Bitcoin (BTC) surged on Friday, breaking above $116,800, as optimism round Federal Reserve coverage shifts reignited demand for digital belongings.

The transfer comes simply hours after Fed Chair Jerome Powell hinted that the central financial institution may start easing charges prior to markets had anticipated.

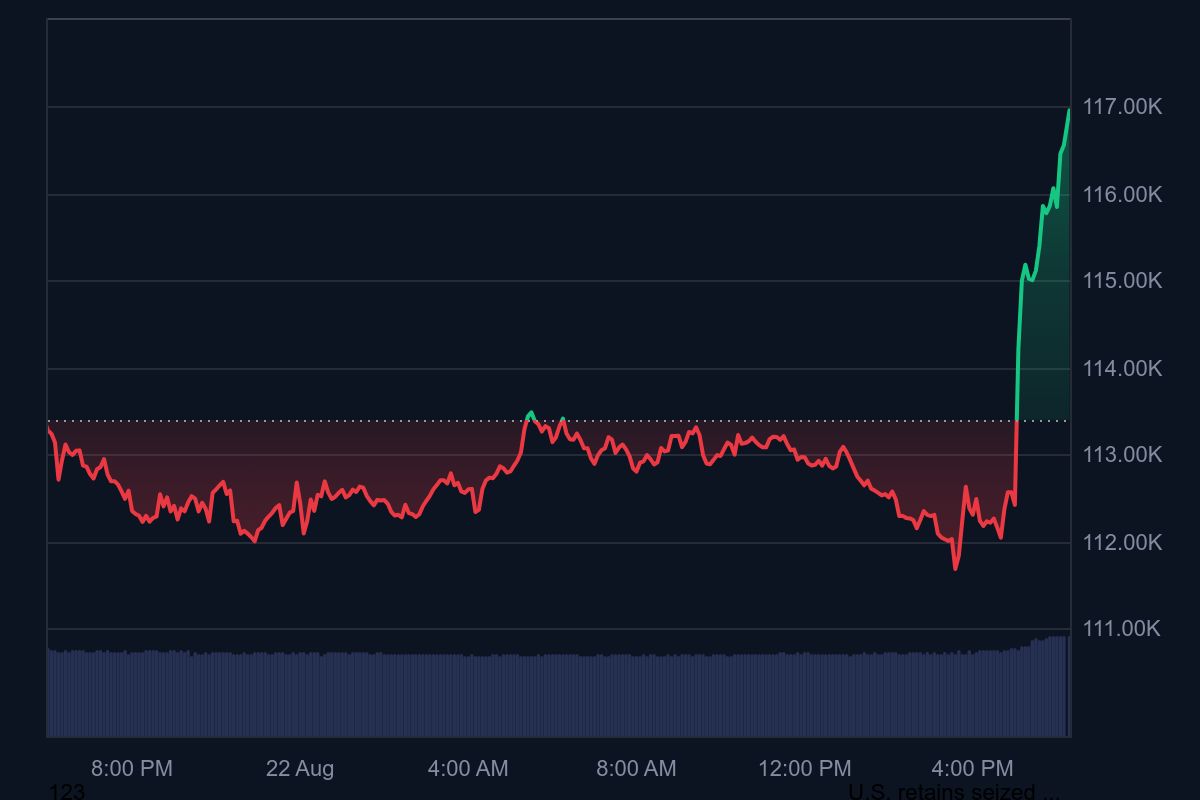

Bitcoin value motion

In accordance with CoinMarketCap, Bitcoin is buying and selling at $116,890, up 3.5% previously 24 hours. Its market capitalization now exceeds $2.32 trillion, whereas each day buying and selling quantity jumped to $69.13 billion, a 15.3% enhance from the earlier session.

With 19.9 million BTC already in circulation and solely 21 million whole provide, the provision squeeze narrative continues to underpin value momentum. Analysts spotlight that macro-driven rallies usually amplify Bitcoin’s position as a “shortage asset,” attracting institutional patrons throughout liquidity shifts.

Powell speech units the tone

On the Jackson Gap summit, Powell famous that financial coverage is already in restrictive territory and flagged the potential for rate of interest cuts within the coming months. Markets reacted swiftly, with the CME FedWatch instrument displaying a 91% likelihood of a September lower.

Whereas equities gained broadly – the Dow Jones climbed 732 factors – Bitcoin outperformed as traders rotated into belongings seen as hedges towards each inflation and financial debasement.

Outlook for Bitcoin

Bitcoin’s sharp breakout above the $115,000 resistance zone now locations the subsequent technical goal close to the $120,000 degree, the place merchants count on heavy profit-taking. If momentum holds, analysts counsel BTC may take a look at new all-time highs earlier than year-end.

Nonetheless, short-term volatility stays possible, significantly as macroeconomic information and Fed commentary proceed to drive investor sentiment. But, with liquidity situations easing and institutional inflows persisting, Bitcoin seems poised to stay one of many main beneficiaries of Powell’s coverage pivot.

Bitcoin’s rally underscores its distinctive place in international markets: a scarce, decentralized asset that thrives in occasions of financial transition. Powell’s Jackson Gap speech could have sparked Wall Avenue’s rally – however Bitcoin is stealing the highlight.