday with $87.2 million exiting the fund’s reserves.

The subsequent largest outflows have been posted by Constancy’s FETH, which noticed $78.4 million in outflows. Bitwise’s ETHW, VanEck’s ETHV, Franklin’s EZET and Grayscale’s ETHE noticed internet day by day outflows of $0.9 million, $4.8 million, $6.6 million and $18.7 million, respectively.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection