Key Takeaways

- Rapper Kanye West’s newly launched YZY token on the Solana community surged to a $3 billion market cap in simply 40 minutes earlier than falling by greater than two-thirds amid insider buying and selling allegations.

- On-chain analysts have flagged a number of crimson flags, together with a liquidity pool containing solely YZY tokens and a single multisig pockets holding a large 87% of the preliminary provide, which has been distributed to different wallets.

- Regardless of issues from on-chain observers, some outstanding crypto whales and merchants have purchased the dip, viewing the token as a short-term, high-risk play just like different movie star memecoins.

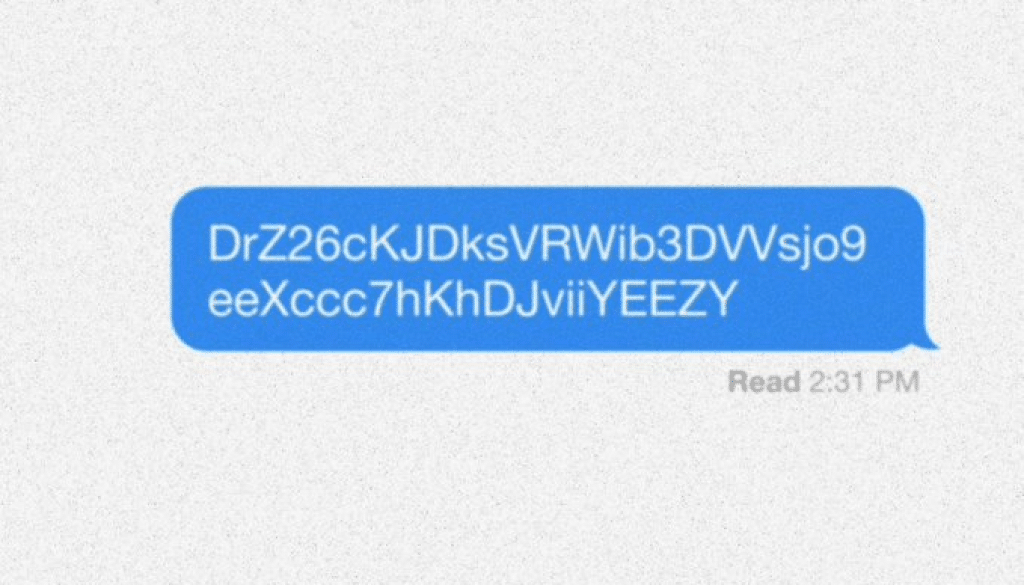

The world of celebrity-endorsed memecoins has seen a brand new entrant, and it’s already following a well-recognized and controversial trajectory. Rapper Kanye West, who goes by Ye, launched the YZY token on the Solana blockchain with the promise of “A NEW ECONOMY, BUILT ON CHAIN.”

The token’s launch was explosive, with its worth skyrocketing to a $3 billion market capitalization in below an hour. Nevertheless, the preliminary euphoria was short-lived.

A swift and big value correction, which has worn out greater than two-thirds of the token’s worth, has adopted, largely because of issues over alleged insider buying and selling and a suspicious token distribution mannequin.

On-Chain Crimson Flags and Suspicious Exercise

Crypto market observers and on-chain analytics companies like Lookonchain and Onchain Lens had been fast to level out important crimson flags.

One of many major issues revolves across the token’s liquidity pool, the place solely YZY tokens had been added. In a typical decentralized alternate (DEX) setup, a token is paired with a stablecoin like USDC to supply a balanced buying and selling atmosphere.

By not doing so, the creators preserve the power to govern the value and liquidity at will. This setup is a basic signal of potential “rug pull” schemes, the place builders can drain the liquidity and abandon the venture.

Moreover, Coinbase Director Conor Grogan revealed that earlier than being distributed, an astonishing 87% of the token provide was held in a single multisig pockets.

A multisig (multi-signature) pockets requires a number of personal keys to authorize a transaction, a function typically utilized by initiatives for enhanced safety.

Nevertheless, on this case, its use previous to distribution raised suspicions of a extremely centralized and managed launch, with one entity having near-total management.

Regardless of Considerations, Whales Are Nonetheless Shopping for

Even with the blatant crimson flags, the attract of a celebrity-backed token has not been misplaced on everybody.

A number of well-known crypto merchants and “whales”—large-scale holders—have reportedly purchased into the token, viewing it as a short-term, high-risk, high-reward play.

Leverage dealer James Wynn, as an example, acknowledged that he “aped” into the token on a 60% pullback, citing the huge progress of President Donald Trump’s eponymous memecoin as a purpose for his funding.

The presence of large-scale merchants means that whereas the preliminary rally was retail-driven, the following part could also be outlined by speculative bets on future pumps fueled by market liquidity and quantity.

Closing Ideas

The YZY token launch is a stark reminder of the unstable and infrequently dangerous nature of the memecoin market. Whereas a celeb’s endorsement can drive a torrent of preliminary hype and funding, it doesn’t assure a good or sustainable venture.

The on-chain crimson flags level to a extremely centralized and doubtlessly manipulated launch, however the market’s response demonstrates that hypothesis, not fundamentals, stays the first driver of those belongings.

Regularly Requested Questions

What’s a “multisig” pockets?

A multisig pockets is a cryptocurrency pockets that requires a number of personal keys to authorize a transaction, providing an additional layer of safety and shared management over funds.

What’s an “insider buying and selling” concern in memecoins?

It refers back to the unlawful apply the place people with private details about a venture’s launch or distribution use that data to purchase in early and make a revenue by promoting at the next value to the general public.

Why is a liquidity pool with just one token a crimson flag?

A liquidity pool with just one token, as a substitute of a token and a stablecoin, is usually a crimson flag for a “rug pull” as a result of it permits builders to govern the value and drain the liquidity at any time.