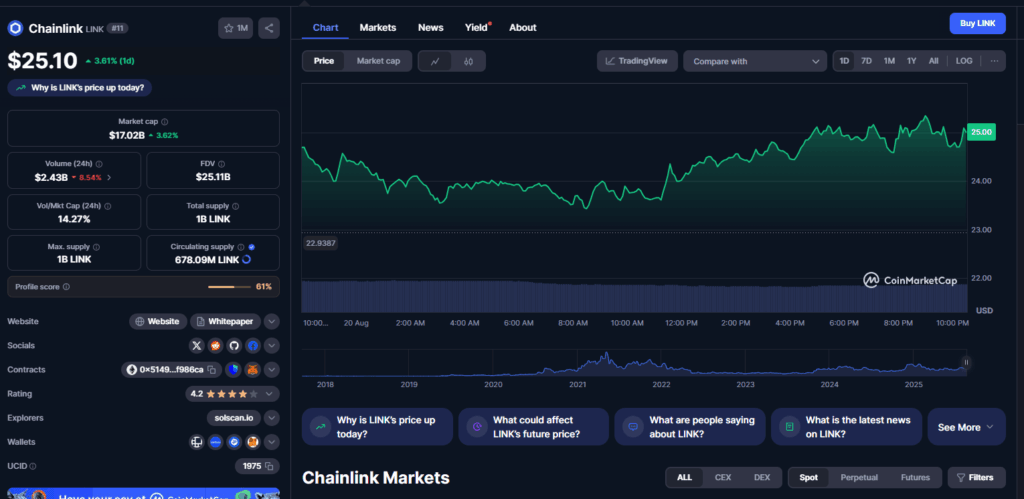

- Chainlink surged previous $26 earlier than stabilizing round $24, supported by sturdy ecosystem development.

- Pockets exercise is spiking, with practically 10,000 new LINK addresses created in a single day.

- Analysts predict LINK might rise to $31 by November 2025, if momentum and adoption proceed.

Chainlink has quietly became one of many most-watched crypto tokens of this bull cycle. The most recent rally pushed LINK past $26 for the primary time in months, reminding merchants why it has typically been referred to as the “spine” of decentralized finance. Since then, the worth has cooled a bit, hovering round $24, however on-chain exercise hints that one thing greater could also be brewing. For a lot of buyers, the query now isn’t if Chainlink will transfer once more—it’s how far and how briskly when it does.

The broader temper round LINK feels totally different this time. The token isn’t simply driving basic market hype; its ecosystem is exhibiting indicators of real growth. Partnerships, integrations, and community development are all including gasoline to the hearth, setting the stage for what could possibly be the venture’s strongest run since its earlier cycles.

Surge in Pockets Development and Adoption

A brand new Santiment report revealed simply how lively the Chainlink group has change into. On Sunday alone, greater than 9,800 addresses made a minimum of one switch, whereas the next day noticed 9,625 contemporary wallets created on the community—each marking document highs for 2025. These metrics level to one thing deeper than hypothesis: real adoption and new customers flowing in.

The final time LINK confirmed this type of pockets development, it was a precursor to a serious rally. Analysts consider that if this momentum holds, Chainlink might lastly transfer past the sideways buying and selling that has capped its progress for a lot of the 12 months. In different phrases, the groundwork is being laid for one more breakout.

The Highway Forward: Can LINK Push Greater?

Forecasts stay bullish. In accordance with CoinCodex knowledge, LINK might climb practically 29% from present ranges to achieve round $31 by November 2025. Technical indicators present a strong mixture of bullish momentum alongside reasonable worry out there—circumstances that generally precede sturdy strikes larger.

Nonetheless, merchants are break up. Whereas some see this as a main entry level, others warn that LINK might stall if broader market circumstances flip bitter. But with regular pockets development, elevated on-chain exercise, and a swelling ecosystem of integrations, many consider the likelihood of one other main rally outweighs the dangers.

Closing Ideas

Chainlink’s story on this cycle is now not nearly worth. It’s about adoption, infrastructure, and turning into an irreplaceable piece of the crypto puzzle. If the information retains trending upward, LINK may not simply revisit previous highs—it might write new ones. For now, the market is watching intently, ready for the following transfer.