Bitcoin mining stays the spine of the crypto financial system. Within the Asia-Pacific (APAC) area, ample hydropower, fuel reserves, and surplus electrical energy create alternatives and friction.

The area affords “inexperienced hash” potential but faces excessive electrical energy prices and fragmented guidelines. For international buyers, APAC bitcoin miners now sit on the heart of debates over vitality use, transparency, and capital entry.

APAC Bitcoin Mining Overview

Newest Replace – In July 2025, Bitdeer expanded hydropower mining capability in Bhutan to greater than 1,200MW, positioning the nation as a renewable mining hub. Marathon Digital and Zero Two started working a 200MW immersion-cooled web site in Abu Dhabi, displaying how superior cooling and flare-gas integration maintain operations in excessive climates. In the meantime, Iris Vitality in Australia reported 50EH/s, signaling how APAC miners scale alongside Western friends.

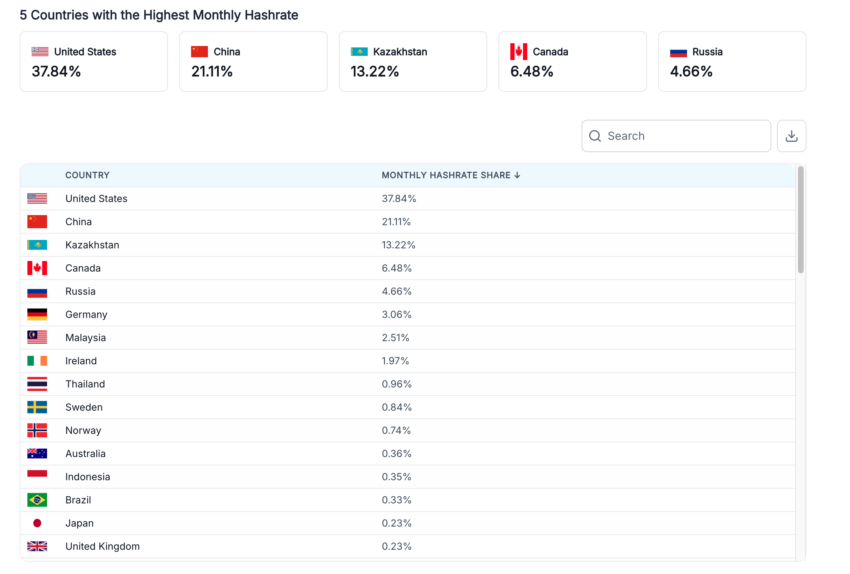

Background Context – The Cambridge Bitcoin Mining Map exhibits that after China’s 2021 crackdown, bitcoin mining shifted throughout Asia-Pacific economies whereas underground exercise in China persists. Vitality knowledge, revealed by Asia-Pacific Financial Cooperation, projects rising renewable penetration, creating circumstances the place bitcoin mining can align with decarbonization objectives if coverage helps it.

Deeper Evaluation – China stays opaque. Regardless of the ban, seasonal hydropower in Sichuan and underground clusters persist. The Cambridge Digital Mining Business Report 2025 warns of underreported exercise in China, complicating international hash energy and focus danger assessments.

The truth is, regardless of the 2021 ban on crypto mining, the nation nonetheless accounts for greater than 21% of world hashrate. This persistence is pushed by underground hydropower operations in areas like Sichuan, dispersed small-scale farms that keep away from detection, and native utilities quietly promoting surplus electrical energy. Whereas Beijing maintains a prohibition on paper, in follow, it seems to tolerate a shadow bitcoin mining trade, including important opacity and transparency dangers to international assessments.

Japan’s excessive electrical energy costs restrict home farms. Nevertheless, corporations corresponding to SBI Crypto and GMO function abroad, at renewable-powered websites. Domestically, SoftBank’s 300MW knowledge heart in Hokkaido illustrates how AI infrastructure overlaps with mining-scale vitality hundreds. PTS signed agreements to provide telecom-grade hashrate over three years in Japan’s enterprise section, indicating regular demand for secure capability.

South Korea is exploring power-system integration. A Might 2025 arXiv research means that monetizing surplus electrical energy by way of bitcoin mining might assist KEPCO scale back debt whereas decreasing grid losses. This mannequin reframes mining as a grid-balancing device somewhat than a burden.

Inexperienced Hash in Asia: Hydropower, Flare Fuel, and Renewable Growth

Bhutan’s hydropower growth with Bitdeer alerts how Asia can model bitcoin mining as environmentally sustainable and appeal to ESG-minded capital. Abu Dhabi’s immersion-cooled web site exhibits how flare fuel and superior infrastructure redefine effectivity in scorching climates. Australia’s Iris Vitality demonstrates a hybrid mannequin by combining renewable-powered mining with AI computing, positioning itself throughout digital and vitality markets. These circumstances present that Asia-Pacific bitcoin mining is rising extra versatile, diversified, and sustainability-driven.

Behind the Scenes – APAC miners stability native politics and international scrutiny. Japan and Korea concentrate on vitality integration somewhat than pure scale. Bhutan markets sustainability, whereas China’s hidden exercise raises transparency considerations. The UAE and Australia leverage their vitality mixes to draw institutional capital and decrease marginal prices.

Broader Influence – Institutional buyers demand excessive disclosure requirements. US-listed miners win belief with SEC filings and market liquidity, whereas APAC corporations should bridge fragmented frameworks. Nevertheless, if Asian miners ship ESG-backed transparency, capital flows might diversify extra evenly between East and West.

Trying Ahead – By 2026, extra APAC miners might method parity with Western friends in the event that they mix effectivity with credible disclosure. Competitiveness will depend upon fast upgrades to next-generation ASICs, integration with renewable grids, and institution of regional reporting requirements that scale back perceived danger for international buyers.

Coverage Prices and Regional Dangers

Information Breakdown—The CCAF 2025 report highlights {hardware} effectivity features and geographic reshuffling of mining capability. The area’s intergovernmental discussion board’s Vitality Outlook exhibits how regional vitality trajectories can reshape bitcoin mining’s value base and carbon profile.

Attainable Dangers –

- Japan: excessive electrical energy prices cap native capability.

- China: underground exercise undermines transparency and danger evaluation.

- Korea: grid integration relies on political and regulatory help.

- Bhutan and the UAE: local weather variability can have an effect on hydrology and flare-gas uptime.

- Provide chains: ASIC manufacturing stays uncovered to tariffs and geopolitics.

Professional Opinion –

“Essentially the most important danger for Asian miners stays regulatory unpredictability. With out long-term readability, capital prices rise and international buyers hesitate.”

— Cambridge Centre for Different Finance, Digital Mining Business Report 2025

“Our facility in Abu Dhabi demonstrates how immersion cooling and flare fuel integration can redefine mining economics in difficult climates.”

— Marathon Digital Holdings, press launch

“By monetizing surplus energy by way of mining, utilities might enhance their monetary well being whereas stabilizing electrical energy networks.”

— ArXiv analysis, Bitcoin Mining and Grid Effectivity in Korea (Might 2025)

The publish APAC Bitcoin Mining Goes Inexperienced Regardless of China Underground Exercise appeared first on BeInCrypto.